Nvidia Stock Surges While AI Market Drives Continued Growth

Nvidia (NASDAQ: NVDA), the leader in discrete graphics processing units (GPUs), has seen its stock rise 25,250% over the past decade, while the S&P 500 increased less than 180%. From fiscal 2015 through fiscal 2025, Nvidia’s revenue grew at a compound annual growth rate (CAGR) of 39%, and net income soared at a CAGR of 61%.

Initially, strong sales in gaming GPUs, also used for cryptocurrency mining, fueled this growth. Recently, however, Nvidia’s expansion is largely due to increased shipments of data center GPUs for the artificial intelligence (AI) sector.

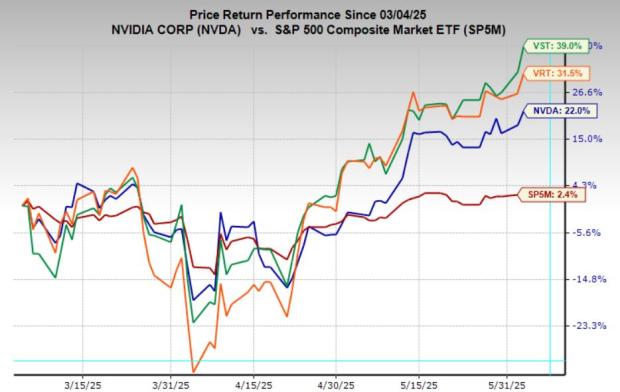

Since the start of 2025, Nvidia’s stock has risen by less than 4%, while the S&P 500 remained stable. Factors like unpredictable tariffs, stricter chip export regulations, and delays in launching Blackwell chips contributed to Nvidia’s recent slowdown. Nevertheless, there are five reasons why Nvidia’s stock may outperform the S&P 500 this year.

1. Dominance in the AI Chip Market

As of the end of 2024, Nvidia held 82% of the discrete GPU market, with AMD at 17% and Intel at 1%. Nvidia’s market control extends to approximately 98% of the data center GPU sector. Its longstanding A100 chips and newer H100 and H200 models strengthen its competitive position, making it difficult for rivals to gain traction.

The global AI market is expected to grow at a CAGR of 31% between 2025 and 2032. If Nvidia matches this growth rate, its annual revenue could rise from $130.5 billion in fiscal 2025 to $1.31 trillion by fiscal 2032, presenting a clear path for significant stock appreciation.

2. A Sticky Ecosystem

Nvidia further solidifies its market position through its proprietary Compute Unified Device Architecture (CUDA). Applications developed in CUDA are optimized for Nvidia hardware, necessitating code rewrites for compatibility with AMD or Intel GPUs. This reliance on CUDA keeps many developers within Nvidia’s ecosystem.

3. Growth Without China

China contributed only 12.5% of Nvidia’s revenue in fiscal 2025, down from 21.5% in fiscal 2023 due to stricter U.S. export controls. Nvidia has tried to mitigate these losses by offering modified GPU versions, but these too have faced restrictions. Despite these challenges, Nvidia’s revenue grew at a CAGR of 120% from fiscal 2023 to 2025 by focusing on less controversial markets.

4. Growth in Other Segments

In Q1 of fiscal 2026, Nvidia generated 89% of its revenue from data center chips, but smaller segments like gaming, professional visualization, and automotive are also experiencing growth. The launch of RTX Super GPUs boosted its gaming division, and professional visualization expanded with upgraded chips and a growing Omniverse platform.

5. Attractive Valuation

Analysts project Nvidia’s revenue and earnings per share to grow at CAGRs of 31% and 29% from fiscal 2025 to 2028. With a current valuation of 34 times this year’s earnings, Nvidia’s stock appears reasonably valued. As investors recognize its long-term growth potential, the stock is poised to outperform the market.

Investment Considerations

Before investing in Nvidia, consider that it was not included among the top stock recommendations from a recent analytical review, which highlighted alternative investment opportunities that may yield high returns.

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.