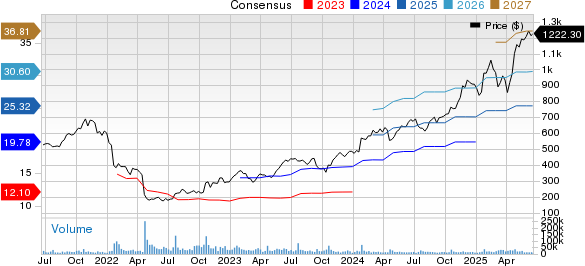

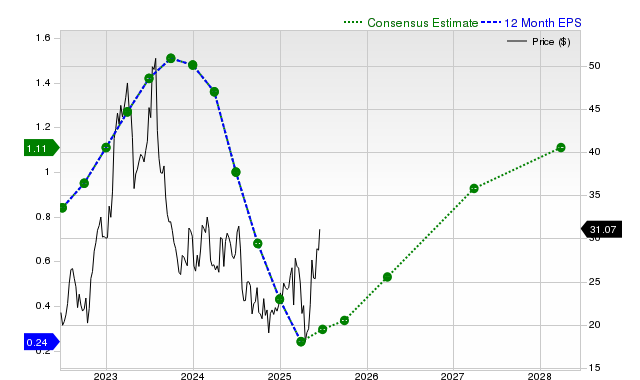

Nvidia (NASDAQ: NVDA) reported Q1 fiscal 2026 revenue of $44.1 billion, a 69% increase year-over-year, despite facing a loss of $2.5 billion in H20 revenue due to new export licensing requirements in China. The company anticipates an $8 billion loss in Q2, with CEO Jensen Huang stating that the Chinese market is now largely inaccessible, as Nvidia’s market share has dropped from 95% to 50%.

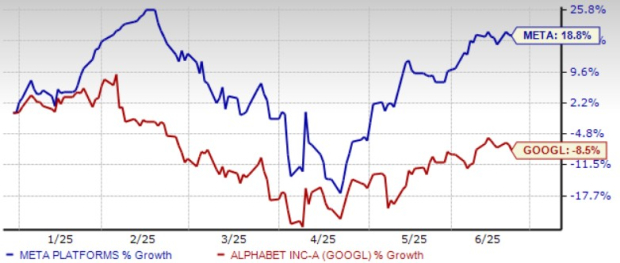

In contrast, Palantir Technologies (NASDAQ: PLTR) achieved Q1 2025 revenue of $884 million, a 39% year-over-year increase, with U.S. revenue growing 55% to $628 million. Palantir has raised its full-year guidance to $3.89 to $3.9 billion, reflecting strong demand and marking a historic milestone of surpassing a $1 billion annual run rate in U.S. commercial revenue.

The AI market is projected to exceed $826 billion by 2030. Nvidia is focusing on building AI factories and infrastructure, while Palantir is capitalizing on practical AI applications within government and commercial sectors.