Nvidia and Bitcoin: A Comparative Analysis of Investment Potential

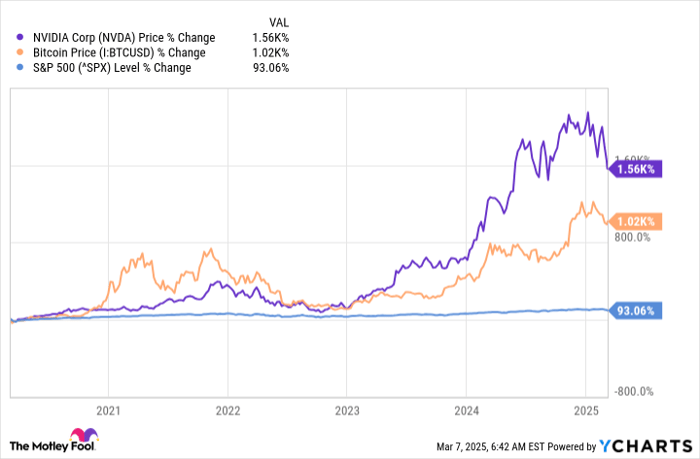

Nvidia (NASDAQ: NVDA) and Bitcoin (CRYPTO: BTC) might seem unrelated, yet both have emerged as top-performing investments over the past five years. They have vastly outperformed the S&P 500 (SNPINDEX: ^GSPC) index, showcasing enormous gains.

NVDA data by YCharts

If you had invested $10,000 equally in Nvidia and Bitcoin five years ago, your investment would now be valued at an impressive $139,000. In contrast, the same amount allocated to the S&P 500 would have grown to just $19,306.

Several unique factors could propel both Nvidia and Bitcoin to new heights this year. However, analysis suggests that one may prove to be a better investment than the other. Read on for the insights.

Image source: Nvidia.

Investment Case for Nvidia

Nvidia is renowned for providing the world’s most advanced graphics processing units (GPUs) used in data centers that are crucial for developing artificial intelligence (AI) models. Recently, Nvidia began shipping the new GB200 GPU, based on Blackwell architecture, which can offer up to 30 times the performance of its previous flagship H100 chip.

However, innovations in AI have raised concerns about a potential collapse in chip demand. A notable example is a start-up based in China, DeepSeek, which has successfully trained its V3 and R1 AI models using significantly less computing power compared to U.S. companies like OpenAI while achieving similar performance in certain benchmarks.

Despite these developments, many leading AI developers are transitioning away from traditional pre-training methods, instead opting to enhance their models through test-time scaling during the inference phase. This adjustment allows AI systems to spend more time reasoning before responding, improving the utility of their existing knowledge.

Top companies, including DeepSeek, OpenAI, Anthropic, and Meta Platforms, are now prioritizing the development of these reasoning models using test-time scaling. Nvidia’s CEO, Jensen Huang, stated that these models require 100 times more computing resources than previous iterations. Therefore, any potential reduction in traditional training workloads is expected to be balanced by an increase in inference demand, indicating sustained demand for Nvidia’s GPUs in the coming years.

Nvidia’s fiscal year 2025 results, ending January 26, revealed a record revenue of $130.5 billion, marking a 114% increase year over year. Notably, over $115 billion of this revenue came from the data center segment, which saw a remarkable 142% growth.

Major clients of Nvidia, such as Meta Platforms, Alphabet, Microsoft, and Amazon, are projected to collectively invest over $300 billion on AI data center infrastructure and chips in 2025, suggesting a prosperous outlook for Nvidia.

Investment Case for Bitcoin

Bitcoin, recognized as the largest cryptocurrency, boasts a market capitalization of $1.7 trillion, surpassing half of the total value of all tokens in the market.

The cryptocurrency’s appeal lies in its decentralization, capped supply, and secure blockchain infrastructure. These features have led many to view Bitcoin as a reliable store of value, often likened to digital gold. This perception gained traction when the U.S. Securities and Exchange Commission (SEC) approved several Bitcoin exchange-traded funds (ETFs), providing a compliant method for financial advisors and institutional investors to acquire Bitcoin.

Recent developments suggest that the SEC may become more supportive of cryptocurrencies. President Donald Trump appointed Mark Uyeda as acting head of the agency until his nominee, Paul Atkins, is confirmed. Uyeda has paused several legal actions against major crypto entities like Binance, and following Atkins’s confirmation, the agency is likely to adopt a more crypto-friendly stance.

Additionally, President Trump recently signed an executive order that could lead to the establishment of a Strategic Bitcoin Reserve, which would initially hold $18 billion worth of coins previously confiscated from criminals. Although it does not yet provide significant momentum for Bitcoin, the possibility of the government buying Bitcoin on the market could enhance its value and reinforce its status as a safe haven for investors.

Looking ahead, Cathie Wood’s Ark Investment Management anticipates that many governments and corporations may include Bitcoin in their balance sheets to counter economic challenges like inflation. Ark expects this trend to potentially drive Bitcoin’s value to $1.48 million per coin by 2030, presenting an impressive 1,560% upside from current levels.

Image source: Getty Images.

Final Verdict

Nvidia and Bitcoin represent fundamentally different asset classes. Nvidia generates substantial revenue and profit, making it easy to evaluate through traditional metrics such as the price-to-earnings (P/E) ratio. Conversely, Bitcoin lacks intrinsic production capacity and has limited practical application, which complicates its valuation. Only 6,935 businesses worldwide currently accept Bitcoin for transactions.

This distinction classifies Bitcoin as a speculative investment, making its true value difficult to determine. Given Nvidia’s current valuation, it appears to be the more prudent investment as we move into 2025.

As of this writing, Nvidia’s stock is trading at a P/E ratio of 37.6, which reflects a 36% discount compared to its 10-year average of 59.4. According to consensus estimates from Wall Street, portrayed by Yahoo! Finance, Nvidia could achieve earnings of $4.50 per share in the upcoming fiscal year.

Nvidia’s Stock Performance: A Critical Examination of Investment Potential

The current fiscal year for Nvidia is projected for 2026, which places the stock at a forward P/E ratio of 24.6:

NVDA PE Ratio data by YCharts

To maintain its current P/E ratio, Nvidia’s stock would need to increase by 52% this year. If it aims to align with its 10-year average, the stock would require a staggering price increase of 141%. This stark scenario does not extend similarly to Bitcoin.

Evaluating Whether to Invest $1,000 in Nvidia Now

Before deciding to purchase Nvidia stock, consider the following:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the 10 best stocks to invest in at this moment. Notably, Nvidia did not make this list. The selected stocks are anticipated to generate substantial returns in the years to come.

Reflecting on Nvidia’s past, if you had invested $1,000 when it was first recommended on April 15, 2005, you would now have $690,624!

Stock Advisor offers a straightforward guide for investors, featuring portfolio-building strategies, regular updates from analysts, and two new stock picks each month. This service has more than quadrupled the S&P 500’s return since 2002. Stay updated with the latest top 10 list upon joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 3, 2025

Randi Zuckerberg, a former market development director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. John Mackey, the former CEO of Whole Foods Market, which is under Amazon, is also a board member. Moreover, Suzanne Frey, an executive at Alphabet, holds a position on the board. Anthony Di Pizio does not have investments in any of the referenced stocks. The Motley Fool has positions in and recommends Alphabet, Amazon, Bitcoin, Meta Platforms, Microsoft, and Nvidia. The Motley Fool also recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily mirror those of Nasdaq, Inc.