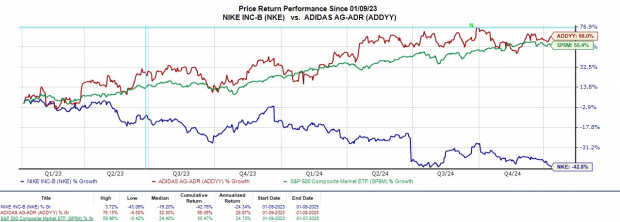

As 2025 begins, Nike NKE shares are sitting close to their 52-week lows, while Adidas ADDYY stocks are near their highs. Investors might be wondering: Will Nike rebound sharply, or can Adidas reach even greater heights?

This situation opens an important discussion about which well-known athletic apparel giant is currently the better investment.

Image Source: Zacks Investment Research

Factors Behind Nike’s Decline and Adidas’ Rise

Nike is currently facing a necessary overhaul of its product line due to stiff competition not only from Adidas but also from brands like Under Armour UAA and New Balance. This situation, coupled with slower sales growth and rising inventory levels, has led to diminished investor confidence.

In contrast, Adidas has taken advantage of Nike’s struggles by expanding its product offerings, resulting in stronger financial performance and better market sentiment.

Sales Outlook & Earnings Projections

Zacks estimates indicate that Nike’s total sales will drop 10% in fiscal 2025, leading to approximately $46.34 billion compared to $51.36 billion last year. Projections for fiscal 2026 suggest a stabilization of sales with a slight increase of 1%, reaching $47.11 billion.

Nike’s annual earnings are expected to decrease by 47%, hitting $2.10 per share compared to EPS of $3.95 in 2024. Fortunately, FY26 forecasts predict a rebound with EPS rising by 12% to $2.36. It is important to note, however, that both FY25 and FY26 EPS estimates have trended downward over the past quarter, with notable declines in the last 30 days.

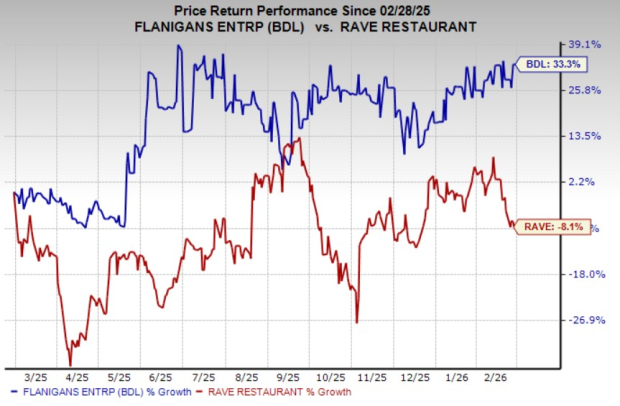

Image Source: Zacks Investment Research

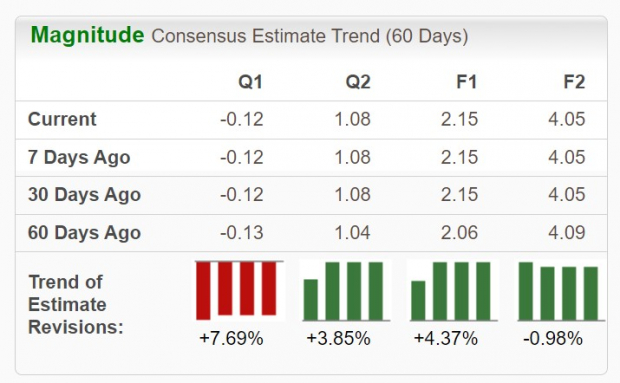

Conversely, Adidas is forecasted to see a sales increase of 6% to about $27.3 billion, marking a further 10% increase in FY25. Its earnings are expected to improve notably from an adjusted EPS loss of -$0.36 in FY23 to $2.15 per share in FY24. More significantly, Adidas’ FY25 EPS is projected to surge by 88% to $4.05.

Interestingly, Adidas’ FY24 EPS estimates have risen by 4% over the last 60 days, while FY25 estimates have dipped slightly.

Image Source: Zacks Investment Research

Comparing Valuation Metrics

Currently trading at $71 per share, NKE has a forward earnings multiple of 34.3X, while ADDYY is priced at $125 with a multiple of 30.9X. Both companies have shares priced above the S&P 500 average of 22.1X and their industry average of 14.4X.

Looking at the price-to-sales ratio, Adidas presents a more favorable option, trading under the recommended level of 2X, while NKE stands at 2.3X.

Image Source: Zacks Investment Research

Dividend Analysis

Nike has a significant advantage in terms of dividends, offering a 2.22% annual yield, in contrast to Adidas’s mere 0.19%, which is below the industry average of 1.92%.

Image Source: Zacks Investment Research

Final Thoughts

Adidas currently holds a Zacks Rank #3 (Hold), while Nike carries a Zacks Rank #5 (Strong Sell). While Nike may appeal more to income-focused investors due to its dividends, the rapid decline in earnings estimate revisions suggests potential risks ahead. On the other hand, investors in Adidas might benefit from the company’s promising growth outlook.

7 Top Stock Picks for the Coming Month

Recently unveiled: Experts have identified 7 standout stocks from a collection of 220 Zacks Rank #1 Strong Buys. They predict these selections have the highest likelihood of experiencing price increases.

Since 1988, this comprehensive list has outperformed the market more than twofold, generating an average annual gain of +24.1%. These hand-picked 7 stocks deserve your immediate interest.

NIKE, Inc. (NKE): Free Stock Analysis Report

Adidas AG (ADDYY): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

To read more on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.