Tech Stocks Slide as Nvidia Stumbles: Market Overview

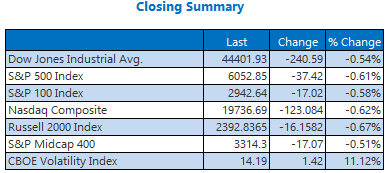

Today, tech stocks displayed notable weakness, largely due to poor performance from Nvidia (NVDA). This shift caused the Nasdaq to drop significantly from its record close on Friday, while the Dow logged its third consecutive triple-digit loss. The S&P 500 also ended lower, as Wall Street experienced profit-taking. In light of these events, the Cboe Volatility Index (VIX) recorded its highest single-session gain since November 15.

Explore today’s market highlights below:

- Nvidia stock reveals vulnerabilities amid recent highs.

- Reddit stock remains resilient despite overall market downturn.

- Additionally, a focus on fintech; a buy recommendation for oil stocks; and news on Macy’s emerging investors.

Key Market Insights

- The Fed’s Beige Book expresses a positive outlook for the 2025 economy. (MarketWatch)

- The European Central Bank (ECB) may consider cutting interest rates. (Bloomberg)

- Fintech stocks are responding to positive upgrades today.

- Exxon-Mobil stock presents an enticing entry point.

- Activist investor invests in Macy’s.

No significant earnings reports were released today.

Market Moves on China’s Central Bank Decisions

Today, oil prices gained traction, supported by the fall of Syrian President Bashar al-Assad’s government and ongoing stimulus measures from China. However, any future disruptions could threaten these gains. Specifically, January-dated West Texas Intermediate (WTI) crude rose by $1.17, or 1.7%, closing at $68.37 per barrel.

In market adjustments, China’s increased gold purchases pushed the precious metal higher. For December delivery, gold prices climbed 1.1% to finish at $2,688.40 an ounce.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the opinions or positions of Nasdaq, Inc.