Investing in Quantum Computing: Why Big Tech is Your Best Bet

In recent months, stocks associated with quantum computing, such as IonQ, Rigetti Computing, and D-Wave Quantum, have seen significant increases in their share prices. This surge has spurred interest in quantum computing as a potential investment avenue.

However, it’s crucial to be cautious about jumping on the bandwagon with popular quantum computing stocks. Instead, I recommend focusing on established tech titans like Nvidia (NASDAQ: NVDA) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

Seeking a smart investment? Our analysts just revealed what they believe are the 10 best stocks to buy right now. Check out the 10 stocks »

Understanding Nvidia’s Role in Quantum Computing

Nvidia is best known for its innovative chipsets, particularly graphics processing units (GPUs). These components are essential for running complex algorithms, powering generative AI applications and machine learning processes.

What sets Nvidia apart is the integration of its hardware with its software. The company provides a software toolkit called Compute Unified Device Architecture (CUDA) that maximizes the performance of its GPUs.

Within this CUDA environment, Nvidia offers a specialized platform named CUDA-Q, which is focused on developing quantum computing applications. This platform allows for the integration of GPUs, central processing units (CPUs), and quantum processing units (QPUs) into a single framework.

Recently, Nvidia announced that Google is using CUDA-Q alongside its H100 GPUs to run simulations for designing its upcoming quantum computer. This development illustrates Nvidia’s potential to become a key provider of both hardware and software for corporations venturing into AI and quantum computing.

Image source: Getty Images.

Alphabet’s Quantum Computing Ventures

Although Nvidia leads in the semiconductor field, major companies like Alphabet are also considering their own chip development.

In December, Alphabet announced a significant milestone in its quantum computing efforts. Google Quantum unveiled its latest quantum chip, Willow, which can solve a problem in under five minutes—something that would take the most advanced supercomputer 10 septillion years to accomplish.

Should You Buy Nvidia or Alphabet Stocks Now?

While both Nvidia and Alphabet have made strides in quantum computing, careful consideration is necessary before investing.

For instance, although Alphabet’s Willow chip showcases incredible power, solving a problem in 10 septillion years isn’t immediately relevant. From my perspective, it’s not a pressing concern right now.

Additionally, even with CUDA-Q gaining traction, it may be premature to expect significant financial returns from this segment of Nvidia’s business in the near future.

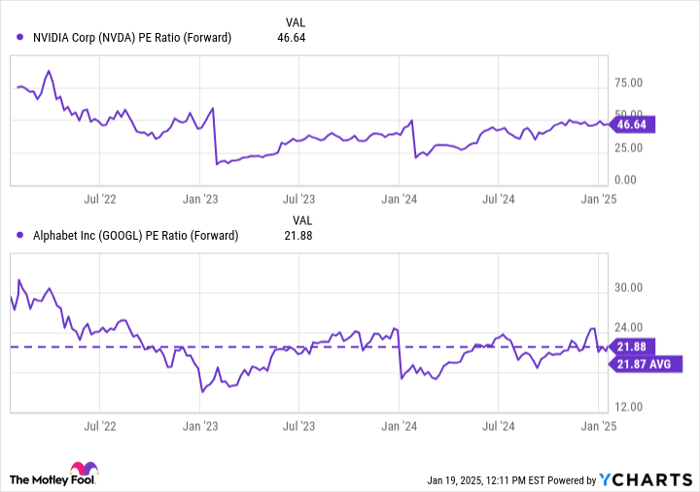

NVDA PE Ratio (Forward) data by YCharts.

Currently, Nvidia has a forward price-to-earnings (P/E) multiple of 46.6, a reduction from previous years. Given that Nvidia’s business model has evolved and is achieving record growth, this valuation suggests the stock could currently be undervalued.

Similarly, Alphabet’s forward P/E stands at 22, consistent with its averages over the past three and five years. Concerns about Alphabet’s potential might be overstated, especially considering its strong position in online search and its rapidly growing cloud services, which compete with heavyweights like Amazon and Microsoft.

Both companies seem attractive for investment—not necessarily due to quantum computing alone. While it may play a role in their future growth, nearer-term opportunities in other areas of AI may offer greater potential right now.

Should You Invest in Alphabet Now?

Before making any moves on Alphabet stock, here’s something to consider:

The Motley Fool Stock Advisor team recently identified what they believe are the 10 best stocks for current investment, and Alphabet is not among them. The selected stocks are projected to yield substantial returns in the coming years.

Consider that when Nvidia made this list on April 15, 2005, if you had invested $1,000, that investment would now be worth $874,051!*

*Stock Advisor returns as of January 21, 2025

Randi Zuckerberg, a former director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. Additionally, John Mackey, former CEO of Whole Foods Market (an Amazon subsidiary), is also a board member. Suzanne Frey, an executive at Alphabet, and Adam Spatacco, who holds positions in several companies, including Alphabet, are also associated with The Motley Fool. The Motley Fool recommends and has positions in several major companies, including Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool also recommends specific options tied to Microsoft. More information is available in their disclosure policy.

The views expressed here are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.