Will Nvidia Outperform Microsoft in the David vs. Goliath AI Showdown?

Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT) stand at the forefront of the artificial intelligence (AI) revolution, each making significant contributions that have shaped the industry.

The AI trend ignited in November 2022, courtesy of Microsoft-backed OpenAI and its popular ChatGPT. While the chatbot’s success relied on Nvidia’s powerful graphics processing units (GPUs) for training its large language model (LLM), the ensuing demand for Nvidia’s chips triggered impressive growth in both its revenue and profitability.

Start Your Mornings Smarter! Subscribe to our Breakfast news for daily market updates. Sign Up For Free »

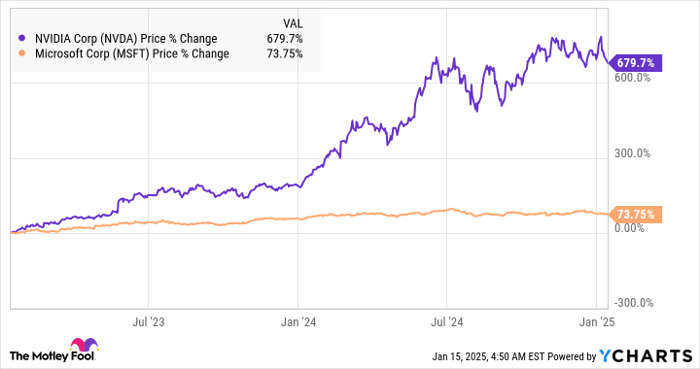

In contrast, Microsoft has gradually reaped the benefits of AI technology. The tech giant is investing billions to build an AI-focused data center infrastructure, which in turn boosts Nvidia’s business. Microsoft projects that its AI-focused investments will “support monetization over the next 15 years and beyond.” This trajectory explains why Nvidia’s stock has far outstripped Microsoft’s in recent years.

NVDA data by YCharts.

As we look ahead, the question remains: will Nvidia maintain its edge over Microsoft in 2025?

Microsoft’s Momentum vs. Nvidia’s Growing Challenges

As noted, Microsoft is seeing gradual AI benefits. For the fiscal year 2024, ending June 30, Microsoft’s revenue grew 16%, reaching $245 billion, and its adjusted earnings rose 20% year-over-year to $11.80 per share. For fiscal 2025, analysts anticipate a 14% revenue growth to $278.6 billion, while earnings are projected to grow 10.5% to $13.04 per share.

Looking further to fiscal 2026, projections remain cautious. Consensus estimates predict a revenue increase of 14% along with a 15% rise in earnings.

MSFT Revenue Estimates for Next Fiscal Year data by YCharts.

In contrast, Nvidia expects remarkable growth, forecasting a 112% revenue increase to $129 billion for the current fiscal year ending January 2025, followed by a projected 52% rise to $196 billion in the next year. Nvidia’s earnings are expected to surge 128% this year and 50% next year.

This data strongly indicates that Nvidia may continue its rapid growth compared to Microsoft. Furthermore, predictions suggest Nvidia’s stock could climb 33%, while Microsoft might see a 20% increase in value. With soaring demand for Nvidia’s AI data center GPUs, its future seems promising.

However, investors should remain cautious of potential headwinds for Nvidia. Issues such as possible restrictions on chip sales abroad, high valuations, and customers’ efforts to diversify away from Nvidia’s products could pose challenges.

Despite Nvidia’s current impressive growth rate, signs of slowing momentum raise concerns about its shining prospects in 2025. On the flip side, Microsoft is enhancing its capabilities in key AI areas, potentially positioning itself for significant gains in the future.

As a demonstration of this momentum, Microsoft’s Azure cloud services revenue surged 33% in the first quarter of fiscal 2025, attributed in part to a 12 percentage point contribution from AI. The surge in big contracts indicates that Microsoft is creating a solid revenue foundation.

The company’s commercial remaining performance obligations (RPO) soared 22% to $259 billion in Q1 2025, signaling a positive growth trend. With 40% of this figure expected to translate into revenue over the next year, Microsoft could exceed Wall Street’s forecasts.

While Nvidia also faces challenges, the company’s strategy to ramp up production of its latest Blackwell AI processors may allow it to navigate its current difficulties and sustain growth.

Investor Strategies and Insights

Given the uncertainties around Nvidia, some investors might find it safer to invest in Microsoft, especially considering its lower valuation. Microsoft is currently trading at 34 times earnings, significantly cheaper than Nvidia’s multiple of 52.

However, Nvidia’s forward earnings multiple aligns more closely with Microsoft at 31, reflecting its anticipated robust growth. This could make Nvidia an appealing option amidst the AI boom. Investors might want to leverage any negative perceptions about Nvidia as a buying opportunity, given its large addressable market and potential to overcome regulatory hurdles.

Nevertheless, Microsoft also emerges as a strong AI investment, presenting substantial opportunities in cloud computing and collaboration tools that can enhance its growth trajectory.

Ultimately, investors can consider either of these two major AI stocks based on their individual risk tolerance, as both NVIDIA and Microsoft occupy advantageous positions in the flourishing AI landscape.

Is Now the Time to Invest $1,000 in Nvidia?

Before making any decisions about Nvidia stock, consider this:

The Motley Fool Stock Advisor team has highlighted what they believe are the 10 best stocks to buy right now, with Nvidia not making the list. Those stocks have the potential for substantial returns in the years to come.

For instance, think about when Nvidia was last recommended on April 15, 2005… investing $1,000 at that point would now yield an incredible $843,960!*

Stock Advisor offers straightforward investment guidance, including portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.