Nvidia Stock Declines Despite AI Conference Announcements and Updates

During the recent GTC AI Conference held in San Jose, California, Nvidia Corp. NVDA faced a notable decline. On Tuesday, its shares slipped over 3%, with the company, led by CEO Jensen Huang, having erased $420 billion in investor wealth since the launch of DeepSeek on January 10, 2025.

Key Announcement Highlights: In a comprehensive two-hour address at the GTC conference, Huang detailed Nvidia’s strategic plans for the next two years. This included updates on their Blackwell and Rubin chips and advancements in AI applications for robotics and telecommunications. A new partnership with General Motors Co. GM aimed at AI-driven manufacturing training was also announced.

Despite these developments, Nvidia’s stock continued its decline, dropping by 3.43%. This performance was in contrast to the Nasdaq 100 index, which fell 1.66%. The Invesco QQQ Trust, Series 1 QQQ, an ETF tracking the index, also saw a reduction of 1.70% on the same day.

Current data from Benzinga Pro indicates that Nvidia’s shares have decreased by 14.04% year-to-date, erasing $380 billion in market capitalization since December 31, 2024, when it stood at $3,297 billion compared to the current $2,917 billion.

In comparison to the company’s market cap at the beginning of this year when DeepSeek topped the Apple Inc. AAPL App Store charts, it has now lost $585 billion since January 24.

Nvidia currently boasts a trailing price-to-earnings ratio of 40.66x, marking its lowest level in over two years, specifically since October 20, 2022.

See also: Larry Summers Discusses Federal Reserve’s Challenges Amid Unknown Economic Factors.

The Importance of Market Trends: Since March 6, the Nasdaq has been in correction territory, with the Magnificent 7 stocks lagging behind the broader market performance in 2025. Chief Dealer Officer John Murillo of B2Broker attributed this technology pullback to various factors including rising interest rates, escalating trade tensions, and a heavy concentration of these high-profile stocks within benchmark indices during this correction.

According to economist Edward Yardeni, low-cost AI chips from China and open-source large language models (LLMs) might put pressure on the so-called ‘AI bubble’, potentially resulting in decreased spending and profitability for the Magnificent 7 stocks.

Technical Perspective: Analyzing Nvidia’s stock reveals troubling trends. The share price, currently at $115.43, indicates a bearish downtrend, remaining below both short-term and long-term moving averages. The relative strength index sits at a neutral 44.03, while the MACD shows a value of -4.04, suggesting a bearish trend with weak downward momentum, given that the blue line is above the red line.

See also: Analysts Expect Fed to Adopt a Measured Stance Amid Economic Uncertainty.

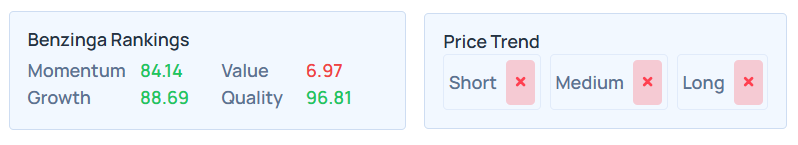

Current Price Action: Despite the latest declines, Nvidia’s shares have increased by 29.12% over the past year. However, Benzinga’s Edge Rankings indicate a poor trend and value rating for the stock. Nevertheless, the company’s momentum, fundamental growth, and quality rankings remain strong amid various market pressures.

Nvidia’s consensus price target stands at $175.95, with a ‘buy’ rating based on the insights from 41 analysts tracked by Benzinga. Price targets vary, ranging from a low of $120 to a high of $220. The latest ratings from firms Mizuho, DA Davidson, and Cantor Fitzgerald average $167.67, suggesting a potential upside of 46.08%.

Read Next:

Photo courtesy: Shutterstock

Momentum75.56

Growth60.74

Quality82.62

Value8.00

Market News and Data brought to you by Benzinga APIs