NVIDIA Corporation (NVDA) and Micron Technology, Inc. (MU) are significant players in the artificial intelligence (AI) semiconductor market, underpinned by increasing demand for data center solutions. As of the third quarter of fiscal 2026, NVIDIA reported revenues of $57 billion—a 62% increase year over year—while its Data Center segment alone generated $51.22 billion, representing 89.8% of total sales.

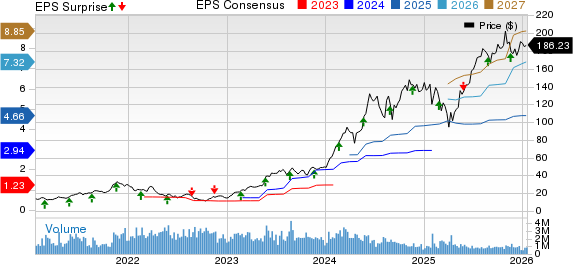

In comparison, Micron Technology’s first quarter of fiscal 2026 saw revenues rise 57% year over year to $13.64 billion, with non-GAAP earnings per share (EPS) leaping 167% to $4.78. Analysts project Micron’s fiscal 2026 revenues and EPS to increase by 94.7% and 297.5%, respectively. In contrast, NVIDIA is expected to achieve a revenue growth of 92.9% and a 55.9% EPS increase. Notably, Micron’s stock has surged 243% over the past year, outperforming NVIDIA’s 35.2% gain.

Micron currently trades at a lower forward price-to-earnings (P/E) multiple of 9.84, compared to NVIDIA’s 25.78, suggesting a more favorable investment opportunity due to its higher growth outlook and better valuation metrics.