“`html

Nucor Corporation Faces Challenges Amid Falling Steel Prices

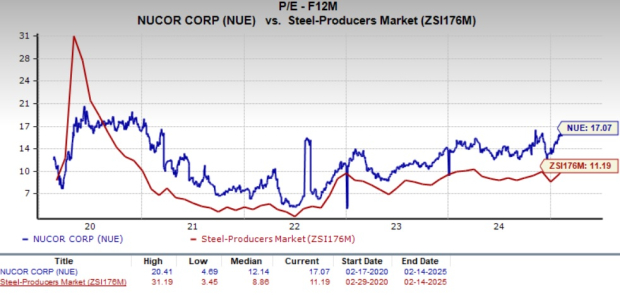

Nucor Corporation (NUE) is currently trading at a forward price/earnings ratio of 17.07X, which is about 52.5% higher than the Zacks Steel Producers industry average of 11.19X, and exceeds its five-year median.

Image Source: Zacks Investment Research

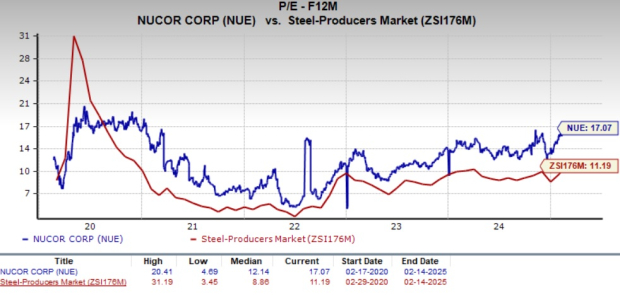

Over the past year, NUE’s stock has fallen by 25.8%. This decline is tied to the volatility in the steel market, particularly a sharp drop in U.S. steel prices, which has led to lowered earnings estimates for NUE. In contrast, the steel industry as a whole has seen a decline of 19.6%, while the S&P 500 has risen by 23.3%. Among NUE’s major competitors, Steel Dynamics, Inc. (STLD) has gained 10.1%. Meanwhile, United States Steel Corporation (X) and Cleveland-Cliffs Inc. (CLF) have experienced losses of 16.5% and 42.2%, respectively, during the same period.

Nucor’s Performance Over the Past Year

Image Source: Zacks Investment Research

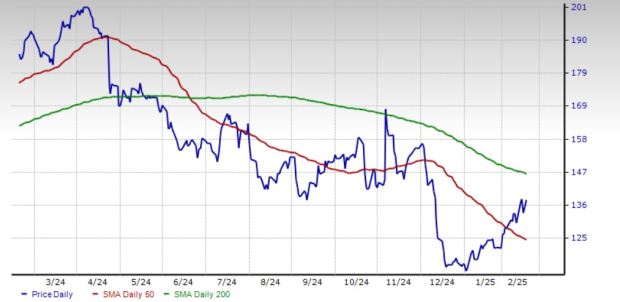

Currently, NUE has been trading below its 200-day simple moving average (SMA) since November 7, 2024. However, the stock surpassed its 50-day SMA on February 3, 2025, indicating a brief moment of optimism. A death crossover occurred on June 20, 2024, and since then, the 50-day SMA has remained below the 200-day SMA.

NUE Trading Above 50-Day SMA

Image Source: Zacks Investment Research

Declining Earnings Estimates Indicate Investor Concerns

In the last 60 days, analysts have revised the Zacks Consensus Estimate for NUE’s 2025 earnings downward. The first-quarter estimate for 2025 has experienced similar downward adjustments.

Currently, the consensus estimate for NUE’s 2025 earnings stands at $7.64, indicating a projected decline of approximately 14.2% compared to the previous year. First-quarter earnings are anticipated to drop by about 66.8%.

Find the latest earnings estimates and surprises on the Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Despite the negative earnings outlook, the market has valued NUE’s shares relatively high. Its elevated valuation raises questions about whether it offers real value at this time. Let’s take a deeper look at the fundamentals.

Nucor’s Growth Strategy to Boost Stock Performance

Nucor aims to increase its production capacity to foster growth and enhance its position as a low-cost producer. The company has launched various growth projects, notably at Gallatin and Brandenburg mills, with strong production and shipment results. NUE has plans to invest $6.5 billion in eight significant growth projects by 2027, which include the largest project at the Apple Grove, WV, sheet mill, as well as micro mills in Lexington, NC, and the Pacific Northwest.

