NVIDIA vs. IonQ: Which AI Stock Should You Buy Now?

NVIDIA Corporation (NVDA) and IonQ, Inc. (IONQ) are both making impactful strides in the artificial intelligence (AI) arena, presenting exciting opportunities for investors.

NVIDIA’s stock saw a remarkable 26.3% increase over the past year. This surge is largely attributed to the high demand for its graphic processing units (GPUs), essential for numerous AI applications. Likewise, shares of IonQ have skyrocketed by 89.5% in the last year, fueled by the promise of quantum computers solving complex problems that traditional computers struggle to tackle. Thus, a pertinent question arises: which of these high-flying AI stocks is a more prudent buy? Let’s delve deeper.

Why Investors Favor NVIDIA Stock

The rise in portable electronics sales and the expanding Internet of Things (IoT) are driving global GPU market growth. According to Precedence Research, the GPU market is projected to expand from $101.54 billion in 2025 to an impressive $1,414.39 billion by 2034. NVIDIA, commanding over 80% market share in discrete GPUs according to Mercury Research, stands to benefit significantly from this growth.

Additionally, NVIDIA is strategically positioned to capitalize on significant data center investments from major tech players, including Microsoft (MSFT), Alphabet Inc. (GOOGL), and Meta Platforms, Inc. (META). In its most recent quarter ending January 26, NVIDIA saw a staggering 93% increase in data center revenues, totaling $35.6 billion. With projected data center spending set to reach $2 trillion over the next five years, NVIDIA’s growth trajectory appears robust.

Although concerns about competition from newcomers like DeepSeek are present, many believe that such competitors will ultimately increase overall demand for computing power, benefitting firms like NVIDIA in the long run. The chipmaker has the necessary resources to produce cost-efficient products and enhance the AI ecosystem. Moreover, in the fourth quarter of fiscal 2025, NVIDIA’s Blackwell AI processor demonstrated surging demand, generating $11 billion in sales, surpassing Wall Street estimates.

Why Invest in IonQ Stock?

IonQ’s quantum computing systems are increasingly crucial for companies like Amazon.com, Inc. (AMZN) and Microsoft, providing AI researchers with essential quantum computing capabilities. The global quantum computing market is on track for substantial growth, with estimates suggesting it will reach $2 trillion by 2035, as noted by McKinsey.

IonQ distinguishes itself in the quantum arena through its innovative linear chains of ions, managing to achieve over 100 qubits while maintaining lower error rates than competitors. In the fourth quarter, IonQ experienced a 92% revenue increase, reaching $11.7 million. The demand for quantum computing is especially significant across life sciences, chemistry, and finance sectors, suggesting further revenue growth for IonQ.

Evaluating NVIDIA and IonQ: Which is the Superior Investment?

Despite their respective strengths, NVIDIA appears to hold a significant advantage over IonQ. Quantum computing remains a speculative field, with practical applications yet to materialize fully. NVIDIA CEO Jensen Huang has pointed out that commercializing quantum computers could take at least 15 years, a timeline that does not favor IonQ.

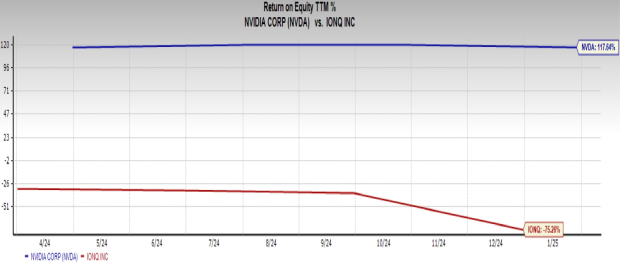

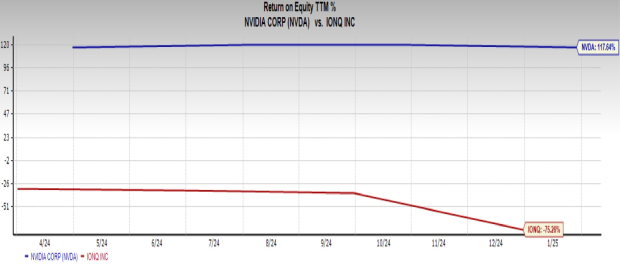

Moreover, with major tech companies eyeing entry into the quantum computing space, IonQ could become a target for acquisition without necessarily benefiting its shareholders. Adding to these concerns, IonQ’s return on equity stands at a troubling negative 75.3% compared to NVIDIA’s impressive 117.6% return.

Image Source: Zacks Investment Research

IonQ’s current price-to-sales ratio of 103.6 is exceedingly high, and the company continues to struggle with profitability, reporting a net loss of $202 million in its latest quarter despite revenue growth.

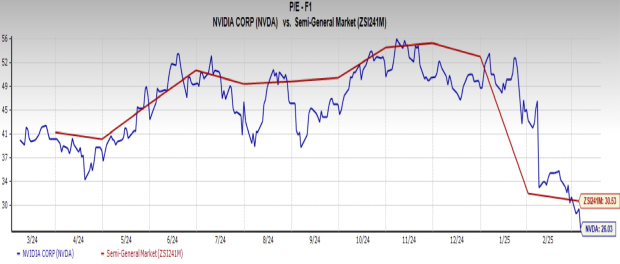

Conversely, NVIDIA recently reported GAAP earnings per share of $0.89, reflecting an 82% increase from the previous year. The stock is also attractively priced, trading at 26.0 times forward earnings, compared to the semiconductor industry’s average of 30.53.

Image Source: Zacks Investment Research

In conclusion, NVIDIA appears to be the stronger AI stock choice at this time, while more risk-tolerant investors may consider adding IonQ to their portfolios. Both companies currently hold a Zacks Rank of #2 (Buy). For those interested, you can explore the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Just Released: Zacks Top 10 Stocks for 2025

Act fast—you can still get in early on our selected top 10 tickers for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has shown exceptional and consistent success. Since inception in 2012 through November 2024, the Zacks Top 10 Stocks gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has meticulously analyzed 4,400 companies covered by the Zacks Rank and selected the top 10 to invest in for 2025. Be among the first to discover these newly released stocks with considerable potential.

See New Top 10 Stocks >>

Looking for the latest recommendations from Zacks Investment Research? Today, download the 7 Best Stocks for the Next 30 Days for free. Click here to get this report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

Meta Platforms, Inc. (META): Free Stock Analysis report

IonQ, Inc. (IONQ): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.