Nutrien Ltd. (NTR) is scheduled to release its fourth-quarter 2023 results on Feb 21, after the closing bell.

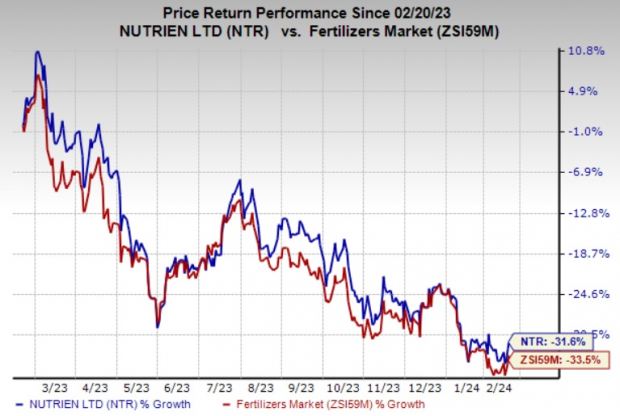

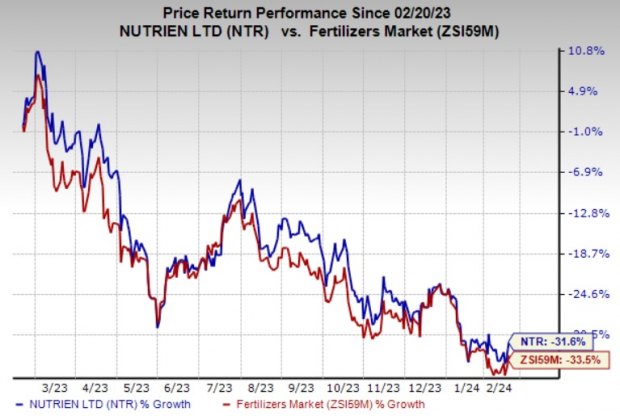

Over the trailing four quarters, the fertilizer maker has delivered an average negative earnings surprise of 28.1%. In the last reported quarter, it posted a negative earnings surprise of 50.7%. The company’s Q4 performance is expected to reflect the benefits of healthy demand for fertilizers, despite the anticipated impact of weaker fertilizer prices. Nutrien shares have witnessed a 31.6% decline in the past year, slightly outperforming the industry’s 33.5% decline.

Image Source: Zacks Investment Research

Let’s delve into the key factors that may influence the company’s Q4 results.

Zacks Model Predicts Earnings Beat

Nutrien is likely to beat earnings estimates this time, backed by a positive Earnings ESP of +39.72% and a Zacks Rank #3.

Estimates and Projections

The Zacks Consensus Estimate for Nutrien’s Q4 consolidated sales is currently projected at $5,243.1 million, reflecting a 30.4% decline from the year-ago quarter. The estimates for sales across various segments indicate a mixed picture, with some segments exhibiting year-over-year growth while others are poised for a decline.

Factors to Consider

Nutrien is expected to have benefitted from robust demand for fertilizers in the December quarter, driven by the strength in the global agricultural market. Strong potash volumes, acquisitions, and efficient cost management are likely to have contributed to the company’s performance. However, weaker fertilizer prices due to global geopolitical events and supply availability are expected to have weighed on its profitability.

What Lies Ahead?

Despite the challenges faced in the fertilizer market, Nutrien’s focus on cost efficiency and digital platform adoption holds promise for the future.

Stocks to Watch

Companies like Ero Copper Corp., Eldorado Gold Corporation, and Franco-Nevada Corporation are also looked upon favorably for a potential earnings beat this quarter, based on their respective Earnings ESP and Zacks Rank.

In summary, Nutrien’s Q4 performance is anticipated to reflect the interplay of various market dynamics, leaving investors eager to learn about the company’s strategies and outlook.

Important: Stay tuned for the earnings release and assess the results in light of the company’s long-term strategy and industry trends.

Disclosure: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Nutrien Ltd. price-eps-surprise | Nutrien Ltd. Quote

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they too have the right combination of elements to post an earnings beat this quarter:

Ero Copper Corp. ERO, scheduled to release earnings on Mar 7, has an Earnings ESP of +10.68% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for ERO’s earnings for the fourth quarter is currently pegged at 26 cents.

Eldorado Gold Corporation EGO, slated to release earnings on Feb 22, has an Earnings ESP of +5.88% and carries a Zacks Rank #2 at present.

The consensus mark for EGO’s fourth-quarter earnings is currently pegged at 21 cents.

Franco-Nevada Corporation FNV, scheduled to release fourth-quarter earnings on Mar 5, has an Earnings ESP of +0.63%.

The Zacks Consensus Estimate for FNV’s earnings for the fourth quarter is currently pegged at 80 cents. FNV currently carries a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Eldorado Gold Corporation (EGO) : Free Stock Analysis Report

Ero Copper Corp. (ERO) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research