“`html

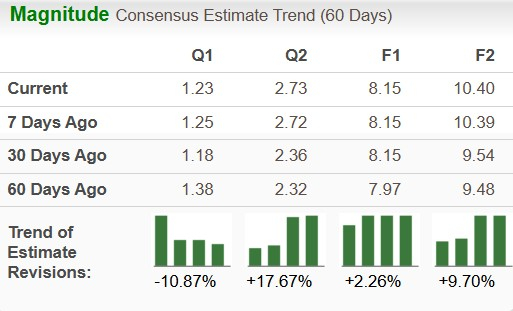

NextEra Energy (NEE) and NRG Energy (NRG) are key players in the Zacks Utility – Electric Power industry, actively investing in clean electricity generation. NRG’s earnings per share estimates for 2025 and 2026 have risen by 2.26% and 9.70%, while NEE’s estimates remained unchanged. NRG’s return on equity (ROE) stands at 103.57%, significantly outperforming NEE’s 12.42% and the industry average of 10.09%.

NRG’s debt-to-capital ratio is 85.83%, compared to NEE’s 59.04%. Despite both companies having substantial debts, their Times Interest Earned (TIE) ratios are high, with NRG at 3.9 and NEE at 2.3. In terms of price valuation, NEE trades at a forward P/E of 21.19, while NRG trades at 15.65, indicating NRG’s lower valuation.

NRG’s shares have gained 81.8% in the last year, outperforming NEE’s 10% increase and the industry’s 17% return. Based on various financial metrics, NRG Energy currently holds a marginal edge over NextEra Energy as an investment opportunity within the utility sector.

“`