In the world of real estate, where some are happy leasing apartments, others dream of owning Netflix House. The behemoth of streaming services is set to take residency in the former Lord & Taylor store at the King of Prussia Mall, a 120,000-square-foot building that will draw curious glances for years to come.

Reports out of the Philadelphia Business Journal disclose that the current space owner is HBC, the retail company overseeing operations through its HBC Properties division. While the building’s price is undisclosed, a 2011 appraisal valued it at $7.37 million. With recent real estate fluctuations in mind, a price in proximity to the initial appraisal wouldn’t be surprising. A decade-long net lease awaits, starting December 31, 2024, comprising a corporate guarantee from Netflix and 2.5% annual rent increases.

Navigating Netflix Drama: Split-In-Half Shows

However, the journey to Netflix House isn’t entirely smooth sailing. An article from Forbes highlights viewer discontent over Netflix’s split-in-half releases, exemplified by the upcoming season four of Outer Banks. The show will premiere its first five episodes on October 10, followed by the remaining segments a mere month later on November 7. Devotees yearn for the traditional Netflix binge, differing from this new episodic approach; a change viewed as more of a hack job than the traditional full-season experience.

Fans lament the serialized treatment of popular shows as a departure from the platform’s binge-worthy reputation. Initially built as a haven for disorder, Netflix seems to be tidying up its offerings, reflecting a shift towards serialized releases over full-season dumps.

Analyzing Netflix Stock: Time to Buy or Sell?

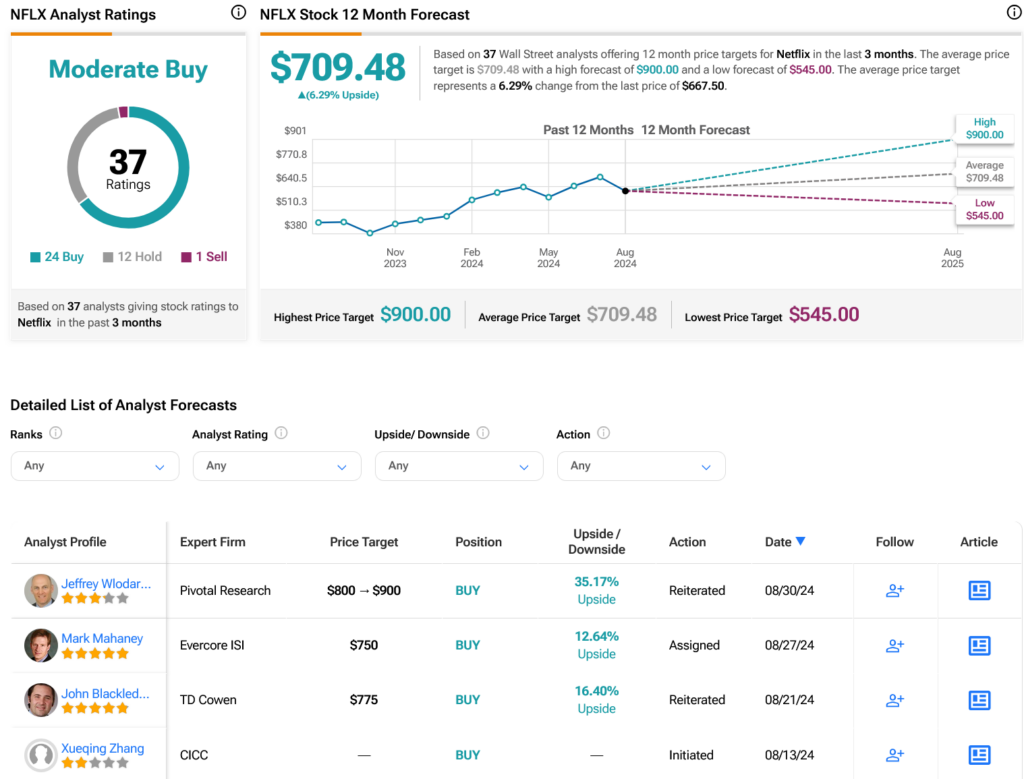

Shifting gears to Wall Street’s perspective, analysts currently place a Moderate Buy consensus on NFLX shares. In the last three months, the consensus stems from 24 Buy ratings, 12 Holds, and a single Sell recommendation, all pointing to interesting times ahead. Despite a robust 50.25% climb in share value over the past year, the current NFLX price target hovers at $709.48 per share, suggesting a modest 6.29% upside.

Discover more about NFLX analyst ratings

Disclosure

Any views and opinions expressed in this narrative are that of the author alone and may not necessarily align with those of Nasdaq, Inc.