Nvidia Faces Short-Term Challenges but Long-Term Growth Potential Remains Strong

The past quarter has not been favorable for Nvidia (NASDAQ: NVDA) as its stock has declined nearly 20%. This drop is significantly steeper than the S&P 500 index, which fell 8% during the same timeframe. While Nvidia’s recent performance has raised concerns, external factors such as export restrictions on its chips and tariffs introduced by the Trump administration are largely to blame. Importantly, Nvidia’s financial health seems strong despite these challenges.

Considering investments? Our analysts have identified the 10 best stocks to buy now. Learn More »

The strength of Nvidia’s financial position was shown in its latest quarterly report for the fourth quarter of fiscal 2025, which concluded on January 26. The results exceeded expectations, and guidance indicates the company’s growth trajectory remains healthy entering the new fiscal year. Several new catalysts are emerging that may support Nvidia’s long-term growth.

Let’s explore these catalysts and their potential impact on Nvidia’s future market performance.

New Growth Opportunities Support Nvidia’s Impressive Growth Potential

Nvidia’s data center segment has attracted significant attention thanks to the surging demand for its graphics processing units (GPUs), particularly for artificial intelligence (AI) model training. However, it’s crucial to remember that Nvidia initially gained recognition through the personal computer (PC) market.

For a long time, Nvidia’s GPUs have powered PCs and workstations for demanding tasks like gaming and content creation. Just five years ago, gaming accounted for nearly half of Nvidia’s revenue. Recognizing the shift toward accelerated computing in data centers, Nvidia was quick to introduce chips designed to handle AI workloads, quickly outpacing competitors like Advanced Micro Devices and Intel.

The launch of Nvidia’s A100 processor in 2020 marked a pivotal moment, particularly as it was used to train OpenAI’s ChatGPT. Since then, Nvidia has consistently enhanced its data center GPU offerings, meeting the increasing demand for AI computing power.

With tech giants collectively investing billions in Nvidia’s AI GPUs for training large language models (LLMs), the company is now shifting its focus to AI inference—where AI models are actually applied. Market projections suggest the chip market for AI inference will expand at an annual growth rate of 35% through 2031.

Nvidia is already pursuing this extensive opportunity. Its latest Blackwell AI chips are specifically designed for inference applications. CFO Colette Kress noted during the recent earnings conference call that many early deployments of the Blackwell systems are intended for inference, a first for this architecture. She also highlighted a remarkable 200x reduction in AI inference costs they’ve achieved within two years.

These advancements suggest Nvidia’s revenue from AI inference is likely to grow significantly, helping it maintain a robust share of the AI chip market, which is anticipated to exceed $1.1 trillion in revenue by 2032. Nvidia management also communicated optimism regarding its automotive business, which is poised for expansion.

In fiscal 2025, Nvidia reported $1.7 billion in automotive revenue—an increase of 5% from the previous year. Expectations are high, with projections stating that this revenue could nearly triple to $5 billion this year, fueled by rising compute requirements in vehicles for autonomous functions.

Nvidia is developing a strong ecosystem of customers, including notable companies like Toyota, Hyundai, Uber, and Volvo, which are employing its hardware and software solutions to innovate in automotive technology. With a total addressable market (TAM) estimated at $300 billion, Nvidia’s automotive sector has significant room for future growth.

Overall, Nvidia’s total market opportunities across various segments amount to $1.7 trillion. With just under $131 billion in revenue last fiscal year, the vastness of its addressable market indicates substantial revenue and earnings growth potential, suggesting the stock might regain its upward momentum in the future.

Nvidia’s Earnings Growth and Favorable Valuation Suggest Upcoming Stock Price Surge

Nvidia wrapped up fiscal 2025 with non-GAAP (adjusted) earnings of $2.99 per share, marking a notable 130% increase from the prior year. Analysts anticipate Nvidia will continue to showcase robust earnings growth.

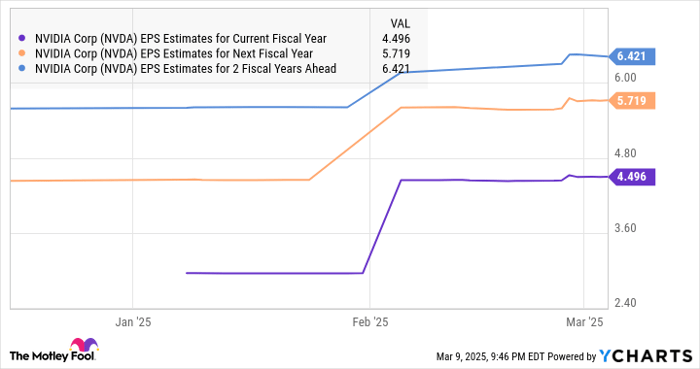

NVDA EPS Estimates for Current Fiscal Year data by YCharts

Consensus projections indicate Nvidia’s earnings could reach $6.42 per share by fiscal 2028. Should the stock attain a trading multiple of 30 times earnings, akin to the Nasdaq-100 index average, Nvidia’s share price could reach $193 in three years. Such a rise would represent a 75% increase from current levels, highlighting the stock’s potential to outperform the market in the near future.

Currently trading at only 25 times forward earnings, this could be an opportune moment for investors to consider adding this semiconductor leader to their portfolios, given its capacity for continued robust growth and the likelihood of delivering superior investor returns.

Seize the Opportunity for Potential Profits

Ever felt like you missed out on buying leading stocks? Here’s your chance.

Our experienced analysts occasionally issue a “Double Down” Stock recommendation for companies they foresee about to rise sharply. If you’re concerned you’ve missed the boat, now may be the best time to invest before it’s too late. The results are compelling:

- Nvidia: if you had invested $1,000 when we doubled down in 2009, you’d have $277,401!*

- Apple: if you had invested $1,000 when we doubled down in 2008, you’d have $43,128!*

- Netflix: if you had invested $1,000 when we doubled down in 2004, you’d have $467,393!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this may be a rare opportunity.

Continue »

*Stock Advisor returns as of March 10, 2025

Harsh Chauhan holds no positions in the stocks mentioned. The Motley Fool owns shares in and recommends Advanced Micro Devices, Intel, Nvidia, and Uber Technologies. The Motley Fool also recommends BYD Company and has disclosed the following options: short May 2025 $30 calls on Intel. Full disclosure available upon request.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.