Recently, Nucor has also focused on strategic acquisitions to diversify its offerings. The acquisition of Southwest Data Products broadens its portfolio aimed at data center clients, while the buyout of Rytec Corporation allows Nucor to expand into high-performance door production. This diversification is expected to create opportunities for cross-selling across its other businesses.

Robust Financial Health Underlines NUE’s Capital Allocation

Nucor is committed to maximizing shareholder returns, supported by a strong balance sheet and healthy cash flows. By the end of 2024, the company reported liquidity of approximately $4.1 billion in cash and short-term investments. Furthermore, it generated around $4 billion in cash from operations during 2024. NUE has returned approximately $2.7 billion via dividends and share buybacks last year, totaling around $12 billion returned to shareholders since 2020, representing 57% of its net earnings. In December 2024, Nucor raised its quarterly dividend to 55 cents per share from 54 cents. Nucor has consistently increased its dividend for 52 years since it started paying dividends in 1973. The company is committed to returning at least 40% of its annual net earnings to shareholders.

Currently, NUE provides a dividend yield of 1.6%. Its payout ratio stands at 25%, well below the 60% threshold, which suggests long-term sustainability. The company has achieved a five-year annualized dividend growth rate of 8.2%, reinforcing confidence in its future dividend payments.

Struggles from Weak Steel Prices Impact Nucor’s Future

Nucor is facing challenges due to falling steel prices, which have significantly affected its stock performance. The decline in U.S. steel prices was sharp in 2024, driven by a decrease in demand and an oversupply situation following a strong growth period at the end of 2023 and early 2024.

The price of benchmark hot-rolled coil (HRC) dropped by more than 40% last year, falling from $1,200 per short ton in early 2024. Several factors contributed to this slump, including decreased lead times for steel mills, an influx of imports, reduced demand from key sectors, and broader economic uncertainties.

Declines in industrial output and construction projects added to the pressure. This environment has led to decreased profitability among steel producers. Although recent price increases for steel mills and the impact of tariffs on steel and aluminum imports signed by President Trump have bolstered HRC prices somewhat, a full recovery is unlikely in the near future, given the weak manufacturing landscape and ongoing demand challenges.

Furthermore, global automotive production slowdowns have diminished steel consumption in this crucial market. The recent construction sector slowdown in the U.S., caused by rising interest rates, has also curbed steel demand. Inflation and high borrowing costs have negatively impacted the residential construction market. In addition, manufacturing activities have weakened due to reduced demand for goods and increased interest rates.

“`

Nucor Faces Pricing Challenges Despite Production Expansion

In the fourth quarter of 2024, Nucor Corporation (NUE) struggled with lower steel prices, which negatively impacted its performance. Analysts predict further price declines in 2025, indicating a tough environment ahead.

Market Conditions Strain Nucor’s Growth

Nucor, a key player in the steel industry, is observing pressured prices across its steel mills and products. This trend suggests a challenging path for the company as it heads into the first quarter of 2025. Although Nucor is expanding its production capabilities and focusing on strategic acquisitions, these efforts may not be sufficient to counteract the prevailing headwinds of the market.

Weighing the Pros and Cons of Holding NUE Stock

While Nucor’s growth strategies are encouraging, persistent issues within the steel sector are affecting the company’s overall performance. Analysts note that decreasing steel prices and lower earnings estimates present significant obstacles. Investors should consider that NUE, labeled as a Zacks Rank #3 (Hold), may not be poised for immediate gains. For those already holding the stock, it may be wise to maintain current positions until a clearer market trend emerges.

Exciting Opportunities on the Horizon: Zacks Top 10 Stocks for 2025

Zacks Director of Research, Sheraz Mian, has identified ten stocks poised for potential growth in 2025. This selection boasts an impressive record, gaining +2,112.6% since its start in 2012, significantly outperforming the S&P 500’s +475.6%. Be among the first to explore these promising investment opportunities.

Want to stay ahead? Download the latest recommendations from Zacks Investment Research, including 7 Strong Stocks for the Next 30 Days.

For detailed analyses of specific companies, check these reports:

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

United States Steel Corporation (X): Free Stock Analysis Report

Nucor Corporation (NUE): Free Stock Analysis Report

Cleveland-Cliffs Inc. (CLF): Free Stock Analysis Report

To delve deeper into this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are of the author and do not necessarily reflect those of Nasdaq, Inc.