Investing in AI: Nvidia vs. Intel in the GPU Market

Investors looking to capitalize on artificial intelligence (AI) should consider shares of graphics processing unit (GPU) manufacturers like Nvidia (NASDAQ: NVDA) and Intel (NASDAQ: INTC). Nearly every AI application relies on these specialized chips, making investments in GPU companies a direct route to the AI sector’s growth.

Currently, Nvidia offers stronger exposure to AI demand. However, Intel’s discounted valuation and future growth plans present an intriguing scenario for potential investors. Which GPU manufacturer is the better investment today? The answer may surprise you.

Nvidia: The Dominant Force in AI

Nvidia’s impressive $3 trillion market capitalization is largely attributed to its leadership in AI chip manufacturing. Estimates suggest that the company holds between 70% to 95% of the market share for GPUs tailored for AI applications.

This market dominance stems from a decade of strategic foresight. For example, in 2006, Nvidia introduced its CUDA developer suite, enabling developers to customize chips for optimal performance, effectively locking in customers and promoting software use.

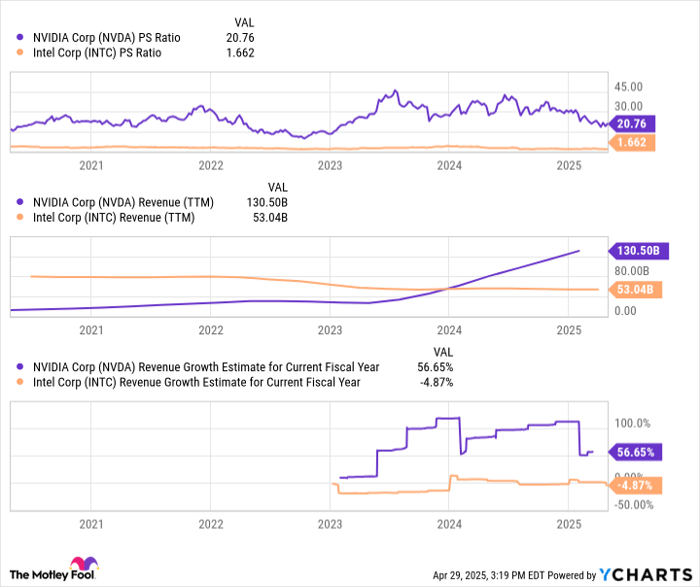

Moreover, Nvidia was among the first to invest significantly in machine-learning GPUs, giving it a substantial advantage over competitors. In contrast, Intel has struggled with management missteps, leading to a decline in revenue, with its valuation now more than 90% lower than Nvidia’s on a price-to-sales ratio.

Intel’s leadership acknowledges the company’s challenges. Patrick Gelsinger, Intel’s former CEO, noted, “In that race, they are so far ahead. Given the other challenges that we have, we’re just not going to be competing anytime soon.”

Given these dynamics, Nvidia stands out as the leading choice for AI investment. However, could Intel present an attractive option given its low valuation?

NVDA PS Ratio data by YCharts; PS = price to sales, TTM = trailing 12 months.

Intel: A Potential Underdog in AI

Nvidia is currently generating tens of billions in AI accelerator sales each quarter. Its competitor, Advanced Micro Devices, is achieving over $1 billion in sales. Meanwhile, Intel is lagging behind; in 2024, it missed its annual target of $500 million in AI GPU sales.

Despite these hurdles, is Intel’s valuation low enough to consider a minor investment? Looking at gross margins provides a compelling reason to consider it.

NVDA Gross Profit Margin data by YCharts.

Nvidia’s chips are sold at a premium, leading to gross margins nearing 75%, while Intel’s are around 30%. This difference offers Intel a competitive avenue. If demand for AI chips continues to exceed Nvidia’s supply, Intel could attract developers and data center operators with lower prices and greater availability. Such shifts might help enhance Intel’s developer ecosystem, which currently faces significant challenges.

For those considering an investment in AI, holding a significant position in Nvidia is advisable. Additionally, a small investment in Intel might offer diversification at a minimal cost, allowing potential benefits as the market evolves.

Is Intel a Buy for Your Portfolio?

Before investing in Intel, consider this:

The Motley Fool analyst team has identified the 10 best stocks for investors at this time, and Intel is not among them. The selected stocks could yield significant returns in the coming years.

For example, when Netflix was on this list on December 17, 2004… a $1,000 investment then would now be worth $611,271!*

Similarly, if you had invested $1,000 in Nvidia when it was added on April 15, 2005… it would have grown to $684,068!*

Note that Stock Advisor has historically provided an average return of 889%—significantly outperforming 162 from the S&P 500.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.