“`html

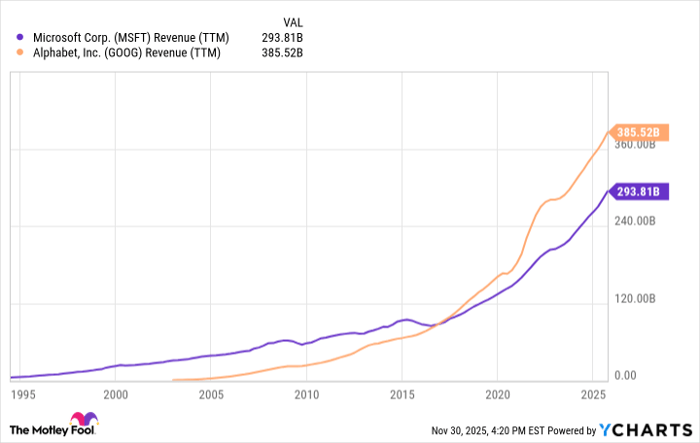

Key Developments in AI Market Shakeup: Last week, Google announced it is exploring the purchase of billions in custom TPU chips, previously dominated by Nvidia’s GPUs, indicating a significant shift in the AI landscape. This was followed by Amazon’s introduction of its next-generation AI chip, Trainium, offering AI developers up to 40% cost savings compared to Nvidia’s solutions. This new competition is impacting Nvidia’s market share, as concerns grow over its long-term dominance.

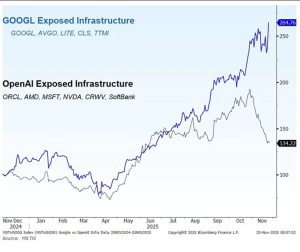

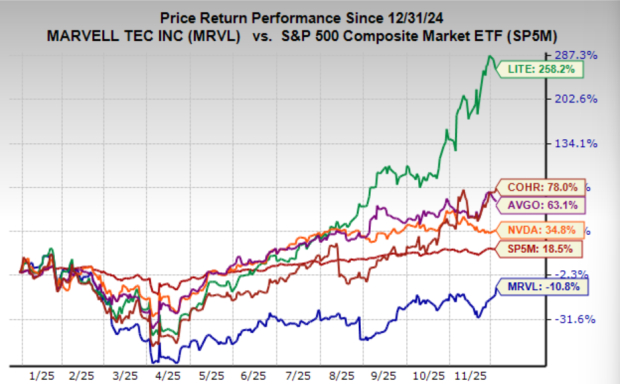

Market Response: In the wake of these developments, a notable divide has emerged within the AI sector. Companies aligned with Google and Amazon are seeing stock increases, while Nvidia and its associates are experiencing declines. Specifically, Luke Lango highlights four driving forces behind this change: the rise of Google’s TPUs, growing worries about Nvidia’s GPU share, uncertainties around OpenAI’s financing, and advancements in Google’s Gemini 3.0.

Future Implications: Investors are urged to reassess their portfolios as the AI market is evolving towards a more selective investing environment. According to Lango, this signifies a transition from a broad-based investment approach to a focused strategy, prioritizing companies positioned to benefit from the shifting landscape. Stakeholders are advised to consider balancing their Nvidia holdings and to remain invested in the wider AI sector.

“`