New Meta Options Up for Grabs: Analyze Your Choices

Investors Eyeing Meta Platforms Inc Options

Investors in Meta Platforms Inc (Symbol: META) have new options available today, set to expire on March 7th. According to Stock Options Channel, our YieldBoost formula has evaluated the META options chain and identified noteworthy put and call contracts.

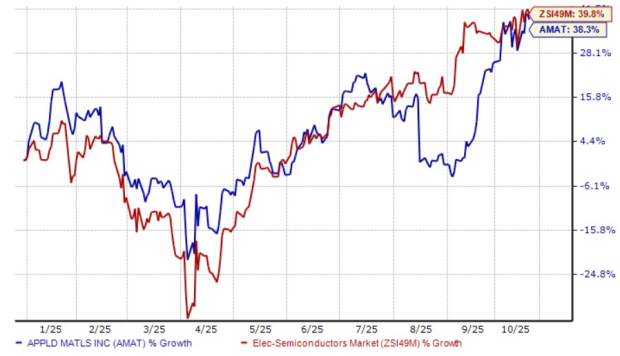

The put contract with a $625.00 strike price currently has a bid of $29.95. By selling-to-open this put contract, an investor commits to buying the stock at $625.00 while collecting the premium. This lowers the cost basis of the shares to $595.05 (not including broker commissions). For those keen on purchasing META shares, this could offer a better deal compared to the current trading price of $628.73 per share.

The $625.00 strike is roughly a 1% discount to the current stock price, making it out-of-the-money by that percentage. There’s a 55% chance that this put contract might expire worthless, based on current analytics including greeks and implied greeks. Stock Options Channel will continuously monitor these odds, updating a chart on our website for this specific contract. Should the contract expire without value, the premium would yield a 4.79% return on the cash outlay, or an annualized rate of 40.68%—this is what we call the YieldBoost.

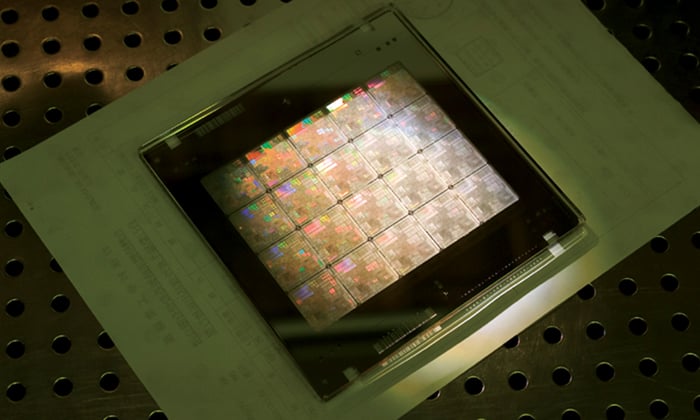

Below is a chart showing the trading history for Meta Platforms Inc over the past twelve months, with the location of the $625.00 strike marked in green:

Opportunities on the Call Side

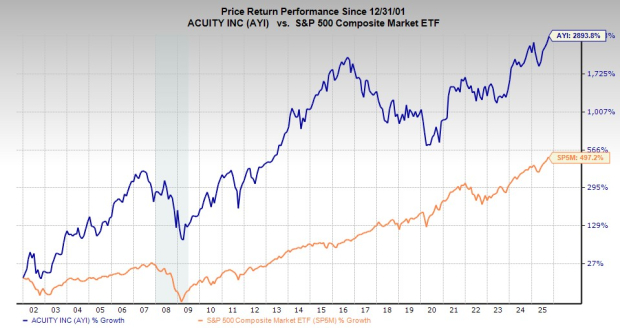

Now, turning our attention to the call side of the option chain, we see a call contract at the $635.00 strike price with a current bid of $30.25. If an investor buys META shares at the current price of $628.73 and sells-to-open this call contract as a “covered call,” they would commit to selling the stock at $635.00. This would yield a total return (excluding dividends) of 5.81%, assuming the stock is called away at the March 7th expiration (not including broker commissions).

Investors should remember, however, that if META’s shares surge, possible gains could be capped. Therefore, reviewing the company’s twelve-month trading history and business fundamentals is essential. Below is a chart illustrating META’s trading history with the $635.00 strike indicated in red:

The $635.00 strike represents an approximate 1% premium over the current price, making it out-of-the-money by that same percentage. There’s also a chance the covered call could expire worthless, in which case the investor would retain both their shares and the premium earned. Current analytical readings indicate a 50% likelihood of this outcome. Stock Options Channel will keep track of these odds and provide updates, including the trading history of the option.

If the covered call expires worthless, the premium would boost returns by 4.81%, translating to an annualized rate of 40.84%, which we also term the YieldBoost.

Volatility Insights

In addition, the implied volatility for the put contract is at 38%, while the call contract stands at 39%. Our calculations show the actual trailing twelve-month volatility, based on the last 250 trading days and today’s price of $628.73, is 36%. For more insights on put and call options contracts, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the Nasdaq 100 »

Top YieldBoost Calls of the Nasdaq 100 »

Also see:

• STO Options Chain

• INB Historical Stock Prices

• PILL Market Cap History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.