Market Insights: Nvidia Holds Steady While Meta Eyes a Recovery

As the year 2024 approaches its end, Nvidia Corporation NVDA is stable around its essential 20-day averages. At the same time, Meta Platforms META appears ready to bounce back, having surpassed its 50-day average.

Nvidia Corporation Analysis

Technical evaluations show that Nvidia’s stock remains bolstered by its 20-day exponential moving average. As of Monday, shares closed at $137.49, slightly above the 21-day exponential moving average of $137.36 and the 20-day simple moving average of $137.37. However, it is trading below the 50-day simple moving average of $139.96 while staying above the 200-day simple moving average of $117.63.

This scenario suggests the stock is currently supported at the 20-day levels, with a relative strength index reading of 49.91 placing it in a neutral territory.

Meta Platforms Overview

In contrast, Meta shows signs of a bullish trend, having recently surpassed its 50-day moving average. At the close on Monday, Meta shares reached $591.24, above both the 50-day simple average of $587.91 and the 50-day exponential average of $588.93. However, it remains below the 20-day simple moving average of $609.59 but is trading above the 200-day average of $528.11.

This positioning supports the notion that Meta is experiencing an upward trend, although a relative strength index of 46.5 indicates a neutral movement as well.

Market Implications: Looking ahead, Jim Cramer, in a recent post on X dated December 16, cautioned that Nvidia might face a market correction due to recent price surges without sufficient momentum. He predicted a “vicious” and “fast” reversal could occur. This comes alongside Nvidia’s ongoing antitrust investigation in China related to its acquisition of Mellanox Technologies back in 2020.

Analyst Ming-Chi Kuo from TF Securities anticipates this investigation will remain unresolved for a while, recalling the lengthy antitrust case against Qualcomm Inc (QCOM) which lasted 15 months.

Further Development: Analysts Raise Forecasts

On December 1, JPMorgan increased its price target for Meta Platforms to $725, maintaining its “overweight” rating amid a predicted rise in the internet sector’s growth in 2025. This growth is expected to stem from a new focus on AI applications, leading to higher spending from Meta and other tech firms next year.

Meanwhile, Truist Securities analyst Youssef Squali also kept a ‘buy’ rating on Meta, increasing the target price to $700 per share based on impressive revenue, profit margins, and long-term growth potential.

Current Stock Performance: Nvidia shares are showing a minor increase of 0.62% in premarket trading and have surged 185.43% year-to-date, significantly outperforming the Nasdaq 100, which rose 28.13% in the same period.

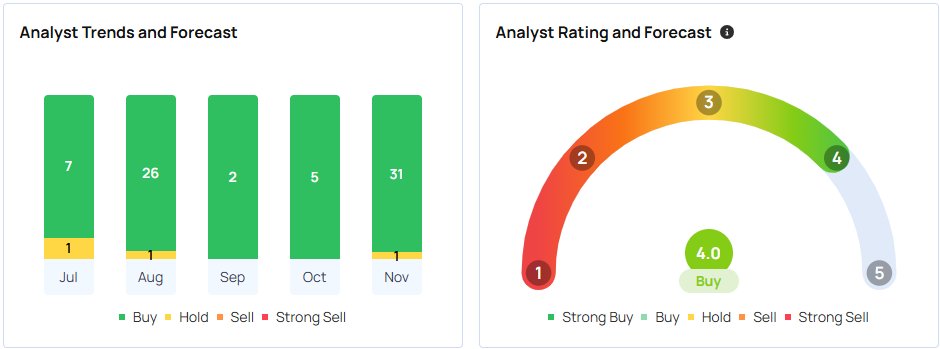

According to Benzinga surveys, Nvidia’s consensus price target stands at $170.56 as evaluated by 40 analysts. The most optimistic forecast is $220 from Rosenblatt, set on November 21, 2024, while the most conservative target is $120 from New Street Research on August 6, 2024.

The average price target, calculated by analysts from DA Davidson, Phillip Securities, and Truist Securities, suggests an 11.83% upside potential for Nvidia.

Price Movement for Meta: Shares of Meta are up 0.48% in premarket trading and have increased by 70.74% year to date, outperforming the Nasdaq 100 as well.

Benzinga’s data indicates a consensus price target of $642.51 for Meta, based on input from 41 analysts. The highest target of $811 was issued by Rosenblatt on October 31, while the lowest at $360 was assigned by Exane BNP Paribas on May 2.

The average target from JPMorgan, Truist Securities, and Piper Sandler reflects a potential upside of 17.55% for Meta.

Next Steps: Stay tuned for further developments in the market as we head into the new year.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs