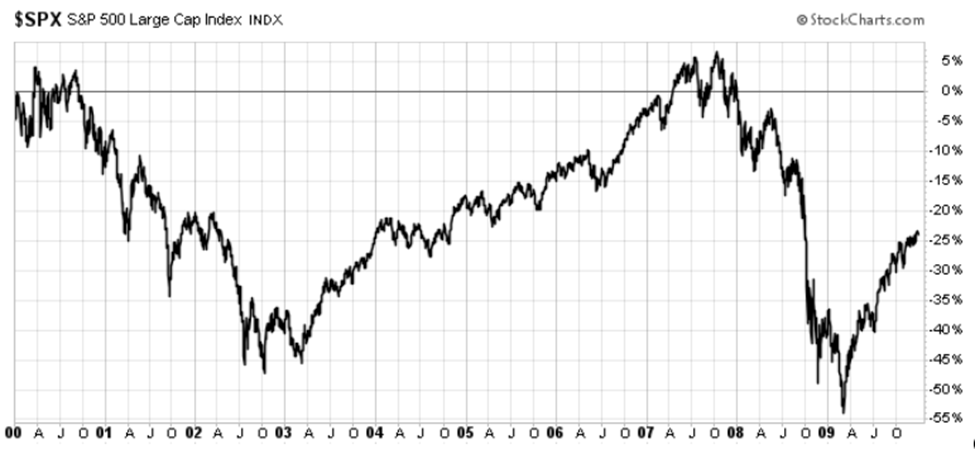

NVIDIA Corporation NVDA has demonstrated an impressive 171.2% gain in 2024, reinforcing its leading role in the semiconductor sector. This strong performance has outpaced gains from the Zacks Semiconductor – General industry, which stood at 119.1%, and the Technology Select Sector SPDR Fund XLK ETF, which realized a 20.8% increase.

2024 Stock Performance Overview

Image Source: Zacks Investment Research

Additionally, NVIDIA reached a significant milestone by becoming a member of the $3 trillion market capitalization club, joining giants like Apple Inc. AAPL and Microsoft Corporation MSFT. With a market cap of $3.387 trillion, NVIDIA ranks just behind Apple as one of the most valuable companies in the U.S.

The crucial question remains: will this momentum carry into 2025?

AI as NVIDIA’s Key Growth Driver

NVIDIA’s rapid ascent in the market is primarily attributed to its dominance in artificial intelligence (AI), especially in supporting generative AI applications. NVIDIA’s graphics processing units (GPUs) have become the essential tools for businesses utilizing AI, from ChatGPT to complex automation tasks.

According to a report by Fortune Business Insights, the generative AI market is expected to hit $967.65 billion by 2032, growing at a compound annual growth rate (CAGR) of 39.6%. NVIDIA’s GPUs serve as the backbone for AI models addressing various challenges, such as health diagnostics and manufacturing efficiency. As industries increasingly adopt AI for better productivity, NVIDIA is well-positioned to sustain its leadership role.

Broadening NVIDIA’s Impact Beyond AI

NVIDIA’s influence stretches beyond AI technologies. Its GPUs are vital in other sectors such as automotive, healthcare, and manufacturing. In the automotive sector, NVIDIA fosters the development of autonomous vehicles, a field anticipated to grow rapidly over the coming decade. Likewise, in healthcare, NVIDIA’s innovations enhance diagnostic imaging, leading to better patient outcomes. This diverse applicability marks NVIDIA as a resilient growth contender in the tech industry.

Furthermore, NVIDIA’s data center solutions are gaining significant traction. As businesses ramp up their investments in cloud computing and edge technologies, the demand for robust data center infrastructure is surging, positioning NVIDIA as a pivotal player in this expanding segment. These advancements are set to considerably bolster NVIDIA’s revenues as companies pursue digital transformation, solidifying its long-term growth outlook.

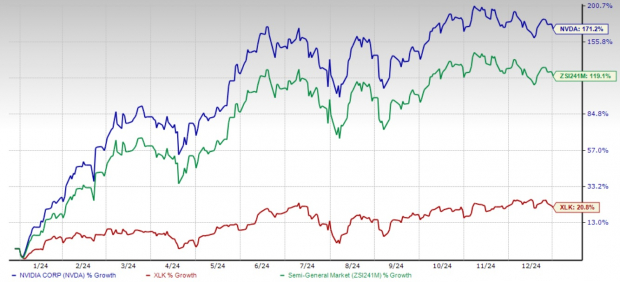

NVIDIA’s Financial Performance: A Source of Confidence

NVIDIA’s financial results affirm its market status. In the third quarter of fiscal 2025, revenues surged by 94% year over year, with non-GAAP EPS increasing by 103%. For the upcoming fourth quarter, NVIDIA anticipates revenues to reach $37.5 billion, a substantial increase from the $22.1 billion recorded in the same quarter last year.

The Zacks Consensus Estimate for NVIDIA’s revenues and earnings in fiscal 2025 and 2026 illustrates confidence in sustained growth. This optimism is fueled by NVIDIA’s strong standing in sectors including gaming, automotive, and professional visualization.

Image Source: Zacks Investment Research

Moreover, NVIDIA’s solid balance sheet further boosts confidence. By the end of the third quarter of fiscal 2025, the company held $38.4 billion in cash. Throughout the first three quarters of the fiscal year, it generated $47.5 billion in operating cash flow and $45.2 billion in free cash flow. Such financial robustness not only fuels ongoing innovation but also positions NVIDIA to capitalize on new market opportunities.

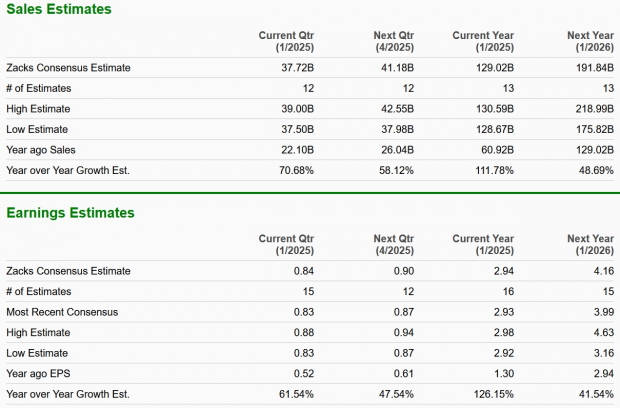

Caution Advised Amid Premium Valuation

NVIDIA’s remarkable performance in 2024 has propelled its stock valuation to elevated levels. Currently, NVIDIA shares trade at a forward 12-month price-to-earnings (P/E) multiple of 34.01X, which is notably higher than the sector average of 29.38X. This elevated valuation could signal limited upward potential for NVDA stock in the near future.

Image Source: Zacks Investment Research

Conclusion: Maintain NVIDIA Stock for Now

Despite NVIDIA’s stature as a powerhouse in the semiconductor field with compelling long-term growth prospects, its high valuation calls for careful consideration.

For existing shareholders, remaining invested seems prudent, as the company’s fundamental strengths and growth trajectory remain robust. However, for new investors, it may be wise to wait for a better buying opportunity, ideally during a market correction, to avoid overpaying for future growth prospects.

In summary, NVIDIA continues to be a formidable player, but the current valuation landscape warrants a cautious approach. Holding onto the stock is advisable, though entering now may not be the best strategy. Currently, NVDA holds a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Selects “Top Stock to Double”

From a vast selection of stocks, five Zacks specialists have each identified their top pick expected to rise by 100% or more in the coming months. From these, the Director of Research, Sheraz Mian, has chosen one with the greatest explosive potential.

This chosen company caters primarily to millennial and Gen Z consumers, amassing nearly $1 billion in revenue last quarter alone. Recent price corrections suggest that now is an opportune moment to invest. While not all selected stocks are guaranteed winners, this one may far outperform earlier Zacks picks like Nano-X Imaging, which soared by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest investment advice from Zacks Investment Research? Download 5 Stocks Set to Double for free today.

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.