Nvidia Corporation (NVDA) has become the first company to achieve a $4 trillion market cap as of Wednesday, with shares peaking at $164 on a post-split basis. The stock has risen 20% year-to-date and over 1,400% in the past five years, contributing to a new all-time high for the Nasdaq.

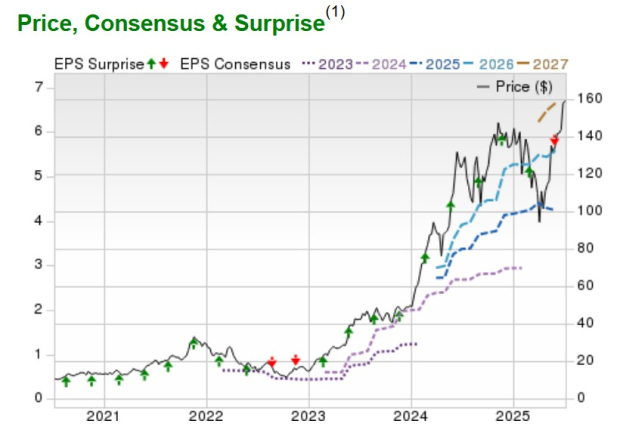

Nvidia’s total sales are projected to increase by 51% in fiscal year 2026, reaching $197.54 billion, and by an additional 25% to $247.24 billion in FY27. Earnings are expected to grow over 40% in FY26, increasing from $2.99 per share to $4.24.

The average Zacks price target for Nvidia stands at $176.98, indicating a 10% upside from its last closing price of $160. Nvidia’s current forward P/E ratio is 37.7, which is lower than its decade average of 45.1. The company continues to expand in autonomous vehicle technology through its DRIVE AI Platform.