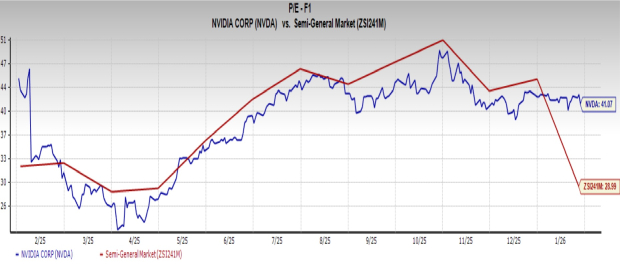

NVIDIA Corporation (NVDA) is currently trading at a forward price-to-earnings (P/E) ratio of 41.07, significantly above the Semiconductor industry average of 28.99. The elevated valuation raises concerns about potential volatility if growth expectations are not met, particularly amid risks from a U.S.-China trade conflict and competition from companies like Intel Corporation (INTC) and Advanced Micro Devices, Inc. (AMD).

On a positive note, Chinese authorities have authorized the purchase of NVIDIA’s H200 AI chips for the first time, with approvals worth approximately $10 billion, likely boosting sales. NVIDIA anticipates global data center capital spending to reach $3 trillion to $4 trillion annually by 2030, which could enhance revenue. For fiscal Q3 2026, NVIDIA reported revenues of $57 billion, up 62% year-over-year, and expects Q4 revenues to be around $65 billion.

NVIDIA’s net profit margin stands at 53%, surpassing the industry’s 49.34%, indicating robust fundamentals. The company holds a Zacks Rank #1 (Strong Buy), with a consensus estimate for earnings per share growth of 10.7% year-over-year, reinforcing its position as a compelling investment opportunity despite current market apprehensions.