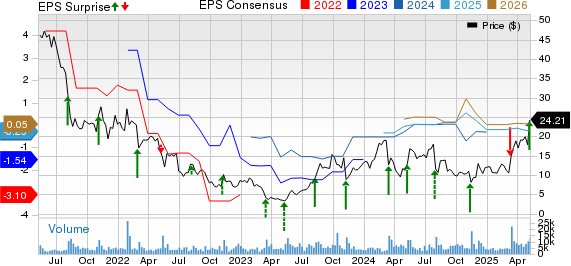

Northern Trust Corporation achieved adjusted earnings per share of $1.46 in Q4 2023, outperforming the Zacks Consensus Estimate of $1.33. However, this marked an 11.5% year-over-year decline.

The company faced a drop in net interest income (NII) and a deterioration in credit quality. On the positive side, increasing fee income and growth in total assets under custody (AUC) and assets under management (AUM) balances contributed to the financial performance.

Quarterly Performance and Financials

Quarterly total revenues reached $1.55 billion, a 1.7% increase year over year, but fell short of the Zacks Consensus Estimate of $1.66 billion. Meanwhile, NII stood at $501.1 million, down 8.9% from the prior year.

Trust, investment, and other servicing fees totaled $1.1 billion, reflecting a 4.6% increase from the year-ago quarter, while non-interest expenses rose by 5% to $1.39 billion.

AUM and AUC Growth

As of December 31, 2023, Northern Trust’s total AUC surged 124% year over year to $11.92 trillion, and total AUM increased by 15% to $1.43 trillion

Deteriorating Credit Quality and Capital Ratios

The total allowance for credit losses expanded by 10% year over year, reaching $220.4 million. At the same time, non-accrual assets saw a significant increase, jumping 41.8% to $65.1 million.

Under the Standardized Approach, capital ratios displayed improvement, with the Common Equity Tier 1 capital ratio, the total capital ratio, and the Tier 1 leverage ratio increasing from the prior-year quarter.

Capital Deployment Activities

In Q4 2023, Northern Trust returned $302.4 million to shareholders through share repurchases and dividends.

Analyst’s Viewpoint

Northern Trust’s Q4 performance faced challenges due to a decrease in NII and escalating expenses, which may impact profitability in future quarters. However, the rise in fee income and increasing AUC and AUM balances are expected to provide support to the company’s financials.

Performance of Other Major Banks

Other major players in the industry, such as Citigroup Inc. and Wells Fargo & Company, demonstrated distinctive patterns in their Q4 earnings, each facing their unique challenges and opportunities.