“`html

Comparing AI Growth Potential: NVIDIA vs. SoundHound AI

NVIDIA Corporation (NVDA) and SoundHound AI, Inc. (SOUN) are making notable progress in the artificial intelligence (AI) sector, resulting in increased stock prices over the past year. Each company targets different segments of the AI market, prompting an analysis of which one has greater growth potential.

SoundHound AI: An Optimistic Outlook

The recent trade agreement between the United States and China presents favorable conditions for SoundHound AI. Tariffs on Chinese imports have decreased from 145% to 30%, while China has reduced import duties on American goods from 125% to 10%. This 90-day truce benefits companies engaged in trade between the two nations.

Furthermore, a partnership with Tencent allows SoundHound AI to operate in China. Tencent plans to integrate SoundHound’s voice AI technology into its cloud offerings for the automotive sector. While tariffs may not directly impact a software company like SoundHound, they can increase operational costs. Additionally, worsening trade relations could jeopardize its collaboration with Tencent.

SoundHound AI’s first-quarter 2025 revenues surged by 151% year over year, reaching $29.1 million. The adjusted earnings per share (EPS) loss narrowed by 14% during the same period. The company ended the quarter with positive cash and cash equivalents and no long-term debt. For the full year 2025, it targets an 85% to 90% revenue growth along with a positive adjusted EBITDA.

NVIDIA: A Strong Market Position

NVIDIA stands to benefit from the significant investments in AI infrastructure made by companies like Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOGL). These cloud computing firms are purchasing NVIDIA’s graphics processing units (GPUs) to enhance their AI computing power. Notably, Alphabet recently reported that growth from its AI products far exceeded that of Google Cloud.

By 2028, NVIDIA projects AI data center spending could reach $1 trillion, driving stock growth. The demand for NVIDIA’s advanced chips is on the rise, with shipments of its next-generation Blackwell chips increasing due to their superior AI interface and energy efficiency. The popularity of the CUDA software platform among developers is also expected to bolster NVIDIA’s quarterly performance.

Which Stock Offers Better Gain Potential: NVIDIA or SoundHound AI?

While the recent trade deal and the increasing adoption of SoundHound’s voice-enabled AI systems are promising, the company is primarily growing through acquisitions rather than organic means. If corporate cultures do not integrate well, this could be detrimental to SoundHound AI’s expansion.

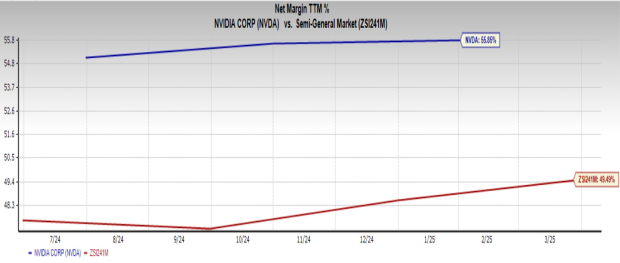

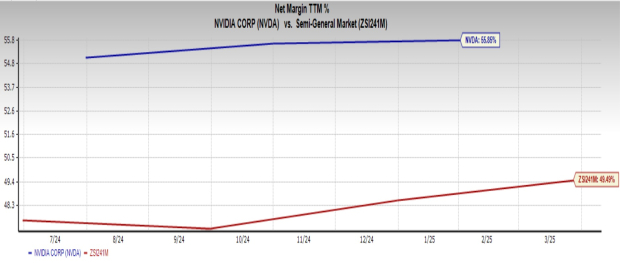

SoundHound AI has yet to turn a profit and has struggled to meet its financial guidance, which affects its stock growth trajectory. Although it issued positive EBITDA guidance for the fourth quarter of 2023, its adjusted EBITDA remained a negative $22.2 million five quarters later. In contrast, NVIDIA has proven more adept at generating profits, boasting a net profit margin of 55.9%, surpassing the Semiconductor – General industry average of 49.5%. This margin indicates that NVIDIA has greater potential for future growth.

Image Source: Zacks Investment Research

Moreover, SoundHound AI lacks the competitive advantage in GPUs that NVIDIA possesses. With over 80% market share in the GPU sector, NVIDIA is better positioned to withstand market fluctuations, which could pose challenges for SoundHound AI. Consequently, NVIDIA appears to offer more consistent gains in the near future. As of now, both NVIDIA and SoundHound AI hold a Zacks Rank of #3 (Hold).

Investment Opportunities with Zacks

We’re not kidding.

Several years ago, we stunned our members by providing 30-day access to all our picks for only $1, with no obligation to spend more.

Thousands have seized this opportunity. Many others hesitated, fearing there must be a catch. Nevertheless, this initiative aims to familiarize you with our portfolio services that have closed a number of positions with double- and triple-digit gains in 2024 alone.

Want to receive the latest recommendations? Download our report on the 7 Best Stocks for the Next 30 Days.

This article was originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`