AI Boom Boosts Semiconductor Giants: Nvidia vs. TSMC

Artificial intelligence is transforming the semiconductor industry as businesses upgrade their technology to meet AI demands. The two biggest winners in this shift are Nvidia (NASDAQ: NVDA) and Taiwan Semiconductor Manufacturing (NYSE: TSM), often called TSMC.

Nvidia is experiencing an surge in demand for its AI-related products, even though it’s a fabless firm and doesn’t produce its own chips. Instead, TSMC plays a crucial role by manufacturing chips for Nvidia and multiple other companies.

As both companies are pivotal in shaping current AI technology, investors face a dilemma: which company offers the better long-term investment? Below is a comparison of TSMC and Nvidia.

How TSMC Powers AI Progress

Fueled by AI demand, TSMC’s revenue surged 36% year over year, reaching $23.5 billion in the third quarter. This impressive performance places it second in market capitalization among major semiconductor companies, trailing only Nvidia and surpassing giants like Intel and Samsung.

The cornerstone of TSMC’s success is its three-nanometer (nm) semiconductor manufacturing process. This advanced technology enables the production of faster chips with lower energy use and higher computational power while maintaining the same chip size.

TSMC has attained mastery in 3nm production, unlike rivals such as Samsung, allowing it to capture an estimated 90% market share in the advanced semiconductor segment.

This dominance has not gone unnoticed; TSMC has received $6.6 billion from the U.S. government as part of the CHIPS Act, aimed at establishing semiconductor factories within the U.S., which currently lacks the capability to manufacture these advanced AI chips.

Robust revenue growth has bolstered TSMC’s financial position. By the end of Q3, the company reported total assets of $194.9 billion, which included $59.6 billion in cash, while its liabilities stood at $67.8 billion.

Effective cost management helped TSMC achieve a Q3 gross margin of 57.8%, up from 54.3% the previous year, leading to a net profit margin increase to 42.8% from 38.6%.

Nvidia’s Leadership in AI Chips

Like TSMC, Nvidia has excelled in technology that drives the AI boom. TSMC excels in chip manufacturing, while Nvidia has focused on accelerated computing.

Nvidia’s dominance in AI is largely due to its innovation in accelerated computing, which involves using processors separate from the CPU to efficiently manage data-heavy tasks, essential for AI applications.

The company pioneered GPU technology in 1999 and now dominates the market, boasting an estimated 80% share in the GPU sector.

This strategic focus has resulted in a record revenue of $35.1 billion during its fiscal third quarter, marking a 94% year-over-year increase. Continued strong demand for AI has led Nvidia to project Q4 revenue of approximately $37.5 billion, a 70% rise compared to the previous year.

The company’s newly developed Blackwell architecture, tailored for AI applications, is expected to drive further revenue growth into 2025. According to Nvidia, “demand exceeds our supply,” reflecting strong customer interest in this innovative technology.

Nvidia’s financial results reflect this growing demand, with total assets of $96 billion at the end of Q3. Among its assets, $38.5 billion is in cash and marketable securities, significantly exceeding total liabilities of $30 billion.

Pitting Nvidia Against TSMC

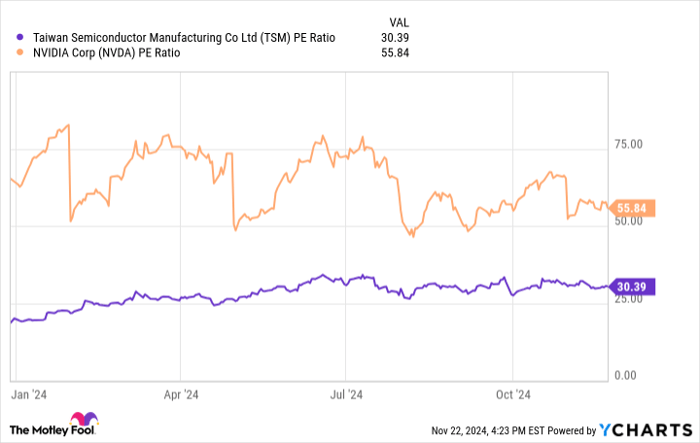

For investors keen on capturing opportunities in the booming AI sector, owning shares of both Nvidia and TSMC is ideal. However, for those looking to choose between the two, several factors come into play, including their price-to-earnings (P/E) ratio, a common metric used for stock valuation that indicates how much investors are willing to pay for each dollar of earnings.

Data by YCharts.

Although TSMC’s P/E ratio has risen during 2024, it remains lower than Nvidia’s at this time, suggesting TSMC stock offers better value for investors compared to its counterpart.

When combining this valuation insight with TSMC’s advanced 3nm manufacturing process, it becomes evident that TSMC may slightly outshine Nvidia as the preferred investment in the expanding AI market.

Last Chance for a Potentially Profitable Move

Ever feel you missed investing in top-performing stocks? This might be your chance to get in on the action.

Occasionally, our team of expert analysts identifies a “Double Down” stock they believe is poised for significant growth. If you think you’ve missed your chance, now is the opportune moment to invest before it becomes too late. Here are some impressive numbers:

- Nvidia: $1,000 invested in our 2009 recommendation would be worth $355,011!*

- Apple: $1,000 invested in 2008 would be worth $44,516!*

- Netflix: $1,000 invested in 2004 would be worth $470,586!*

Currently, we are presenting “Double Down” alerts for three remarkable companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Robert Izquierdo has positions in Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.