New Options Available for Bilibili Inc: A Look at Call Contracts

Investors of Bilibili Inc (Symbol: BILI) have fresh opportunities today with the introduction of options expiring on February 28th. Using our YieldBoost formula at Stock Options Channel, we explored BILI’s options chain and found an appealing call contract.

Highlighted Call Contract: Maximizing Potential Returns

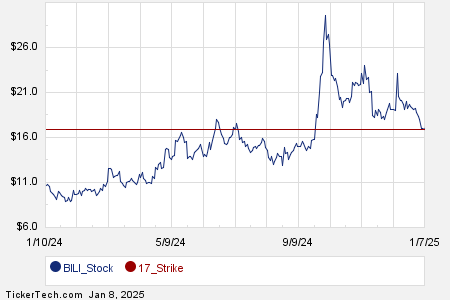

The notable call contract for a strike price of $18.50 currently has a bid of 48 cents. If an investor buys shares of BILI stock at the current price of $16.86 per share, then sells this call contract as a “covered call,” they will agree to sell their stock at $18.50. By doing this, including the premium collected, the total return (not counting any dividends) would amount to 12.57% if the stock is called away at the expiration date, before considering broker commissions. It’s also essential to analyze Bilibili’s recent trading trends and business fundamentals to gauge potential future performance. A chart showcasing BILI’s trailing twelve-month trading history, featuring the $18.50 strike price in red, is displayed below:

Understanding Strike Price Dynamics and Investor Options

The $18.50 strike price represents about a 10% premium over the current stock price, indicating it is out-of-the-money by that percentage. There exists a possibility that this covered call could expire worthless; if this occurs, the investor retains their shares and the collected premium. Current analytics suggest that there is a 55% chance of this outcome. Updates on these probabilities will be tracked over time on our website, along with a detailed chart of the option contract’s trading history. Should the covered call indeed expire worthless, the premium would provide a 2.85% increase in return for the investor, which translates to an impressive annualized rate of 20.38%, a figure we denote as the YieldBoost.

Volatility Insights: Implied vs. Actual

The implied volatility for the aforementioned call contract stands at 75%. Conversely, our calculation of the actual volatility over the past year (considering the last 251 trading days’ closing values alongside today’s price of $16.86) is also 75%. For more insights on additional options contracts, both put and call, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Related Insights:

- Top Ten Hedge Funds Holding FNI

- Funds Holding WH

- SUSC shares outstanding history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.