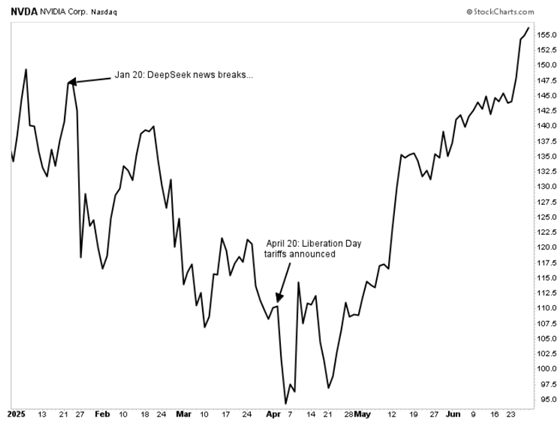

NVIDIA Corporation (NVDA) experienced a dramatic stock drop of 17% on January 28, 2023, following headlines about DeepSeek’s AI project that claimed to rival its technology. This drop resulted in a loss of nearly $600 billion in market capitalization, marking the largest single-day market cap decline in Wall Street’s history. The stock later fell nearly 40% from its highs, bottoming out just below $95.

However, NVIDIA rebounded impressively, surging over 65% since its low on April 20 and reaching all-time highs, positioning itself as the most valuable company on the market. The company recently reported GPU sales of $130.5 billion in the past year, up from $27 billion in fiscal year 2023, as CEO Jensen Huang stated the company’s vision has evolved beyond just chip manufacturing.

Amid these developments, NVIDIA announced plans to supply over 18,000 Blackwell chips to Saudi Arabia’s AI firm HUMAIN, further solidifying its dominance in the AI sector. The company is shifting focus towards broader technological solutions, indicating a profound opportunity in AI and robotics, with Huang noting a pivot to becoming a foundational layer for the AI economy.