When Walmart revealed its plans to acquire TV manufacturer Vizio for $2.3 billion, the reverberation could be felt across the financial landscape. Roku, the renowned connected TV platform company, witnessed the market’s capricious response firsthand as its stock experienced a significant drop in value, fueling investor anxiety about potential rivalry with the retail behemoth. While many speculate that Walmart’s move is a direct challenge to Roku’s dominance, a deeper analysis paints a different picture.

Charting Walmart’s Strategic Course

Contrary to popular belief, Walmart’s sights are set not on Roku but on a much larger and formidable adversary in the form of e-commerce titan Amazon. As the whisperings of anonymous sources and industry insiders suggest, Walmart’s real battle lies in the digital advertising arena—a realm where Amazon has quietly established itself as a formidable force, generating a staggering $47 billion in ad revenue in 2023.

Strategic Maneuvers and Market Forces

Powered by its expansive consumer base, Amazon’s prowess in digital advertising is evident through its ability to harness valuable customer data for targeted marketing, a competitive advantage that Walmart is eager to replicate. In a bid to bolster its advertising capabilities, Walmart struck key partnerships with industry leaders like The Trade Desk and Roku, signaling its intention to carve out a significant presence in the digital marketing sphere.

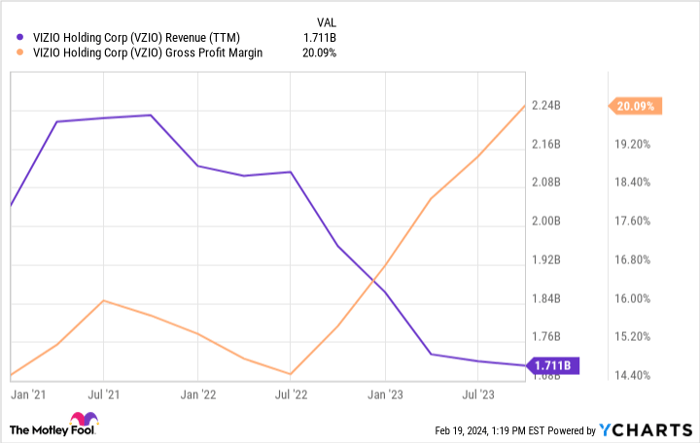

As Walmart’s acquisition of Vizio unfolds, the synergy between Vizio’s platform-focused business model and Walmart’s strategic vision becomes clear. Just like Roku, Vizio relies on an ad-centric approach, with declining device revenue offset by a surge in software-related income, aligning perfectly with Walmart’s ambition to challenge Amazon in the advertising arena.

Rising Above the Fray: The Roku Resilience

Amidst the market upheaval and strategic realignments, Roku stands steadfast with an impressive milestone of over 80 million active accounts, reaffirming its dominance in the market. Despite potential competition from retail giants like Walmart and Amazon, Roku’s consistent growth trajectory and unwavering user base demonstrate resilience in the face of evolving market dynamics.

While Walmart’s foray into the TV manufacturing realm may pose some challenges for Roku, history and market performance hint at a different outcome. Roku’s unwavering growth in user base and innovative offerings continue to outshine competitors, positioning the company as a formidable player in the connected TV landscape.

For investors eyeing long-term prospects, the recent fluctuations in Roku’s stock price may present a valuable opportunity to capitalize on the company’s enduring strength in the face of evolving market forces.

Before diving into Walmart’s stock, investors are advised to consider the expert recommendations from the Motley Fool advisory team. Discover the 10 stocks with significant growth potential that could reshape your investment portfolio for the better.

*Stock Advisor returns as of February 20, 2024