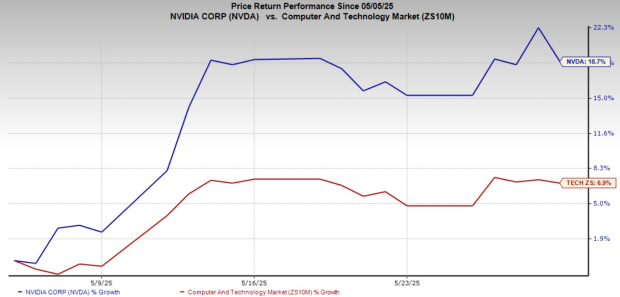

NVIDIA Shares Surge 18.7% Amid Trade Optimism and Strong Demand

NVIDIA Corporation (NVDA) has experienced an 18.7% increase in share price over the past month, significantly outperforming the Zacks Computer and Technology sector, which rose 6.9% during the same timeframe.

Image Source: Zacks Investment Research

This rise prompts the question: Should investors take profits now, or continue holding NVDA?

Trade Truce Boosts NVIDIA’s Stock

The rally in NVIDIA shares is partly due to improved sentiment surrounding U.S.-China trade relations. The U.S. reduced tariffs on Chinese imports from 145% to 30%, while China cut its tariffs on U.S. goods from 125% to 10%. These changes are effective for 90 days.

This temporary easing of trade tensions has alleviated worries about extended disruptions and bolstered stocks across various sectors, particularly technology and semiconductors. Major companies like Advanced Micro Devices (AMD), Micron Technology (MU), and Broadcom (AVGO) also benefited, with their shares rising by 10%, 17.4%, and 20.6%, respectively, in the last month.

For NVIDIA, this trade relief has reignited buying interest, already supported by strong fundamentals. With solid footing in AI and chip innovation, holding this stock may be beneficial for investors.

Data Center Demand Fuels Growth

NVIDIA’s Data Center segment remains its main growth driver. In the first quarter of fiscal 2026, the segment generated $39.1 billion in revenues, accounting for 89% of total sales. This marks a year-over-year growth of 73% and a sequential increase of 10%, largely driven by surging demand for AI solutions.

Using cutting-edge Hopper 200 and Blackwell GPU platforms, cloud and enterprise customers are rapidly scaling their AI infrastructure. Hyperscalers are significant contributors, adopting NVIDIA’s GPUs to enhance their AI workloads.

The upcoming Blackwell architecture aims to deliver up to 25 times better AI inference performance than Hopper 100, further securing NVIDIA’s competitive edge as the demand for AI computing rises.

NVIDIA’s Solid Financial Performance Amid Challenges

NVIDIA’s financials remain robust despite facing geopolitical challenges. In the first quarter of fiscal 2026, revenue grew 69% year-over-year, and non-GAAP earnings per share increased by 33%.

Although NVIDIA expects an $8 billion revenue hit in the second quarter from export restrictions on its H20 chips in China (following a $2.5 billion loss in Q1), the company is optimistic about its momentum. Second-quarter revenue guidance stands at $45 billion, representing a 50% increase from the same period last year.

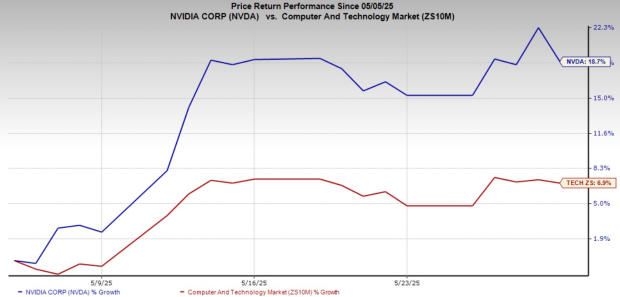

Wall Street anticipates ongoing growth, with estimated revenue increases of 51% in fiscal 2026 and 24% in 2027, alongside earnings growth of 40% and 32%, respectively. This outlook underlines NVIDIA’s potential as a long-term growth story, despite current geopolitical pressures.

Image Source: Zacks Investment Research

NVIDIA’s Valuation and Caution Signs

NVIDIA currently shows signs of being overvalued, evidenced by a Zacks Value Score of D.

The forward 12-month Price/Earnings (P/E) ratio for NVDA shares stands at 29.13X, surpassing the sector average of 25.52X.

Image Source: Zacks Investment Research

Comparing with other semiconductor firms, NVIDIA trades at a lower P/E multiple than Broadcom (32.91X) but a higher multiple than AMD (23.49X) and Micron (9.61X).

Conclusion: Maintain NVIDIA Stake for Now

NVIDIA’s strong fundamentals, dominance in AI, and solid growth forecast justify holding onto the stock. Despite a high valuation, the company’s operational and financial momentum indicates that now is not the time to sell.

NVIDIA carries a Zacks Rank of #3 (Hold) at this time.

Market Insights on Semiconductor Stocks

The semiconductor market is expected to grow significantly, from $452 billion in 2021 to $803 billion by 2028, driven by demand in AI, Machine Learning, and the Internet of Things.

The views and opinions expressed herein do not necessarily reflect those of Nasdaq, Inc.