Investment Outlook Unpacked

Novo Nordisk (OTCPK:NONOF) reigns supreme in an industry fortified with formidable entry barriers, unyielding pricing power, and minimal demand responsiveness.

The company rides the enduring tailwinds of a burgeoning diabetic and obesity-afflicted population. This crucial demographic shift has paved the way for substantial reinvestment in organic growth, strategic acquisitions, and the expansion of production facilities.

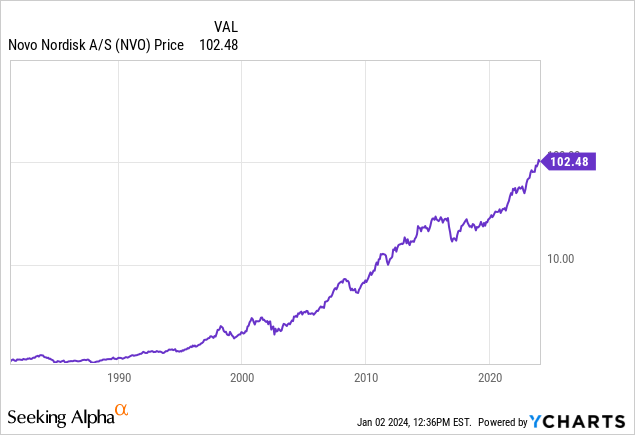

Remarkable capital allocation, soaring returns on invested capital, stable revenues, negligible debts, and outstanding net income margins endorse its standing as a prized long-term investment. The continuous market favoritism has flabbergasted the predictions, surpassing initial expectations.

Corporate Overview

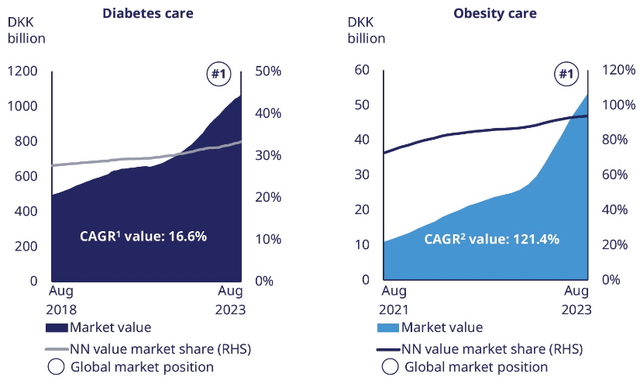

Novo Nordisk dominates the pharmaceutical landscape with a formidable stronghold in diabetes and obesity care. A surge in demand for its weight-loss marvel, Wegovy, has propelled the company to record-breaking earnings, thereby cementing its status as Europe’s most valuable enterprise with a colossal $460B market cap.

The insulin market, a dominion dominated by three colossi — Novo Nordisk, Sanofi (SNY), and Eli Lilly (LLY) — commands over 90% of the global market share. This oligarchic grip bequeaths them with sky-high margins, astronomic returns on capital, and unassailable pricing dominance.

Novo Nordisk’s primary revenue contributors and their proportional impact are:

- Injectable GLP-1: Ozempic and Victoza (43.6%)

- Oral semaglutide: Rybelsus (7.7%)

- Insulin products (22.8%)

- Obesity care: Wegovy and Saxenda (18.3%)

- Rare disease (7.6%)

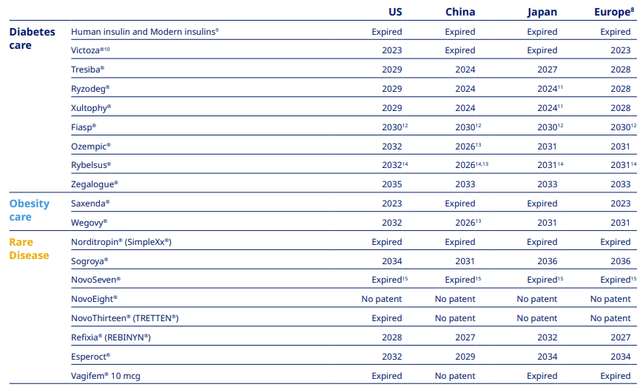

Although only a handful of insulin products retain patent protection for the compound itself, a majority of insulin products are shielded by patents on the dosing pens and delivery devices.

