Nvidia Stock Drops After Major Export Controls and Manufacturing Plans

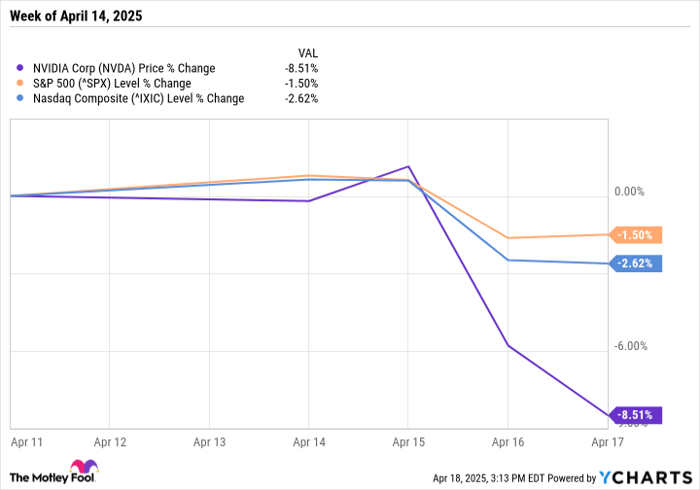

Shares of Nvidia (NASDAQ: NVDA) fell 8.5% last week during a shortened trading week caused by the Good Friday holiday. Consequently, Nvidia stock closed at $101.49 per share.

For context, the S&P 500 index experienced a decline of 1.5%, while the tech-heavy Nasdaq Composite index dropped 2.6%. In the same period, shares of competitor Advanced Micro Devices (AMD) fell by 6.3%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Below, we discuss two significant events that influenced Nvidia’s stock last week.

Data by YCharts.

Nvidia Stock Gains 1.3% on U.S. Manufacturing News

Nvidia’s stock saw a slight uptick of 1.3% on Tuesday, amidst a broader market downturn where the S&P 500 fell approximately 0.2%. Investors responded positively to Nvidia’s announcement made in a Monday blog post: the company is collaborating with its manufacturing partners to construct facilities aimed solely at producing Nvidia AI supercomputers within the U.S. Within the next four years, Nvidia plans to generate up to $500 billion in AI infrastructure through these partnerships.

Notably, Nvidia has initiated production of its new Blackwell chips at Taiwan Semiconductor Manufacturing Company‘s (NYSE: TSM) facilities in Phoenix, Arizona. TSMC is the world’s leading contract manufacturer of semiconductors and has been Nvidia’s core production partner. Furthermore, Nvidia is forging additional partnerships with Amkor and Siliconware Precision Industries Co., Ltd. (SPIL) for packaging and testing operations in the same state.

Additionally, Nvidia is setting up two supercomputer manufacturing facilities in Texas, one in collaboration with Foxconn in Houston and another with Wistron in Dallas. The company anticipates that mass production at these plants will begin in the next 12 to 15 months, as stated in their blog post.

Nvidia Stock Drops 6.9% Following Export Control Disclosures

Nvidia’s stock plummeted 6.9% on Wednesday, attributed to a filing with the U.S. Securities and Exchange Commission (SEC) in which Nvidia revealed plans to incur charges of up to $5.5 billion in its fiscal first quarter. This charge arises from new U.S. government restrictions preventing the export of its H20 chip to China and specific other countries.

The costs linked to the H20 chip include products in inventory, purchase commitments, and necessary reserves. Essentially, Nvidia holds purchase orders from Chinese companies for these chips which it may no longer fulfill, alongside an inventory of chips that could either go unsold or require significant discounts. Demand for these chips from Nvidia’s primary customers in the U.S. and other nations unaffected by the export controls remains strong, particularly for Nvidia’s more advanced Hopper and Blackwell chips.

The decline in Nvidia’s stock continued into Thursday.

Second Round of Export Restrictions Since August 2022

This recent action by the U.S. government represents the second phase of export restrictions that began in August 2022, targeting chips and systems capable of handling advanced AI operations. The first phase of expansion occurred in October 2023, affecting a wide range of Nvidia’s products within its data center sector, which generates the majority of its revenue. Notably, 90.6% of the company’s total revenue in its last reported quarter came from data center operations.

Initially, Nvidia had designed the H20 chip in response to the first wave of export controls as a compliant product for the Chinese market. However, the current restrictions present ongoing challenges regarding exports to China and other designated countries.

