Nvidia’s Strategy to Counteract Tariffs with U.S.-Made GPUs

Many investors are worried about how tariffs will affect Nvidia‘s (NASDAQ: NVDA) stock. However, Nvidia is taking significant steps to mitigate these concerns. The company plans to produce its most powerful GPUs entirely in the U.S.—a strategic win that ensures critical products will not depend on foreign sources.

Despite these advancements, there are key details regarding Nvidia’s Blackwell GPUs that investors should consider, particularly since the company cannot start this production immediately.

Nvidia’s Competitive Landscape and Growth Potential

Nvidia has announced plans for its Blackwell chips to be produced entirely in the U.S. While production won’t begin overnight, it is expected to ramp up in the next 12 to 15 months.

Components for these GPUs will be sourced from Taiwan Semiconductor Manufacturing’s (NYSE: TSM) facility in Phoenix, Foxconn’s site in Houston, and Wistron’s facility in Dallas, with final assembly occurring in Nvidia’s Texas plant. Although Nvidia might face upcoming semiconductor tariffs mentioned by President Trump, carve-outs could apply to firms like Nvidia that are relocating production to the U.S.

In any case, Nvidia is set to navigate these tariff challenges in the upcoming months, allowing investors to shift their focus away from tariff implications and toward artificial intelligence (AI) opportunities.

The growth of AI is continuing unabated even amidst tariff discussions. This presents a crucial moment for investment, as companies hesitant to invest in AI infrastructure risk falling behind competitors. This is a factor leading Nvidia to predict data center capital expenditures will grow from $400 billion in 2024 to over $1 trillion by 2028. Given that Nvidia captured $115 billion from its data center segment in the past year, its revenues are poised to rise in tandem with this growth.

Recent Challenges Affecting Nvidia’s Financial Position

Nonetheless, concerns persist regarding how the Trump administration will manage Nvidia’s foreign exports. The company recently had to write off $5.5 billion in inventory for H20 chips intended to comply with export regulations for China.

Due to new export restrictions, those chips can no longer be shipped overseas, leading Nvidia to absorb the loss in its first-quarter fiscal year 2026 financial results. Although this will impact profits for the quarter, Nvidia’s balance sheet remains strong with approximately $43.2 billion in cash and equivalents as of Q4, minimizing the overall impact.

The market reaction to this development was severe, resulting in a 5% drop in Nvidia’s stock price. With Nvidia’s current market capitalization at $2.7 trillion, this equates to a loss of about $135 billion. This overreaction by the market may provide a prime opportunity for investors to buy.

The Stock Price Opportunity for Investors

Investors should focus on Nvidia’s future prospects, which include U.S.-made GPUs and the expanding AI data center market. The past write-off shouldn’t overshadow the substantial growth opportunities ahead—making Nvidia’s current valuation one that savvy investors may consider a bargain.

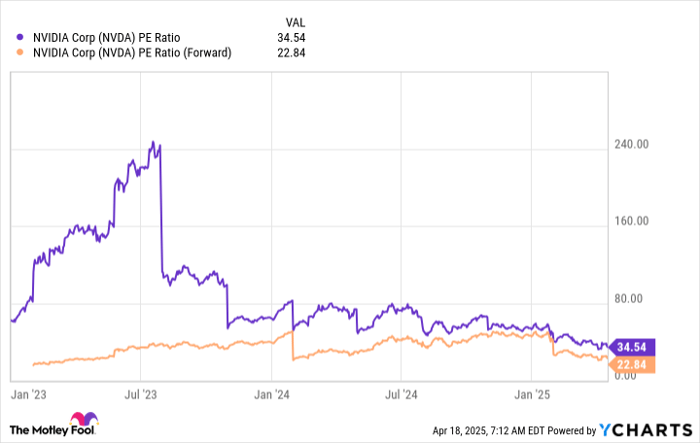

NVDA PE Ratio data by YCharts

Nvidia’s stock is currently trading at 23 times forward earnings, slightly above the broader market index, the S&P 500 (SNPINDEX: ^GSPC), which trades at 19.8 times forward earnings. Nvidia’s forward P/E ratio only considers one year of expected growth, yet given the company’s prospects for continued expansion, its outlook remains promising.

Should You Consider Investing $1,000 in Nvidia?

Before making a decision on Nvidia, investors should weigh this information:

The Motley Fool Stock Advisor analyst team has recently highlighted what they believe to be the 10 best stocks to buy now… and unfortunately, Nvidia did not make the list. The selected stocks could yield significant returns in the years to come.

For instance, when Netflix was featured on this list on December 17, 2004, if you had invested $1,000 then, it would be worth approximately $524,747 now!* Similarly, if you had invested $1,000 in Nvidia when it made the list on April 15, 2005, that investment could have grown to $622,041!*

With Stock Advisor boasting an average total return of 792 % versus 153 % for the S&P 500, it may be worthwhile to discover the latest top 10 list when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 21, 2025

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily represent the views of Nasdaq, Inc.