This industry structure and the formidable barriers to entry have fueled Novo Nordisk’s revenue growth, clocking in at a staggering 10.5% CAGR over the last decade. Bestowed with a fundamental product commanding scarce demand elasticity, operating margins soar over 43%, while returns on invested capital stand imperiously at 32%.

In recent times, Novo Nordisk has honed its focus on the obesity segment, magnifying its revenue contribution from a mere 2% in 2017 to an impressive 18% of total revenue, surpassing all investor aspirations.

Exceeding Expectations

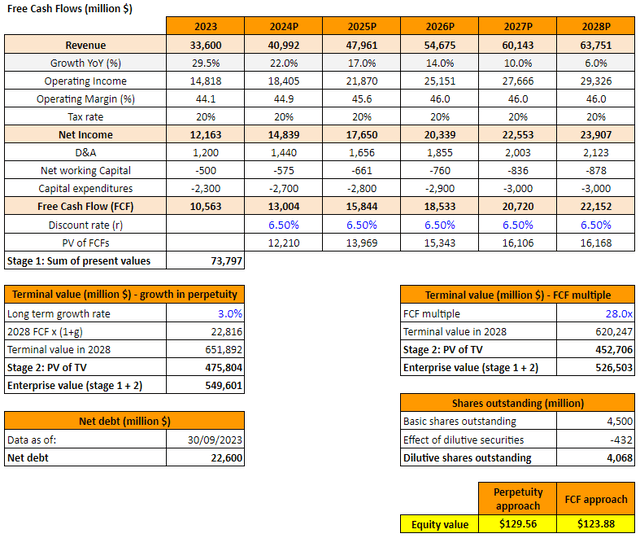

In my initial coverage of Novo Nordisk, I anticipated a 25% surge in revenues for 2023, followed by a 15% uptick in 2024. Miraculously, the company has galloped past my projections, with the stock catapulting to eclipse the previous fair price ($186 per share, $93 after the 2:1 split).

Following three incremental revisions to guidance throughout the year (in April, August, and October), revenue escalation is now poised to reach 29% for the entirety of 2023 (34% at CER), with net income margins surging above 36% (in contrast to 31.4% in 2022).

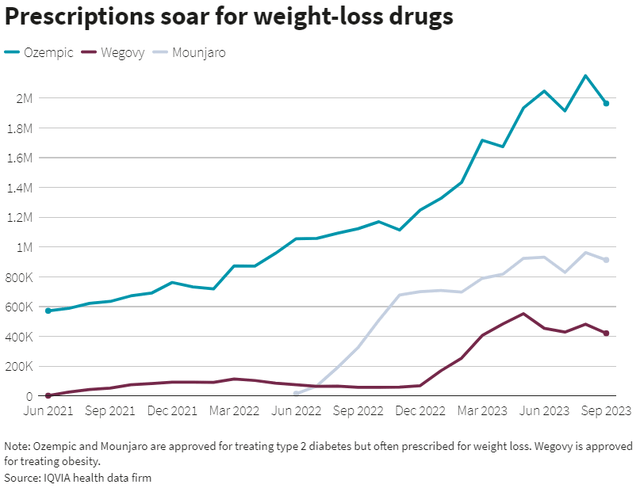

The staggering feats of the company in the past year are chiefly attributable to a spike in revenues from the injectable GLP-1 segment, witnessing Ozempic revenues surge by 53% over the initial 9 months. Simultaneously, the obesity care segment witnessed a seismic 167% surge in the same period, driven primarily by a stratospheric 481% spike in Wegovy’s revenues.

With Ozempic constituting nearly 40% of total revenues, any surge in demand precipitates a monumental impact on the overall financial performance. Meanwhile, Wegovy’s revenue contribution has surged from a modest percentage the previous year, owing to supply constraints (2.9%), to commanding 13% of total revenues during 2023, thanks to the ramp-up in production capacity to cater to the entire U.S. demand for the 2.4mg dose (though challenges persist in meeting the 1.7mg demand).

Geographically, GLP-1 diabetes products witnessed swifter growth outside the U.S., predominantly fueled by mushrooming demand in China (80% revenue upsurge), whereas the growth in obesity products was largely steered by the U.S., the primary market for this segment (comprising 79% of obesity revenues), where the company has fervently focused to meet the escalating demand.

In Europe, Wegovy has only been introduced in Germany, the U.K., Denmark, Norway, and Iceland, signifying substantial untapped potential.

