The Dominance of Novo Nordisk in Diabetes Care

For several decades, Novo Nordisk has held the reins as a leader in diabetes care. Amidst fierce competition, the Denmark-based pharmaceutical giant has steered the way in combatting the global health crisis of diabetes. Staking claim to a staggering 33.8% share in the worldwide diabetes market as of November 2023, up nearly 2% from the previous year, Novo Nordisk’s innovative insulin products continue to revolutionize diabetic care.

The company’s recent submission of icodec for regulatory approval in key markets signals a milestone towards a potential once-weekly insulin product. A shift from daily to weekly dosing stands to revolutionize treatment convenience for diabetes patients who require insulin, painting a promising future for Novo Nordisk’s foray into diabetes care innovation.

Continued Innovation and Market Success

Novo Nordisk’s prowess transcends diabetes care, extending into the realm of obesity management with the remarkable success of its weight loss medicine, Wegovy. As demand outstripped supply, the company’s resilience in resolving supply shortages speaks volumes about its market adaptability.

With contenders such as Eli Lilly, Amgen, Pfizer, and Viking Therapeutics vying for a slice of the weight-loss medicine market, Novo Nordisk stands as a stalwart competitor, poised to retain its position as a top seller in obesity therapies.

Expanding its horizons, Novo Nordisk recently unveiled promising phase 1 results for amycretin, an oral diabetes medicine, exemplifying the company’s commitment to innovation immersed within its core therapeutic domains.

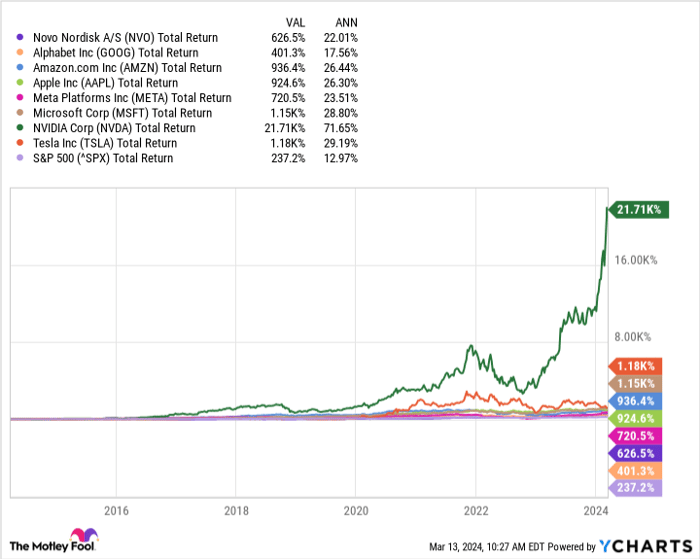

A Parallel to the Magnificent Seven

Novo Nordisk mirrors the essence of the coveted Magnificent Seven with its track record of innovation, financial excellence, and enduring stock market returns. Embracing a culture of constant reinvention, the company remains at the forefront of diabetes and obesity care, signaling a potential candidate for an esteemed group like the Magnificent Eight.

A Call to Investors

As the speculation looms over a potential expansion from the Magnificent Seven to the Magnificent Eight, investors are urged not to overlook the undoubted potential harbored within Novo Nordisk. With its consistent performance and innovative portfolio, Novo Nordisk presents a compelling case for inclusion in investment portfolios.

Before delving into Novo Nordisk stocks, weighing the wisdom of the Motley Fool’s top 10 stock picks could provide valuable insight into the evolving investment landscape. With a proven track record of outperforming the S&P 500, their recommendations may hold the key to unlocking substantial returns in the future.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Pfizer, and Tesla. The Motley Fool recommends Amgen and Novo Nordisk and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Disclaimer: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.