Northern Trust Set to Announce Quarterly Earnings with Analyst Insights

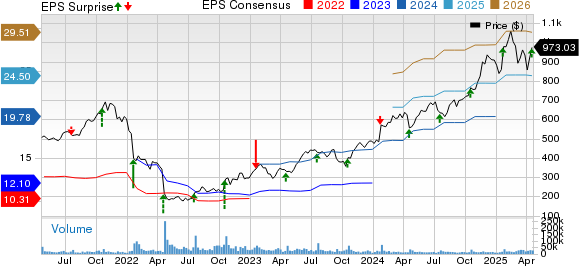

Northern Trust ($NTRS) will release its quarterly earnings report on Tuesday, April 22nd, before the market opens, according to Finnhub. Forecasts indicate expected revenue of $1,986,681,244 and earnings of $1.89 per share.

For additional details, visit Quiver Quantitative’s $NTRS Stock page, which tracks information on insider trading, hedge fund activity, and congressional trades.

Summary of Insider Trading at Northern Trust

In the past six months, insiders at Northern Trust have executed 14 trades of $NTRS Stock, with only sales reported and no purchases. Below are details of those trades:

- PETER CHERECWICH (Chief Operating Officer) has conducted 2 sales, divesting 42,285 shares for approximately $4,635,164.

- STEVEN L FRADKIN (Vice Chairman) has sold 36,974 shares across 4 trades for about $3,811,488.

- SUSAN COHEN LEVY (EVP and General Counsel) sold 19,585 shares, yielding approximately $2,002,762.

- THOMAS A SOUTH (Executive Vice President) executed 2 sales of 8,804 shares for around $958,852.

- JANE KARPINSKI (Executive Vice President) sold 6,600 shares, totaling about $689,792.

- TERESA PARKER (President/Asset Servicing) sold 4,439 shares, amounting to roughly $447,717.

- JASON J. TYLER (President/Wealth Management) sold 2,237 shares, equivalent to approximately $252,042.

- JOHN LANDERS (Controller) sold 900 shares for about $100,296.

For ongoing updates on insider transactions, refer to Quiver Quantitative’s insider trading dashboard.

Hedge Fund Movements Related to Northern Trust

In the most recent quarter, 339 institutional investors increased their positions in Northern Trust, while 314 reduced their holdings.

Here are notable recent changes:

- JPMORGAN CHASE & CO divested 1,333,239 shares (-31.0%) in Q4 2024, valued at around $136,656,997.

- AMERICAN CENTURY COMPANIES INC sold 1,068,259 shares (-26.3%) in Q4 2024, totaling approximately $109,496,547.

- FIDUCIARY MANAGEMENT INC /WI/ removed 950,338 shares (-100.0%) in Q4 2024, with a value of about $97,409,645.

- NUANCE INVESTMENTS, LLC reduced their stake by 900,838 shares (-49.3%) for an estimated value of $92,335,895.

- KBC GROUP NV increased their position by adding 644,261 shares (+201.6%), valued at approximately $66,036,752.

- ROYAL BANK OF CANADA raised their investment by 562,976 shares (+60.2%), worth around $57,705,040.

- BLACKROCK, INC. decreased their holdings by 503,280 shares (-3.2%) for an estimated total of $51,586,200.

To stay updated on hedge fund portfolios, check Quiver Quantitative’s institutional holdings dashboard.

Analyst Ratings for Northern Trust

Recently, Wall Street analysts have shared their perspectives on $NTRS. There have been 2 buy ratings and 3 sell ratings issued.

Recent notable ratings include:

- Morgan Stanley rated the stock as “Underweight” on 04/07/2025.

- Goldman Sachs rated it as “Sell” on 01/23/2025.

- Wolfe Research issued an “Underperform” rating on 01/03/2025.

- RBC Capital rated it as “Outperform” on 10/24/2024.

- Evercore ISI issued an “Outperform” rating on 10/24/2024.

For more analyst ratings and price targets for Northern Trust, visit Quiver Quantitative’s $NTRS forecast page.

Current Price Targets for Northern Trust Stock

In recent months, six analysts have set price targets for $NTRS, with a median forecast of $105.0.

The following are some recent price target estimates:

- Betsy Graseck of Morgan Stanley set a target of $95.0 on 04/07/2025.

- Alexander Blostein from Goldman Sachs set a target of $102.0 on 01/23/2025.

- Steven Chubak of Wolfe Research set a target of $110.0 on 01/03/2025.

- Gerard Cassidy from RBC Capital set a target of $107.0 on 10/24/2024.

- Glenn Schorr of Evercore ISI set a target of $103.0 on 10/24/2024.

- Kenneth Leon from CFRA set a target of $107.0 on 10/23/2024.

This article should not be considered financial advice. For more information, please refer to Quiver Quantitative’s disclaimers. There may be inaccuracies due to issues in ticker mapping and other discrepancies.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.