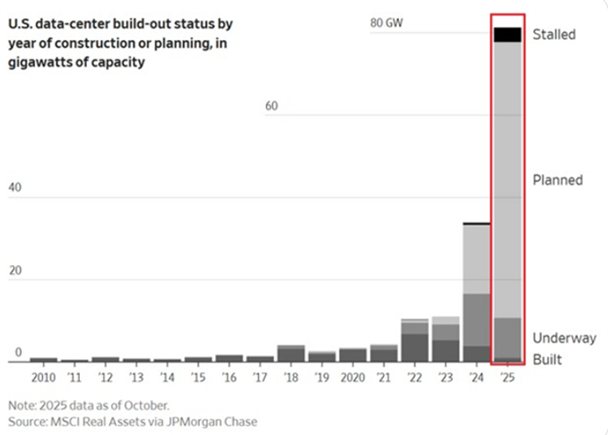

The AI frenzy is set to continue throughout 2026, driven in large part by significant CapEx for the underlying infrastructure. We’ve seen several companies benefit in a huge way from the investments, with the poster child being none other than NVIDIA NVDA.

To put it lightly, the growth from the AI favorite has been unlike anything we’ve seen, with a comparable example being Tesla roughly a decade and a half ago. And with success has come criticism, with many wondering if things are too good to be true.

The reality remains that companies across all industries, and many governments, want access to NVIDIA’s AI GPUs, already inking deals with the Kingdom of Saudi Arabia (KSA), the South Korean government, and the U.K., just to name a handful.

And we’re all familiar with NVIDIA’s role concerning the Mag 7’s CapEx plans, supplying the compute backbone that these mega-cap tech titans need to scale their AI infrastructure.

Previous Quarterly Results

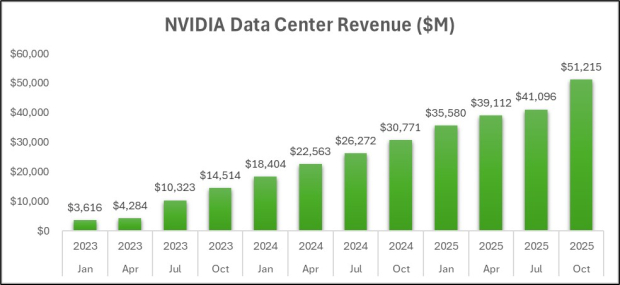

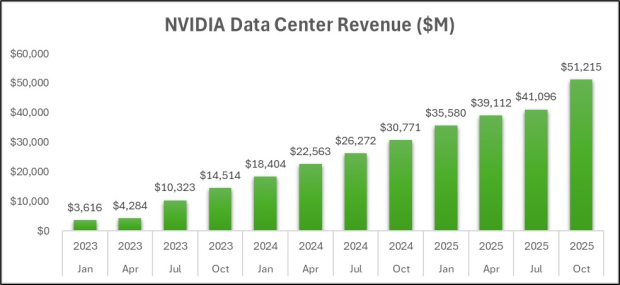

NVIDIA yet again posted a double-beat relative to our consensus expectations in its latest record-setting release, with sales of $57 million growing 62% alongside a 67% jump in EPS. Data Center revenue of $51.2 billion grew a rock-solid 66% from the year-ago period, which also crushed our consensus estimate of $49.1 billion.

Below is a chart illustrating NVDA’s Data Center revenue on a quarterly basis.

Image Source: Zacks Investment Research

As reflected by these results, the demand picture certainly isn’t an issue for the AI favorite, with companies continuing to rapidly seek out compute power. Our consensus estimates support the rosy picture, with EPS expected to soar 55% on 62% higher sales in its current fiscal year. FY27 is looking mighty strong as well, with current expectations suggesting 56% EPS growth on 43% higher sales.

Are Shares Too Expensive?

Shares aren’t expensive on a historical basis, with the current 26.7X forward 12-month earnings multiple well below the 42.4X five-year median and steep five-year highs of 106.3X.

Keep in mind that NVDA shares traded well above current valuation levels in 2020 and 2021, when the AI theme had not yet fully emerged and shares were primarily driven by its gaming results. The current multiple reflects a 16% premium relative to the S&P 500, among the lowest we’ve seen over the last five years.

It’s valid to watch for red flags within the broader AI story, especially given some of the lofty forecasts that we’ve seen some companies dish out. It’s important to remember that NVIDIA’s success, of course, depends on the hardware side, which has a much more visible demand picture.

In harsher words, NVDA still gets paid even if the companies it sells AI GPUs to don’t survive.

All in all, the specific results that NVIDIA NVDA has been reporting do reflect reality. Companies are frantically sourcing AI GPUs, and governments are also inking massive deals with the tech titan to do the same. While 2026 will be likely full of AI ‘losers’, NVIDIA will undoubtedly keep winning.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

see New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.