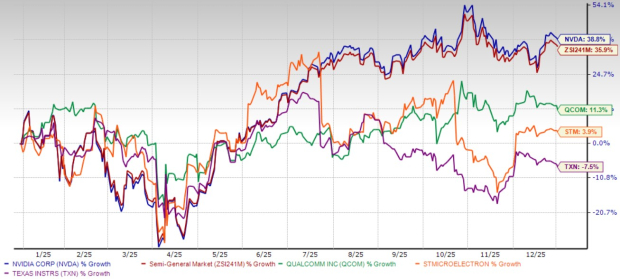

NVIDIA Corporation (NVDA) shares have surged 38.8% in 2025, exceeding the Zacks Semiconductor – General industry’s growth of 35.9%. This performance outshines major competitors, with Qualcomm (QCOM) and STMicroelectronics (STM) gaining 11.3% and 3.9%, while Texas Instruments (TXN) experienced a decline of 7.5%. NVIDIA’s growth is primarily fueled by the booming demand for its graphics processing units (GPUs) used in artificial intelligence applications.

In the third quarter of fiscal 2026, NVIDIA’s Data Center segment reported revenues of $51.22 billion, accounting for 89.8% of total sales, a remarkable 66% increase year-over-year. The company’s free cash flow reached $23.75 billion during the same quarter, contributing to a total of $66.53 billion for the first three quarters. NVIDIA anticipates fourth-quarter revenues of $65 billion, driven by sustained AI demand, and expects a gross margin of 75%, reflecting a 150-basis-point improvement from the previous year.