The Battle of AI Giants: Nvidia vs. Broadcom in 2025

Artificial intelligence (AI) is pushing the limits of technology, driving significant growth in the semiconductor industry. Companies like Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) have thrived in this environment, recognizing the billions of dollars in opportunities that AI presents. Since January, both stocks have outperformed the S&P 500, with Nvidia leading the charge, increasing by over 180%.

Looking ahead to 2025, both companies are gearing up for more growth. Nvidia will launch its successor to the popular Hopper AI chip architecture, while Broadcom has announced major AI chip deals aimed at sustaining growth for years to come.

Start Your Mornings Smarter! Get the latest market news delivered straight to your inbox. Sign Up For Free »

But which stock should you consider buying for 2025?

Both Nvidia and Broadcom Excel in AI

Nvidia has become a household name for AI investors. Its expertise in GPU (graphics processing unit) chips made it a leader in the AI field. The company’s Hopper accelerator chip architecture set a benchmark for tech companies needing powerful computing to process large datasets in AI.

While the H100 chip is still widely used, Nvidia is set to introduce Blackwell chips as the next-generation architecture, meeting the rising demand for advanced AI models. Nvidia CEO Jensen Huang believes Blackwell could become the company’s top product. Analysts project Nvidia’s earnings growth to average 38% in the long run, reflecting high expectations from the market.

Meanwhile, Broadcom has a strong track record in semiconductors, focusing on networking and connectivity applications. However, it has diversified beyond chips, with enterprise infrastructure software accounting for about 41% of its total revenue. Broadcom is increasingly involved in AI, reporting AI-related revenue of $12.2 billion for fiscal year 2024, marking a dramatic 220% increase from the previous year.

The company recently acknowledged major deals for developing AI inference chips with notable AI firms—rumored to include OpenAI and Apple—using its XPU (extreme processing unit) chips. Broadcom anticipates a total AI market opportunity ranging from $60 billion to $90 billion by 2027, with management optimistic about capturing a significant share. Analysts expect Broadcom’s long-term earnings growth to average nearly 22% annually.

Evaluating Value: Which Stock Is the Better Buy?

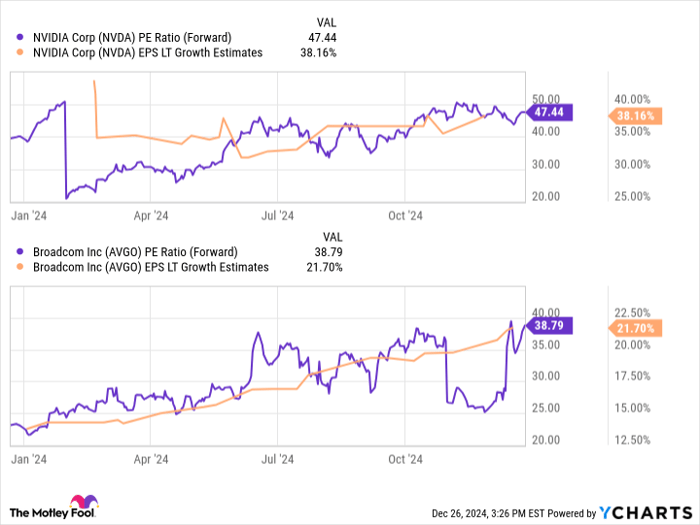

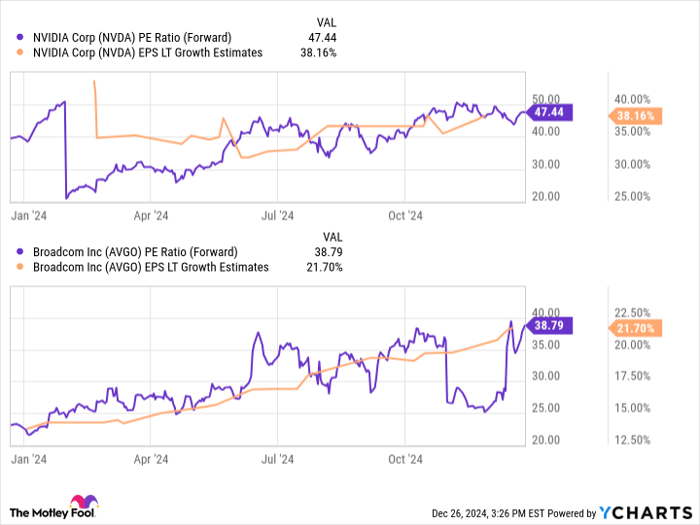

Both companies are positioned for growth, but the better investment may come down to which offers more value for money. This is where the PEG ratio comes into play. It compares a stock’s valuation to its expected growth; the lower the ratio, the better the investment.

For quality stocks, PEG ratios of up to 2.0 to 2.5 are often acceptable. Here’s how Nvidia and Broadcom compare:

NVDA PE Ratio (Forward) data by YCharts

Nvidia boasts a PEG ratio of 1.2, while Broadcom’s sits at 1.8.

It’s essential to remember that the PEG ratio reflects only potential growth; these predictions can change. A company’s future earnings volatility may also impact investor confidence.

Based on these figures, Nvidia appears the better value. However, if the performance of Blackwell underperforms, that could render Nvidia a riskier stock compared to Broadcom’s more diverse business operations.

Determining a Winner: Nvidia Takes the Lead

With both stocks trading at PEG ratios below typically acceptable limits, long-term investors could buy either, or both, today. However, a preference emerges.

If both stocks were trading at similar PEG ratios, my choice would lean towards Broadcom, given its reduced dependence on AI. Yet, Nvidia’s lower PEG ratio suggests it is better positioned to grow despite potential risks. A PEG ratio of 1.2 seems a steal, especially for what is arguably the leading AI company globally.

The notion that AI is merely a temporary trend is unlikely, with substantial investments flowing into the sector. As Blackwell launches, Nvidia’s reputation should remain strong, and ongoing innovation in AI technology could spark continued demand for complex AI chips. Consequently, while both companies look promising, Nvidia appears to be the more compelling buy as we head into 2025.

Seize This Potential Opportunity

Do you ever feel you missed out on investing in major stocks? If so, take note.

Our expert team occasionally issues a “Double Down” stock recommendation for companies poised for significant growth. If you think you’ve missed your chance to invest in top stocks, this could be the ideal time to act. The impressive returns speak volumes:

- Nvidia: if you invested $1,000 when we first recommended it in 2009, you’d have $355,269!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,404!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $489,434!*

Currently, we have “Double Down” recommendations for three standout companies, and this could be one of your final chances.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.