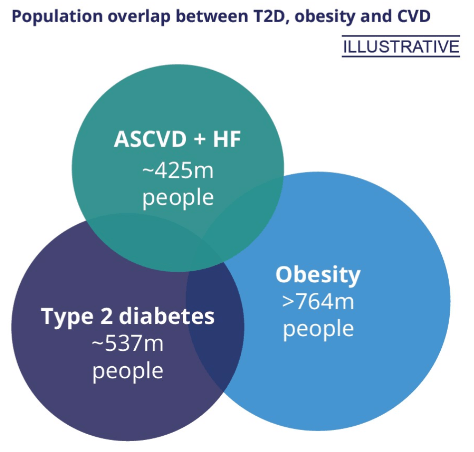

In addition to surpassing the 2025 sales expectations for the obesity segment during 2023 ($3.7B), the company has revealed the findings of the SELECT cardiovascular trial, unveiling a statistically significant outcome and a substantial 20% drop in major adverse cardiovascular events compared to the placebo. This triumph broadens Novo Nordisk’s horizons to new market realms.

These milestones arrive at an opportune juncture following the FDA’s recent approval of Eli Lilly’s Zepbound injection for obesity treatment, which has showcased superior efficacy than Wegovy (although the latter remains applicable for treating pediatric patients).

The complete SELECT results were unveiled at the American Heart Association Congress in November, with a label indication expansion for Wegovy in the pipeline. The FDA has accorded a priority review, and the expansion could secure approval by May 2024.

While gauging the precise total addressable market proves challenging, given the substantial overlap between diabetes, obesity, and cardiovascular diseases, the label expansion for Wegovy could fortify Novo Nordisk’s market preeminence and incite insurance providers to extend coverage for Wegovy.

Novo Nordisk: A Prescription for Success in Production Expansion, Acquisitions, and Valuation

Increasing Production Capacity

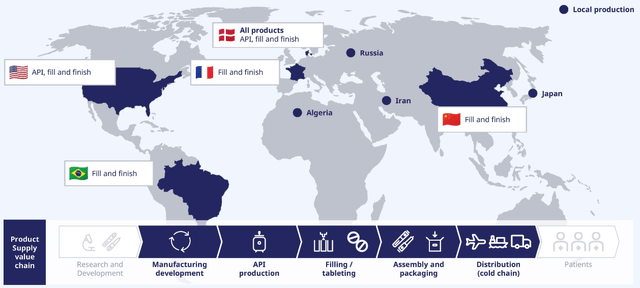

For Novo Nordisk, the challenges of a disrupted supply chain and surging demand have led to shortages in key products like Wegovy and Ozempic. To address this, the company embarked on a supply chain restructuring and investment in expanding production capacity.

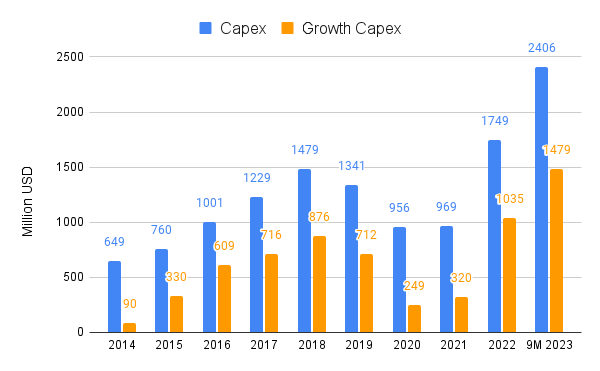

Novo Nordisk has earmarked substantial capital for this expansion, with an expected growth capex of $2.3B for 2023, a significant rise from the $1.1B annual average over the past decade. The company’s commitment to production expansion is evidenced by a series of expansions and acquisitions slated to continue through 2029.

The strategic moves include an $800M expansion of clinical manufacturing facilities in Denmark, a $2.35B investment in a new manufacturing plant for API production, and the acquisition of Alkermes’s facility in Ireland for $92.5M, among others. Notably, a $6.2B investment is planned to expand its Kalundborg facility, auguring the addition of 800 new jobs to the current 4,400-strong workforce.

Strategic Acquisitions

Besides its organic growth, Novo Nordisk has been actively pursuing acquisitions to complement its portfolio. Notably, the acquisition of the ocedurenone molecule from KBP Biosciences and companies like Inversago Pharma and Biocorp represent a strategic thrust into serious chronic diseases and complementary technologies.

