NVIDIA Corporation (NVDA) reported data center revenues of $39.1 billion in Q1 FY2026, up 73% year-over-year, yet faces potential losses of $10.5 billion from export restrictions to China for its H20 chip. Despite these challenges, NVIDIA projects Q2 revenues of $45 billion, reflecting a 50% year-over-year growth. Arm Holdings Plc (ARM), while also positioned for AI growth through energy-efficient chip designs, encounters risks from global trade issues, especially in the Chinese market, where local firms may shift to alternative chip technologies.

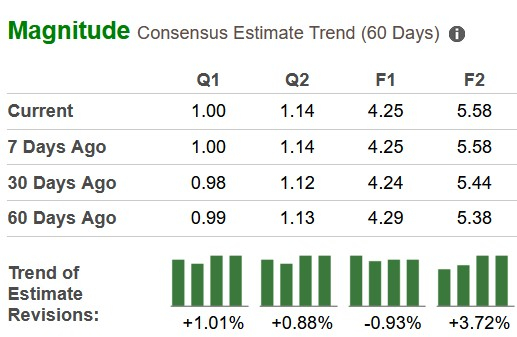

NVIDIA’s earnings per share (EPS) is expected to grow 42.1% in FY2026, compared to 5.5% for Arm Holdings, though ARM’s EPS estimate has declined recently. In terms of stock performance, NVDA shares have increased by 6.2% over the past year, while ARM shares have dropped by 16.9%. Valuation-wise, NVIDIA has a price-to-sales (P/S) multiple of 16.26X, significantly lower than ARM’s 31.2X, indicating NVIDIA may offer better value to investors.

Given its operational scale and technological leadership, NVIDIA is currently regarded as the more favorable choice for investors in the AI chip market, carrying a Zacks Rank #3 (Hold), compared to Arm Holdings’ Zacks Rank #4 (Sell).