“`html

Nu Holdings Ltd. (NU) is experiencing slower growth in Mexico compared to Brazil, where it achieved 10 million users at a 20% quarterly growth rate. Currently, Nubank Mexico is expanding at 10% quarterly, suggesting it may take nearly two years to double its customer base, versus one year in Brazil. The company is exploring new banking licenses in Mexico, which could enhance access to payroll loans and deposit insurance, potentially boosting consumer trust and revenue streams.

Mexican banks have fortified their defenses against Nubank’s entry, unlike the surprise faced by Brazilian institutions during Nubank’s rise. This preemptive action from existing competitors may hinder Nubank’s growth trajectory in Mexico, even as regulatory opportunities present a promising market landscape.

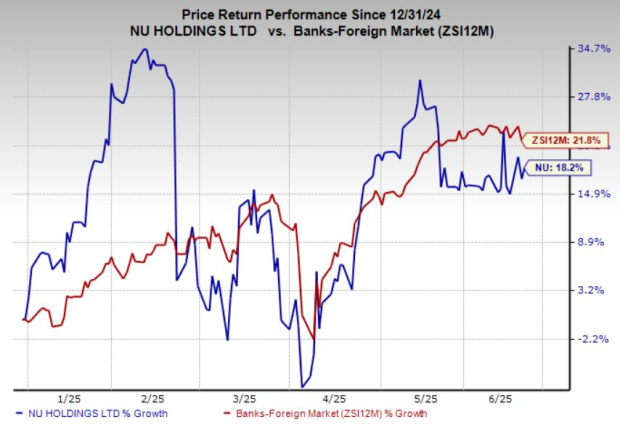

In terms of stock performance, NU has rallied 18% year-to-date, underperforming the industry’s 22% increase. It trades at a forward price-to-earnings ratio of 18.88, significantly above the industry average of 9.2. The Zacks Consensus Estimate for NU’s earnings has been declining over the past 60 days.

“`