In its filing, Nvidia disclosed that on April 9, the U.S. government communicated that a license would now be mandatory for exporting the H20 chip to China and other select nations, primarily due to concerns over its potential use in supercomputers. On April 14, Nvidia received notice that this license requirement would remain effective indefinitely.

Assessing $5.5 Billion Charges in Financial Context

Investors are likely questioning the impact of these new export controls on Nvidia’s financial performance. The company’s first quarter for fiscal year 2026 concludes on April 27, 2025. Nvidia has publicly stated the earnings release date, scheduled for after market close on May 28.

In its fiscal Q1 guidance, Nvidia projected revenue of $43 billion, representing a 65% year-over-year growth rate coupled with a sequential growth of 9.4%. Therefore, the $5.5 billion in H20-related charges could equate to around 12.8% of this anticipated revenue. Historical patterns suggest that Nvidia usually surpasses its guidance. By estimating a possible revenue of between $43.5 billion and $44.5 billion prior to charges, net revenue after accounting for the impact would land around $38.5 billion.

In comparison to prior results, this estimated revenue is slightly lower than the previous quarter’s (Q4 of fiscal 2025) revenue of $39.33 billion. Consequently, it appears likely that Nvidia’s fiscal Q1 revenue may be marginally below last quarter’s results. The optimal forecast would suggest revenue in line with last quarter’s figures.

Contrasting this with the same quarter a year ago (Q1 of fiscal 2025), Nvidia reported revenue of $26.04 billion. Assuming fiscal Q1 2026 revenue settles near $38.5 billion, year-over-year growth would stand approximately at 48%, substantially lower than the over 65% growth initially predicted but still indicating commendable annual growth.

While the $5.5 billion in charges will impact earnings, the company’s long-term strategies and market outlook will be critical as the industry navigates these regulatory challenges.

Nvidia Faces Revenue Decline, Yet Remains a Strong Long-Term Investment

The current market challenges are impacting Nvidia’s net income, linked to the company’s ongoing issues with its H20 chip. This predicament complicates the ability to quantify the financial effects directly, as Nvidia does not separate its profit metrics—like operating income or net income—by specific market platforms such as data centers, gaming, professional visualization, or auto/robotics. However, past management insights suggest that the data center platform is more profitable than Nvidia’s overall profitability. Thus, the decline in net income is likely to exceed the projected 12% to 13% decrease in revenue.

Consequences on Near-Term Earnings

It is important to address the potential negative impact on Nvidia’s fiscal Q1 results as well as the possibility of continued struggles in subsequent quarters. The absence of the H20 chip will place significant pressure on Nvidia’s competitiveness in China’s data center market, and investors should brace for a considerable decrease in revenue from this critical region.

Long-Term Growth Prospects Remain Bright

Despite these challenges, there are robust reasons for shareholders to remain optimistic about Nvidia’s future as a long-term investment. The firm’s total addressable market is substantial, even without the contributions from China. Known for its leading position in graphics processing units (GPUs) for artificial intelligence (AI) applications, Nvidia continues to see high demand. The forthcoming phases of AI, particularly agentic AI and applications in sectors like self-driving technology and robotics, are still in early development stages and show signs of rapid growth.

Investors should keep a broader perspective in mind. While Nvidia’s stock has decreased by 32% from its all-time high of $149.43 on January 6 of this year, it has still risen by 19.9% year-over-year. In contrast, the S&P 500 has delivered a return of only 6.9% during the same period.

Is Now the Right Time to Invest in Nvidia?

For those considering an investment in Nvidia stock, it is wise to weigh the current situation carefully. The Motley Fool’s Stock Advisor analyst team has recently identified what they consider the 10 best stocks for investment—Nvidia is not among them. The highlighted stocks have the potential for significant returns in the future.

Historical Example: When Netflix made this list on December 17, 2004, an investment of $1,000 at that time would be worth $524,747 today. Similarly, an investment in Nvidia, when it was recognized on April 15, 2005, would have grown to $622,041.*

The average return for Stock Advisor is 792%, which significantly outperforms the S&P 500’s 153% over the same span. Don’t miss out on future recommendations by joining Stock Advisor.

*Stock Advisor returns as of April 14, 2025.

Beth McKenna has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.