Nvidia’s Revenue Projections and Market Trends

Nvidia (NASDAQ: NVDA) is experiencing significant revenue growth, driven by demand for its graphics processing units (GPUs) in artificial intelligence (AI) training and data centers. Following a boom in AI since 2022, Nvidia’s revenue surged, even tripling on some occasions. The company anticipates a 50% growth in revenue for the fiscal 2026 second quarter, which could have reached 77% without recent setbacks regarding export licenses to China.

Forecast for Data Center Capital Expenditure

Global data center capital expenditure (capex) is projected to grow from $400 billion in 2024 to $1 trillion by 2028. This increase accompanied by a consistent replacement cycle for GPUs suggests that Nvidia is well-positioned to capitalize on ongoing AI demand and the proliferation of data centers, thereby solidifying its status in the semiconductor market.

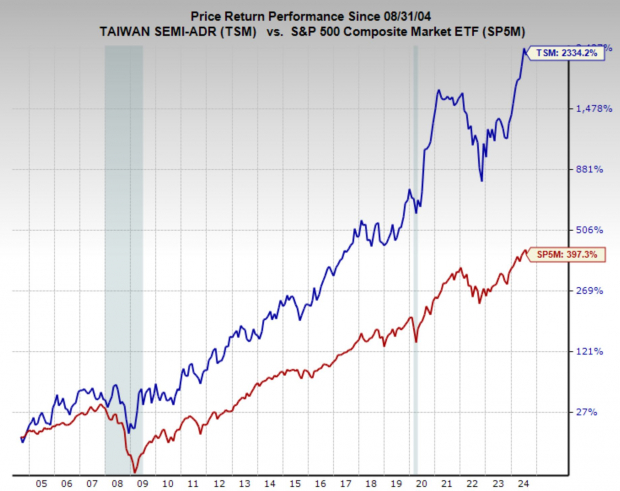

Long-Term Investment Outlook

As Nvidia navigates market challenges and opportunities, analysts believe that while its explosive growth may stabilize, it is likely to outperform the market over the next five years, maintaining its reputation as a strong long-term investment option.