Nvidia vs. Bitcoin: Differing Investment Prospects

Nvidia (NASDAQ: NVDA) leads the semiconductor industry with a market capitalization of $4.3 trillion, primarily supplying data center chips essential for artificial intelligence (AI) model development. The company projects a record revenue of $212 billion for fiscal year 2026, marking a 62% increase year-over-year. Its upcoming GPU architecture, Rubin, expected to launch in 2026, could deliver up to 3.3 times the performance of its current technology.

Conversely, Bitcoin (CRYPTO: BTC) remains the largest cryptocurrency with a market cap of $1.8 trillion, delivering a remarkable 21,100% return over the past decade. However, it has seen a decline of about 4% in 2025. While Nvidia’s revenue is pegged to significantly rise from AI demand, Bitcoin’s value is harder to predict despite its established place as a decentralized digital asset.

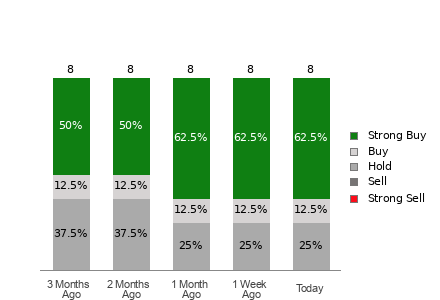

While Nvidia’s forecasts suggest strong future growth, Bitcoin’s stability and long-term potential are uncertain. Analysts indicate that Nvidia’s stock is currently undervalued compared to its historical performance, making it a more attractive buy for 2026 than Bitcoin.