Nvidia Reaches New Heights: What Investors Need to Know

Recently, Nvidia (NVDA) achieved record highs in its stock price. Typically, when a stock hits new peaks, it often continues to rise, especially if the company maintains a positive earnings outlook.

The excitement surrounding Nvidia is largely driven by the AI boom. Analysts have regularly updated their earnings predictions following the company’s impressive quarterly results.

Is Now the Right Time to Invest in Nvidia?

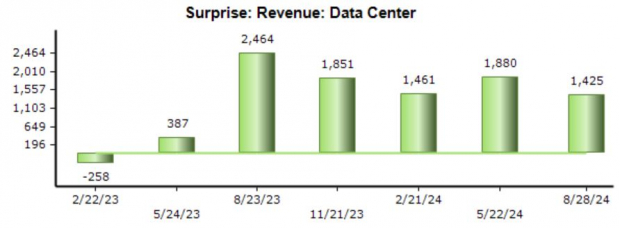

Nvidia’s Data Center performance has been exceptional, exceeding consensus expectations in each of its last five earnings reports. The latest beat was significant, with results surpassing predictions by $1.4 billion due to immense demand.

Image Source: Zacks Investment Research

CEO Jensen Huang shared an optimistic outlook following the recent report, affirming the strong demand for their Hopper architecture and future expectations for Blackwell. He stated, ‘NVIDIA achieved record revenues as global data centers are modernizing their computing stacks with accelerated computing and generative AI.’

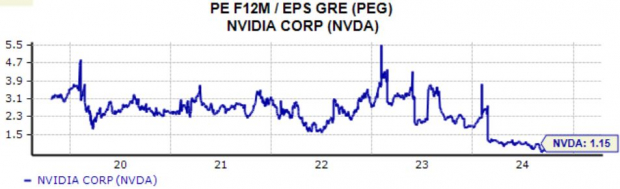

Investors may question the stock’s current valuation, given its rapid ascent. However, its price-to-earnings ratio of 40.9x for the next 12 months is still attractive compared to its five-year average of 50.7x. Furthermore, the price/earnings-to-growth (PEG) ratio is at 1.2x, well below historical benchmarks.

Image Source: Zacks Investment Research

It’s important to note that NVDA’s stock previously traded at higher valuation levels in 2020 and 2021, even before the current AI trends. The company’s historical growth has helped maintain its current multiples.

Nvidia has also seen strong profit margins recently, contributing to its favorable financial outlook. The following chart illustrates the company’s performance on a trailing twelve-month basis.

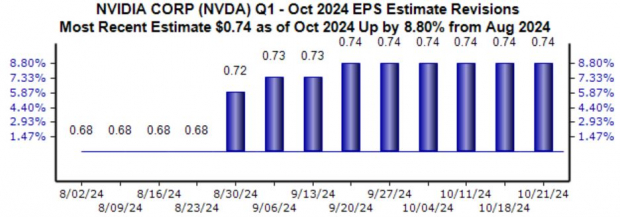

Image Source: Zacks Investment Research

Nvidia reports later than many firms during earnings season, with its next update scheduled for November 19th. Analysts expect earnings of $0.74 per share, a 9% increase from August predictions, marking an 85% rise from the same time last year.

Image Source: Zacks Investment Research

Stay informed about quarterly earnings: Check out Zacks Earnings Calendar.

Moreover, Nvidia’s Gaming segment is showing strong recovery after a downturn related to the pandemic. Its gaming revenue of $2.9 billion has increased by 16% year-over-year, adding to the company’s positive momentum. While Data Center achievements are grabbing headlines, the Gaming segment should also be taken seriously.

Image Source: Zacks Investment Research

The Bottom Line on Nvidia

Nvidia’s recent stock highs have generated excitement, following a few months of stable prices. This positive trend, combined with strong earnings forecasts, suggests further potential for growth.

The valuation metrics remain reasonable, supported by remarkable growth and sustained demand for its AI technologies. Additionally, the recovery in the Gaming segment, a $50 billion share buyback plan, and high historical margins contribute to a favorable outlook for the stock.

Nvidia (NVDA) stands out as a prime option for investors looking to engage with the AI sector.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our experts have compiled a list of 5 stocks expected to double in value soon. Among these, Director of Research Sheraz Mian has singled out one stock predicted to soar the highest.

This standout pick is from one of the most innovative financial firms. With a rapidly expanding customer base (over 50 million) and a range of cutting-edge solutions, this stock is poised for significant growth. While not every selection will succeed, this one has the potential to outperform earlier Zacks recommendations like Nano-X Imaging, which increased by +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Others Poised for Growth

Want the latest investment guidance from Zacks Investment Research? Download your free report on the “5 Stocks Set to Double” today.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.