“`html

Key News Summary

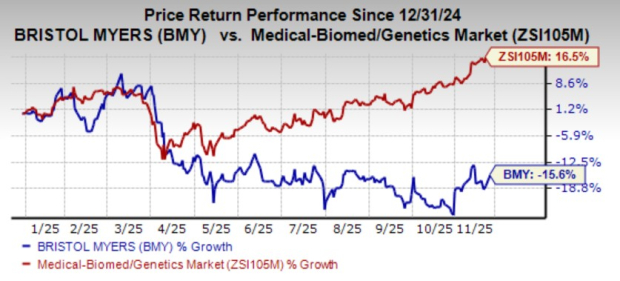

Nvidia’s shares fell sharply after reports emerged that Meta Platforms is considering a partnership with Alphabet to purchase custom AI chips for data centers starting in 2027. This potential shift may affect Nvidia, which currently generates nearly all of its revenue from data center chip sales, highlighting competition risks in the AI chip market.

In Q3 of fiscal 2026, Nvidia reported a revenue of $57 billion, a 62% year-over-year increase, with data center revenue at $51.2 billion, up 66% year-over-year. Despite this growth, investors are concerned about potential pricing pressures as large clients, like Meta, explore alternatives to Nvidia’s offerings.

Following the news, Nvidia’s stock price plummeted, while Alphabet and Broadcom saw gains, signaling investor anxiety about Nvidia’s future market dominance amid increasing competition.

“`