Nutanix Gets Positive Wall Street Backing: What Does It Mean for Investors?

Wall Street analysts’ recommendations are a key resource for investors pondering whether to purchase, divest, or hold a stock. Changes in these ratings can significantly influence stock prices, but how reliable are these ratings?

First, let’s examine what analysts are saying about Nutanix (NTNX) before we consider the credibility of brokerage recommendations and how you might leverage them in your investment strategy.

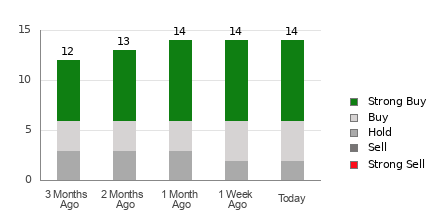

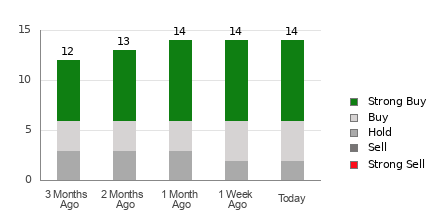

Nutanix holds an average brokerage recommendation (ABR) of 1.54 on a scale from 1 (Strong Buy) to 5 (Strong Sell), based on analyses from 14 brokerage firms. This ABR reflects an inclination toward a Strong Buy recommendation.

Breaking it down further, out of the 14 total recommendations contributing to the current ABR, eight suggest Strong Buy while four propose Buy. In numerical terms, Strong Buy and Buy make up 57.1% and 28.6% of all recommendations respectively.

Analyzing Brokerage Recommendation Trends for NTNX

View Nutanix’s price target and stock forecast here>>>

While the ABR hints at a good investment opportunity in Nutanix, relying solely on this metric could be misleading. Research has shown that these brokerage ratings often do not effectively predict which stocks will rise significantly in value.

This inconsistency largely stems from the inherent conflicts faced by brokerage firms. Their analysts usually express a positive bias due to their connections with the companies they analyze. Analysis reveals that for every Strong Sell recommendation, there are five Strong Buys. This imbalance suggests a misalignment between institutional interests and those of individual investors, thus providing limited insight into stock performance.

Consequently, it’s wise to use these recommendations alongside your personal assessments or with tools known for accurately forecasting stock trends.

Zacks Rank, a tool developed by us with a strong track record, classifies stocks from #1 (Strong Buy) to #5 (Strong Sell) and serves as an effective gauge for potential short-term stock performance. Thus, aligning the ABR with the Zacks Rank could provide a stronger basis for investment decisions.

Differentiating Between Zacks Rank and ABR

It is essential to understand that while both Zacks Rank and ABR feature a similar 1-5 scale, they measure different aspects.

The ABR is derived purely from brokerage ratings and presented with decimals (e.g., 1.28), while the Zacks Rank is a quantitative model responding to fluctuating earnings estimates and is delivered as whole numbers (1-5).

Historically, analysts from brokerage firms have tended to err on the side of optimism. Their ratings usually do not fully align with their internal research due to potential conflicts of interest. This trend leads to misleading guidance for investors.

In contrast, the Zacks Rank is influenced by revisions in earnings estimates which are closely tied to short-term stock price movements, according to data-driven research.

The distinct Zacks Rank ratings cater to all stocks under analysis, ensuring a balanced distribution across the five ranks.

Timeliness is another point of divergence. The ABR may not always reflect the most current evaluations, whereas Zacks Rank updates promptly match real-time changes in earnings outlooks, making it a reliable measure for future price movements.

Is NTNX a Solid Investment?

Recent revisions to earnings estimates for Nutanix indicate a Zacks Consensus Estimate for this year has risen by 1.4% over the last month, now at $1.49.

The upward revisions reflect analysts’ rising confidence in the company’s earnings potential, suggesting that NTNX could be set for a price increase soon.

The substantial adjustment in the consensus, combined with other favorable earnings-related factors, has earned Nutanix a Zacks Rank of #2 (Buy). For those interested, you can view today’s complete list of Zacks Rank #1 (Strong Buy) stocks here>>>>

With Nutanix’s buy-equivalent ABR, investors may find useful guidance.

Just Released: Zacks Top 10 Stocks for 2025

Act quickly – there’s still time to invest early in our 10 top picks for 2025. This selection, curated by Zacks Director of Research Sheraz Mian, has achieved remarkable returns. Since its inception in 2012 up to November 2024, the Zacks Top 10 Stocks portfolio grew by +2,112.6%, far exceeding the S&P 500’s +475.6%. Sheraz carefully evaluated 4,400 companies and identified the top 10 to hold for 2025. Don’t miss your chance to discover these newly released stocks with great potential.

Nutanix (NTNX): Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.