The acquisition of ocedurenone for $1.3B targets cardiovascular and kidney diseases and is in line with the company’s expansion into other chronic conditions. Additionally, Novo Nordisk’s acquisition of Inversago Pharma and Biocorp, at a combined cost of $1.23B, indicates a clear focus on enhancing its offerings in the obesity, diabetes, and medical device segments.

Evaluating Future Growth Potential

As Novo Nordisk continues to outperform expectations, a key question arises—whether the market has fully factored in the company’s future growth potential.

While the expectations hint at revenue growth surging above 20% in 2024, the longer-term outlook is clouded by factors such as ongoing trials and potential competition. The company’s investments in production facilities expansion are expected to result in a minor decline in revenue growth in the coming years, tempered by factors such as potential trial outcomes and market dynamics.

Furthermore, Novo Nordisk’s low average interest rate on debt stands at under 1%, contributing to a relatively low discount rate. The company’s low beta of 0.20x also underscores a subdued risk profile. However, investors should consider the company’s net debt in a broader context, accounting for both cash and short-term investments as well as rebates. These factors shape the complete picture of Novo Nordisk’s valuation.

The Unprecedented Surge of Novo Nordisk: A Hidden Glimmering Jewel

Novo Nordisk has been on a remarkable winning streak, defying market expectations and setting new standards for the pharmaceutical industry. Just as a dormant volcano suddenly erupts, Novo Nordisk has seen an unexpected surge in demand, significantly outpacing its own growth projections and leaving investors in awe.

Impressive Growth Trajectory

With a 17% increase in operating profits from the previous year and a staggering 51% surge in share price, Novo Nordisk’s performance has been nothing short of sensational. The company’s rapid ascent is akin to a phoenix rising from the ashes, catapulting itself to the forefront of the pharmaceutical domain.

Navigating Risks and Challenges

While the terrain ahead seems favorable, it’s crucial to acknowledge the potential stumbling blocks that lie in wait. The looming apprehension regarding FDA and EMEA approvals for label expansion of Wegovy, and the shadow of a burgeoning competitive landscape, pose as immediate concerns. However, amidst this tumultuous terrain, Novo Nordisk’s steadfast grip on the reins of the obesity market is undeniable and unwavering.

So we are only scratching the surface of the obesity market. The biggest challenge we have is not competition, it’s actually awareness of obesity as a chronic disease, the need for medical intervention, the value it has on your health system. So I welcome competition in actually driving and unlocking that market.

Source: Lars Jorgensen (CEO), J.P. Morgan 42nd Annual Healthcare Conference, January 2024.

In light of potential regulatory obstacles and unknown side effects, the need for agile and responsible navigation is evident. Regulatory vigilance and the pursuit of groundbreaking innovation have been pivotal in the past—factors that will continue to influence the company’s trajectory in the future.

A Firm Footing in the Market

The surge in demand has proven to be both a blessing and a challenge for the company. While meteoric demand levels may well be the envy of any business, they also present logistical challenges such as meeting this unprecedented surge. Novo Nordisk’s proactive measures to bolster production capacity appear to be a step in the right direction, solidifying its position in the market.

Moreover, the company’s sophisticated grasp on innovation and product development, combined with its unwavering compliance with regulatory obligations, further fortify its standing. The unwavering quest for efficiency and prudent resource allocation underscore the company’s indomitable spirit and calculated approach.

Looking to the Future

As investors gauge the future of Novo Nordisk, the outlook remains bullish. The company’s astute reinvestment in organic growth, along with a judicious approach to debt management and capital distribution, exudes a sense of confidence and responsibility. This measured stance, coupled with optimistic growth projections for the obesity market, paints a promising picture.

Against the backdrop of soaring market valuation, Novo Nordisk’s stock, by all accounts, appears grossly undervalued. With a newfound fair price pegged at $126 per share, the company presents an enticing prospect for investors, positioning it favorably as a “buy” in the eyes of many astute analysts.

The unfolding narrative of Novo Nordisk epitomizes an unexpected resurgence, akin to a comet suddenly illuminating the night sky, captivating the attention of investors and industry analysts alike. The company’s unwavering ascent and meticulous groundwork are indicative of a remarkable journey, one marked by triumph and fortitude.