NVIDIA Shares Tumble Over 10% Amid AI Competition Fears

DeepSeek’s Launch Raises Concerns for Investors

This morning, the stock market is facing a significant downturn. Shares of NVIDIA Corporation NVDA are down more than 10% as traders react negatively.

Investors may worry that NVIDIA’s decline could continue, prompting its designation as our Stock of the Day.

The cause of this sell-off stems from the announcement by Chinese startup DeepSeek, sparking fears that the United States is losing its edge in the AI sector. DeepSeek introduced a free, open-source large language model, claiming it was developed in just two months for less than $6 million. Notably, the company released a reasoning model last week that, according to third-party tests, outperformed OpenAI’s model in several areas.

Related: Super Micro Stock Faces Sharp Drop as Market Reacts to DeepSeek AI News

NVIDIA’s Support Levels Under Pressure

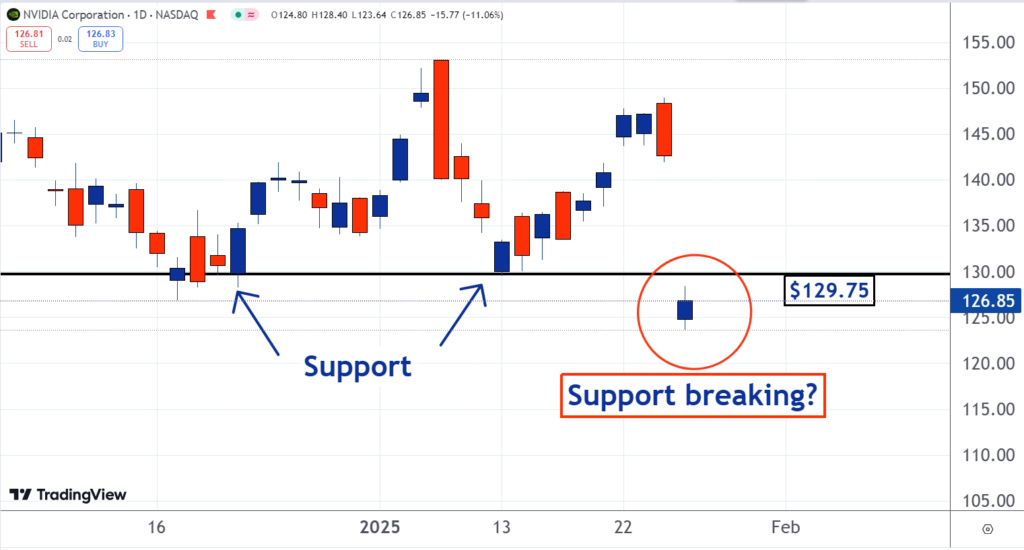

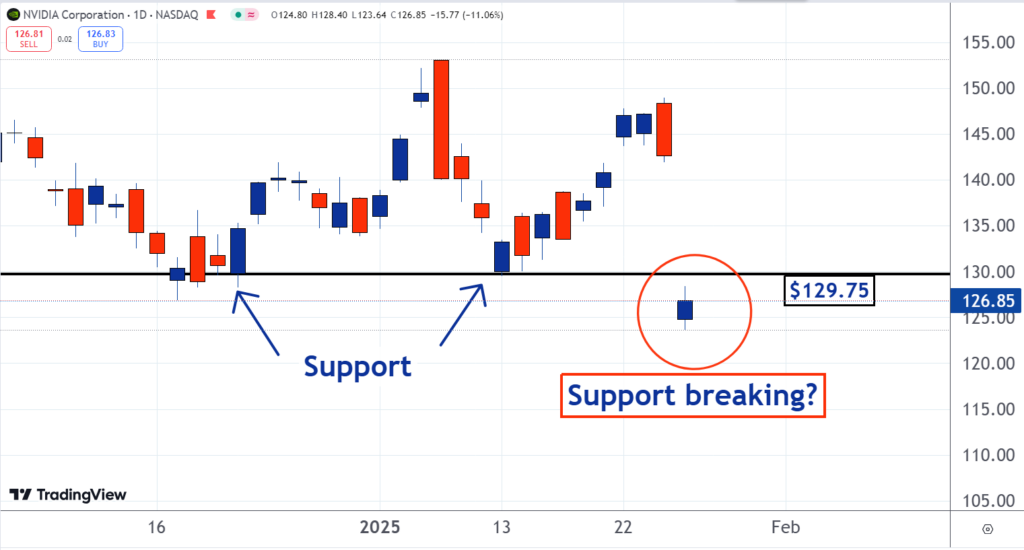

The drop in NVIDIA’s stock has broken through its critical support level of $129.75. This bearish trend indicates that further declines may be imminent.

When a stock’s price falls, it signals a greater number of shares available for sale compared to buyers. Sellers typically have to reduce prices to attract interest, creating a downward trend in the stock.

A support level signals a change in dynamics; sufficient demand at this price can absorb selling pressure. This is why stock declines often stall or even reverse at these levels.

As illustrated in the chart, NVIDIA previously found support around the $130.00 mark. Notably, sell-offs in December and early January paused when shares reached this point and rebounded shortly after each time.

This phenomenon occurs because buyers, concerned about missing out, may raise the prices they’re willing to pay. Other buyers often follow suit, triggering a snowball effect that elevates the stock price.

Breaking Support Signals New Challenges

Currently, the support level has deteriorated, with shares now trading below it. This suggests that investors who had previously contributed to the support by placing buy orders have either finished or canceled their purchases. With diminished demand in the market, sellers might find themselves lowering prices further to entice buyers back.

This situation could lead to even more significant declines for NVIDIA in the coming days.

Read Next:

Photo: Tigarto/Shutterstock.com

Market News and Data brought to you by Benzinga APIs