NORTHROP GRUMMAN Set to Report Earnings and Key Insider Activity

NORTHROP GRUMMAN ($NOC) is scheduled to announce its quarterly earnings on Tuesday, April 22nd, prior to market opening, according to Finnhub. Analysts project the company will generate revenue of $10,050,621,392 and report earnings of $6.32 per share.

For more insights, visit Quiver Quantitative’s $NOC Stock page, where you can track insider trading, hedge fund activities, and congressional trading.

Recent Insider Trading at NORTHROP GRUMMAN

In the last six months, insiders at NORTHROP GRUMMAN have conducted 64 trades of $NOC Stock, with no purchases and all trades being sales.

Below is a summary of the most notable insider trading activities:

- Kathy J. Warden (Chair, CEO and President) sold 3,750 shares for approximately $1,783,687.

- Benjamin R. Davies (CVP & Pres. Defense Systems) executed 4 sales, selling 2,105 shares for around $1,042,725.

- Michael A. Hardesty (Corp VP, Controller & CAO) sold 1,931 shares for about $875,872.

- Kathryn G. Simpson (Corp VP & General Counsel) recorded 2 sales totaling 1,924 shares for approximately $840,013.

- Mark A. Welsh III completed 56 sales, selling 198 shares for about $95,114.

For further details, explore Quiver Quantitative’s insider trading dashboard.

Hedge Fund Movements Involving NORTHROP GRUMMAN

In the latest quarter, 686 institutional investors increased their positions in NORTHROP GRUMMAN Stock, while 660 reduced their holdings.

Significant changes include:

- Morgan Stanley divested 805,949 shares (-16.2%) in Q4 2024, valued at approximately $378,223,806.

- Capital International Investors added 461,307 shares (+5.9%) in Q4 2024, amounting to about $216,486,762.

- T. Rowe Price Investment Management, Inc. sold 457,927 shares (-87.5%) in Q4 2024, valued at approximately $214,900,561.

- Price T Rowe Associates Inc. /MD/ increased their holdings by 450,858 shares (+28.5%) in Q4 2024, worth around $211,583,150.

- Balyasny Asset Management L.P. removed 429,796 shares (-98.9%) from their portfolio in Q4 2024, valued at approximately $201,698,964.

- First Trust Advisors LP addition of 371,814 shares (+337.1%) in Q4 2024 is valued at around $174,488,592.

- Invesco Ltd. added 343,018 shares (+24.7%) in Q4 2024, approximating $160,974,917.

Track hedge funds’ stock portfolios via Quiver Quantitative’s institutional holdings dashboard.

NORTHROP GRUMMAN’s Government Contracts

NORTHROP GRUMMAN has received $7,913,573,811 in award payments over the past year.

Key contract awards include:

- Integrated Battle Command System (IBCS) Hardware Full Rate Production for Wisla Phase II.: $440,808,738.

- IGF::OT::IGF NEXTSTEP NRA Award, building on the success of previous contracts: $399,116,896.

- Next Generation Overhead Persistent Infrared Polar Space Vehicles 1 and 2 Study: $348,486,941.

- Block 3 EA Subsystem Hemisphere Production: $292,514,272.

- GWS Software Development (GFC, IDT, GSS): $170,249,622.

For more government contract details, visit Quiver Quantitative’s government contracts dashboard.

Recent Analyst Ratings for NORTHROP GRUMMAN

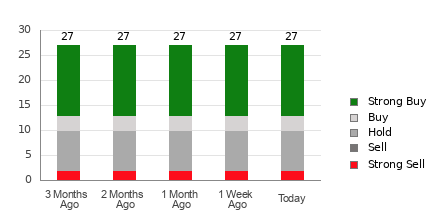

In recent months, Wall Street analysts have provided their assessments on $NOC. Currently, three firms have issued buy ratings while none have provided sell ratings.

Recent analyst insights include:

- Morgan Stanley issued an “Overweight” rating on 04/16/2025.

- Wells Fargo provided an “Overweight” rating on 03/07/2025.

- Susquehanna offered a “Positive” rating on 01/08/2025.

To follow analyst ratings and price targets for NORTHROP GRUMMAN, check out Quiver Quantitative’s $NOC forecast page.

Latest Price Targets for NORTHROP GRUMMAN

In the last six months, multiple analysts have set price targets for $NOC. Three analysts have provided targets with a median of $550.00.

Notable price targets include:

- Charles Minervino from Susquehanna set a target price of $557.00 on 01/08/2025.

- Sheila Kahyaoglu from Jefferies proposed a target price of $550.00 on 10/30/2024.

- David Strauss from Barclays set a target of $550.00 on 10/29/2024.

This article is not financial advice. Please see Quiver Quantitative’s disclaimers for further details. Note potential inaccuracies due to ticker-mapping mistakes and other anomalies.

This article was originally published on Quiver News. Read the full story.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.