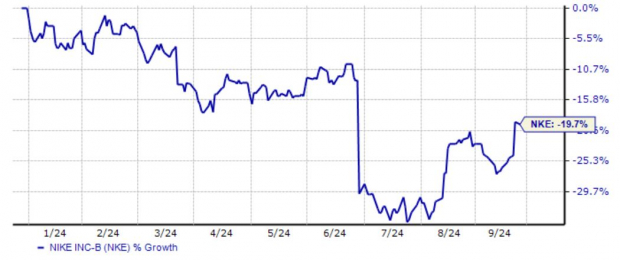

The approaching quarterly results from the giant apparel company, Nike NKE, set the stage for a significant event as we enter the third quarter earnings cycle. Nike’s performance in 2024 has left investors disheartened, with the stock plummeting nearly 20% and standing out as one of the major underperformers among large-cap stocks. However, recent price movements show a glimmer of hope, hinting at a potential reversal in fortunes.

As the anticipation builds, the looming question is whether the current optimism surrounding the stock is sustainable in the face of the upcoming earnings release.

Assessing Nike’s Financial Outlook

Fresh off its last quarterly report, Nike found itself readjusting its fiscal year 2025 projections after encountering various challenges during the period. Analysts have revised their earnings forecasts downward for the upcoming release, indicating an almost 40% decline to an anticipated $0.51 per share.

Contrary to conventional wisdom, the company’s recent lackluster performance does not stem from weakened consumer interest but rather signifies a shift in consumer preferences. Nike’s CFO, Matt Friend, highlighted this, expressing, ‘Although our digital business has grown at an approximately 26% CAGR since Fiscal 19, we missed our Q4 plan on softer traffic, higher promotions, and lower sales of certain classic footwear franchises.’

Friend further elaborated, ‘Therefore, despite continued marketplace demand, we are advancing our timelines to tighten total supply of certain classic footwear franchises – at different paces, across different channels, around the world.’

The company’s focus remains on reconfiguring its product mix to entice consumers through innovation. Sales projections have also taken a hit, with an expected year-over-year drop of 10% to $11.6 billion.

In the last few years, Nike’s sales growth trajectory has shifted significantly, as depicted in the chart below, illustrating the percentage change in sales year-over-year.

Navigating the Future

With the Q3 earnings release on the horizon, attention is centered on Nike’s financial performance. The company has faced challenges in resonating with consumers through its product offerings, leading to its substantial decline in 2024.

For investors eyeing short-term gains, it might be prudent to wait for positive revisions in earnings estimates post the upcoming release before considering any significant investment moves.

Zacks’ Semiconductor Revelation

Zacks highlights a promising semiconductor stock that, despite being significantly smaller than NVIDIA, is poised to capitalize on the surging demand for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor industry is projected to grow from $452 billion in 2021 to a staggering $803 billion by 2028.

For a comprehensive analysis and insights into this emerging stock, investors can access the information for free here.

Stay informed with the latest recommendations from Zacks Investment Research by downloading their free report on 5 Stocks Set to Double here.

For a comprehensive analysis of NIKE, Inc. (NKE), access the free stock analysis report here.

Access the full article on Zacks.com here.

Disclaimer: The opinions expressed are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.