“`html

Nvidia Q3 Revenue Highlights

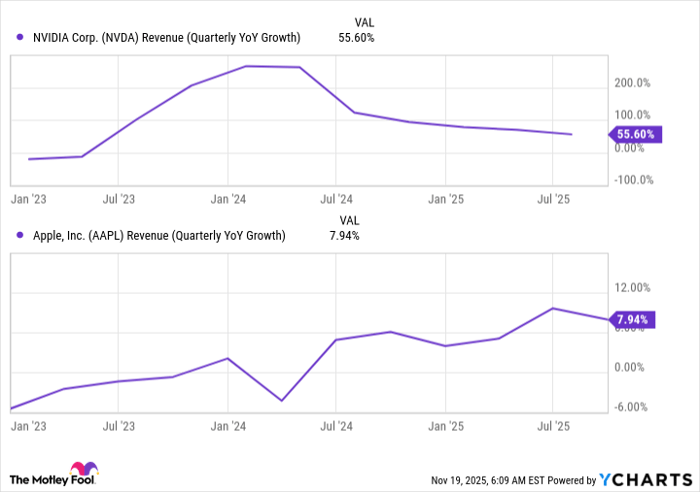

Nvidia (NASDAQ: NVDA) reported a 63% revenue increase to $57 billion for its third fiscal quarter, ending October 26, surpassing the $54.9 billion consensus estimate. Adjusted earnings per share rose 67% to $1.30, exceeding forecasts of $1.25. Notably, data center revenue reached $51.2 billion, a 66% increase, primarily driven by the sales of its Blackwell chips.

Key Metrics and Concerns

The company generated a robust operating cash flow of $23.8 billion and free cash flow of $22.1 billion, with cash and marketable securities totaling $60.6 billion against $8.5 billion in debt. However, accounts receivable surged 89% year-over-year to $33.4 billion, raising concerns over potential collection issues. Nvidia forecasts Q4 revenue at approximately $65 billion, reflecting a 65% growth rate.

Industry Impact

Nvidia’s strategic partnerships with major firms like Meta Platforms, Microsoft, and Oracle highlight its central role in AI infrastructure. Despite recent growth, the increase in accounts receivable requires close monitoring as it may indicate unsustainable financing practices.

“`