NVIDIA’s Resilience in the Market Storm

NVIDIA Corporation NVDA stood firm on Wednesday, a testament to its unwavering strength amidst the tumultuous market conditions. The S&P 500’s upward climb following the Federal Reserve’s decision to maintain rates showcased NVDA’s resilience.

The Path to Consolidation: Setting the Stage for Growth

NVIDIA has been on a rollercoaster, shooting up a remarkable 148% between October 31 and March 8. The force behind this incredible surge was the bullish sentiment reigning over the artificial intelligence landscape.

NVIDIA’s Strategic Moves at GTC Conference

During the GTC Conference, NVIDIA’s executives revealed ambitious plans for the company’s hardware and software products. The unveiling of Blackwell, the latest GPU architecture succeeding the Hopper architecture, ignited a resurgence in NVIDIA’s stock as it bounced back into Monday’s trading range after a brief dip at the start of Tuesday’s session.

Seizing Opportunities Through SPRX

Amidst NVIDIA’s consolidation phase, a potential bull flag pattern has emerged on the daily chart, hinting at a promising future. Investors and traders looking to ride the bullish wave can diversify their portfolios through the Spear Alpha ETF SPRX. This actively managed fund offers a unique opportunity for investors seeking more than just passive market tracking.

Technical Analysis and Projected Growth

NVIDIA’s recent consolidation period has allowed for a healthy correction, pulling down the stock’s relative strength index (RSI) from overbought levels seen earlier in the year. The formation of a bull flag pattern implies the possibility of a significant upward movement. If this pattern materializes, NVIDIA could see substantial growth in the coming weeks, potentially soaring towards the $1,072 mark.

- Traders keenly watch for a breakout from the triangular-shaped flag on robust trading volumes, signaling a potential 26% surge for NVDA.

- A break above the all-time high and upper trend line would excite bullish traders, while a drop below the 21-day exponential moving average could spell trouble for the bull flag.

- Key resistance levels for NVIDIA stand at $919.13 and its all-time high, with supports at $870.85 and $794.80.

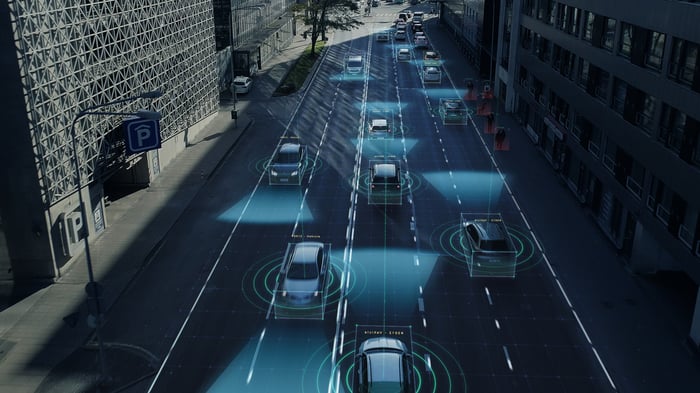

Featured image sourced from Shutterstock