“`html

Market Trends Highlight Promising Investments in AppLovin and MasTec

Since Donald Trump’s victory, the stock market and bitcoin have reached record levels. Investors are optimistic that lower corporate taxes and reduced regulations will fuel growth across various sectors, from technology and cryptocurrency to infrastructure.

Stay informed with the Zacks Earnings Calendar.

Wall Street remains positive about earnings growth forecasts and the Federal Reserve’s projected rate cuts. Given the recent market gains, some profit-taking could be expected, but the upcoming November-January period is typically very bullish for the market.

Investors looking to capitalize on this momentum should consider adding high-performing stocks to their portfolios as 2024 approaches, particularly those with strong earnings revisions.

Today, we examine two companies—AppLovin and MasTec—which have outperformed the S&P 500 over the past year, earning them a Zacks Rank #1 (Strong Buys) after recent strong earnings results.

AppLovin stands to gain from long-term growth in digital applications, with an added boost from artificial intelligence (AI). Meanwhile, MasTec is poised to benefit from developments in the energy sector and infrastructure investment.

Is AppLovin Worth the Investment After a 620% Surge in 2024?

AppLovin Corporation’s APP is empowering companies and app developers by helping them acquire and retain users, enhance customer value, and measure marketing effectiveness. Its AI-enhanced technologies enable clients to reach target users across various platforms.

In the competitive landscape of digital applications, AppLovin thrives as clients increasingly utilize its services to capture audience attention and increase downloads.

Image Source: Zacks Investment Research

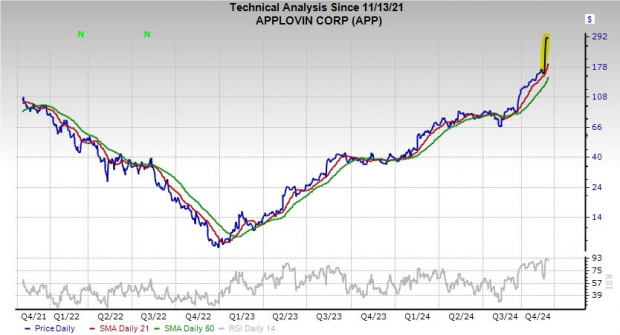

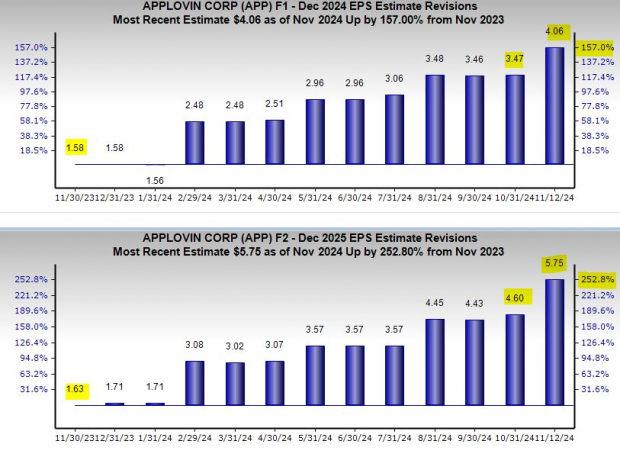

In 2023, AppLovin reported a revenue increase of 17%, following a rise in 2022 and an impressive 93% growth in 2021. The company announced another strong quarter on November 6, with adjusted earnings surging 316% year-over-year, software platform revenue up 66%, and total sales up 39%.

After its Q3 release, FY25 earnings estimates for AppLovin jumped from $4.16 to $5.75 per share. Earnings projections have risen significantly for both FY24 and FY25, with increases of 160% and 250%, respectively.

AppLovin is expected to raise its earnings per share by 314% in 2024 and another 42% in the following year, with sales projected to grow by 40% in 2024 and 20% in 2025.

Image Source: Zacks Investment Research

The stock price of AppLovin has skyrocketed 620% year-to-date and roughly 1,750% over the past two years, surpassing Nvidia’s 800% and Meta’s 410% gains during the same periods.

While some profit-taking might occur, any dips toward AppLovin’s moving averages could serve as favorable buying opportunities.

MasTec Positioned for Growth Amid Key Market Trends

MasTec, Inc. MTZ is a premier U.S. infrastructure constructor, offering a range of services including engineering, installation, maintenance, and upgrades. The company is benefiting from the rise in electrification and infrastructure investment due to ongoing energy transition trends.

MasTec is also poised to gain from the increasing demand sparked by the growing AI sector. These trends are likely to continue, particularly if there’s a second term for Trump, aligning with a focus on reshoring and infrastructure development.

Image Source: Zacks Investment Research

MasTec recently reported a strong third quarter on Halloween, ending the period with a record backlog of $13.9 billion, an increase of $1.4 billion year-over-year. CFO Paul DiMarco noted that favorable macrotrends in their markets enable the company to prioritize capital allocation for growth opportunities.

“`

MasTec Reports Impressive Growth and Strong Forecasts for Future Earnings

Sales Growth and Positive Projections

MasTec (MTZ) experienced notable sales growth of 23% in both 2023 and 2022, a rise partially attributed to its acquisition of Energy Alternatives, Inc. The company anticipates a 2% increase in revenue for 2024, followed by a more significant 9% in 2025.

Forecasts Indicate Strong Earnings Growth

Following its Q3 earnings release, MasTec’s estimates for fiscal years 2024 and 2025 have risen by 20%. With a Zacks Rank #1 (Strong Buy), the company is projected to see adjusted earnings grow by a remarkable 84% in 2024, and an additional 45% in 2025.

Image Source: Zacks Investment Research

Long-term Growth and Stock Performance

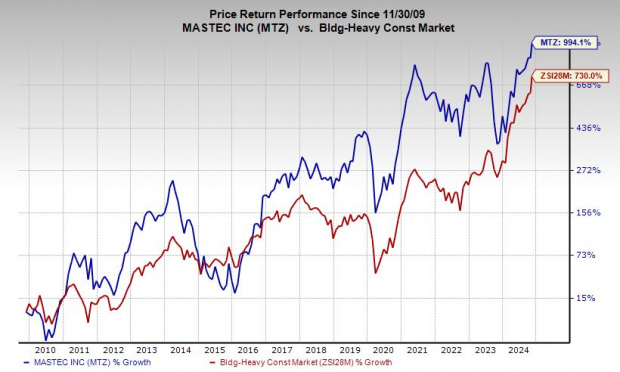

Over the past 20 years, MasTec’s stock has skyrocketed by 1,600%, outpacing its Building Products – Heavy Construction industry, which increased by 575%, and the S&P 500’s 435%. Recently, MTZ reached new all-time highs, fueled by an impressive 84% gain year-to-date.

Monitoring Potential Market Corrections

However, as MasTec continues to surge, there may be short-term obstacles ahead, similar to other stocks. Investors should closely observe its 21-day moving average for signs of stability. Currently, MTZ trades 9% below the average Zacks price target, and of the 13 brokerage recommendations Zacks surveyed, 11 are “Strong Buys.”

Investing in Infrastructure: Opportunities Ahead

The U.S. government has committed trillions of dollars towards repairing and enhancing the country’s infrastructure. This includes investments in roads, bridges, AI data centers, renewable energy, and more.

In this climate, several unexpected stocks stand to benefit significantly from this ongoing investment trend.

Download our report “How to Profit from the Trillion-Dollar Infrastructure Boom” for more insights.

Want the latest picks from Zacks Investment Research? Download “5 Stocks Set to Double” for free today.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

MasTec, Inc. (MTZ): Free Stock Analysis Report

AppLovin Corporation (APP): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.